Valuation still does not reflect the headwinds

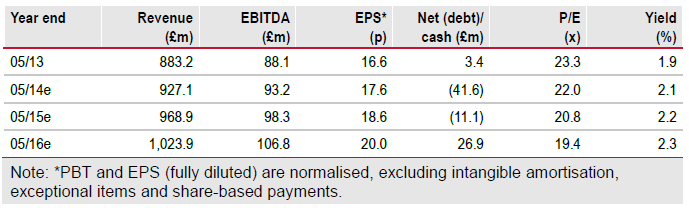

PZ Cussons continues to face tough markets. Growth rates in Europe are low – currently 0% compared to 4% last year – and currency headwinds are likely to adversely affect numbers for the next 12 months. There are also significant risks over the next year in Nigeria, which the company itself has highlighted. Our estimates are below consensus. We expect EPS to grow by an average of 6.5% over the next three years, and we feel that a 2015e P/E of 21x and an EV/EBITDA multiple of 12.7x are a high price to pay for this growth. There is 23% downside to our fair value of 298p.

Interim results comment

Reported sales, operating profits and EPS moved ahead by 4%, 6% and 6% respectively. Excluding currency movements and acquisitions, sales and operating profits were 3.8% and 5.7% respectively, which is a weaker performance than we expected. The estimates from our last note anticipated underlying sales growth 3% points higher. The profit performance in Africa was better than anticipated; what surprised us was weak sales growth in Europe, which was flat on a constant currency basis. Adverse currency movements accounted for a 2% hit to sales and operating profits globally, and these effects will increase in H214 due to further movements in the Indonesian rupiah and the Australian dollar since the end of the reporting period (30 November).

Change in estimates and estimates versus consensus

Since our last note, we have increased our EPS estimates for 2014 and 2015 by 2% and 1% respectively. The increase is due to the inclusion of the acquisition of Rafferty’s Garden, and the re-inclusion of the Polish home care business into our forecasts – both of these changes are earnings-enhancing. Our estimates are below Bloomberg consensus over the next three years by 5%, 9% and 9% respectively. We suspect that where we are different is in the assumption of a heavier impact from Asian currency devaluation, and an expectation of weaker sales trends in Europe. We expect that consensus will have cut estimates after the interim results presentation on 21 January 2014.

To Read the Entire Report Please Click on the pdf File Below