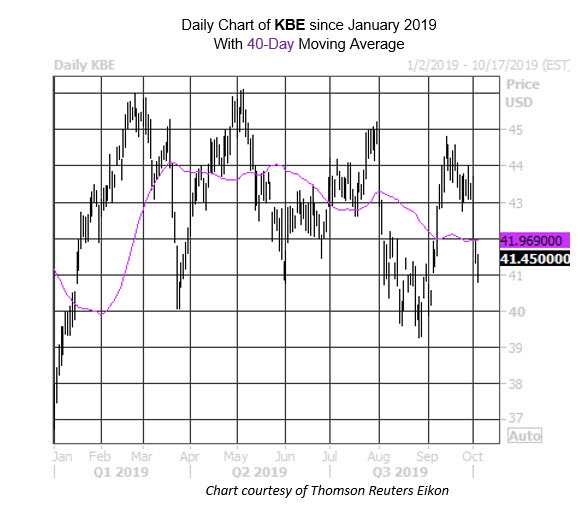

Bank stocks are in focus today, after the latest round of dismal economic data underscores the chances of another Fed rate cut at this month's meeting. This puts SPDR S&P Bank ETF (NYSE:KBE) in the spotlight, with the regional bank exchange-traded fund (ETF) at last check seen down 0.4% at $41.45. In response to its recent struggles, KBE options trading has picked up the pace today.

More specifically, almost 7,600 put options have changed hands, six times the average intraday rate, and 84 times the number of calls trading. Leading the charge are the October 41 and 39 puts, where it looks like a trader is rolling down their position to the 39 puts during today's weakness, likely betting on more downside in the coming days.

Put buying had picked up in a big way coming into today, too. The 10-day put/call volume ratio jumped to 24.66 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), putting the reading in the top quartile of its annual range.

On the charts, KBE is headed toward its fourth straight loss. The ETF is up 11% year-to-date, but earlier this week breached short-term support at its 40-day moving average. Should today's losses hold, it would be the ETF's lowest close in a month.