Cyberark Software Ltd (NASDAQ:CYBR) headlines the unofficial last week of earnings season, set to unveil its first-quarter results before the open tomorrow, May 14. Ahead of the event, CYBR stock has pulled back with the broader market -- down 3.8% to trade at $121.13 -- as the options market prices in a big swing for Tuesday's trading.

Diving right into CyberArk's earnings history, the equity has closed higher in the session following its last six turns in the earnings confessional, averaging a gain of 10.7%. Widening the scope, CYBR shares have averaged a next-day move of 10.2% over the past two years, regardless of direction, with the options market pricing in a bigger 15.5% swing this time around.

Options traders appear to have focused on puts lately. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CYBR's 10-day put/call volume ratio of 0.91 ranks in the 92nd annual percentile. So while calls have outnumbered puts on an absolute basis, puts have been bought to open over calls at a quicker-than-usual clip the last two weeks.

Echoing this, the security sports a Schaeffer's put/call open interest ratio (SOIR) of 0.96, indicating that put open interest easily surpasses call open interest among options expiring within the next three months. This SOIR is 2 percentage points from an annual high, suggesting short-term options traders have rarely been more put-biased in the past year.

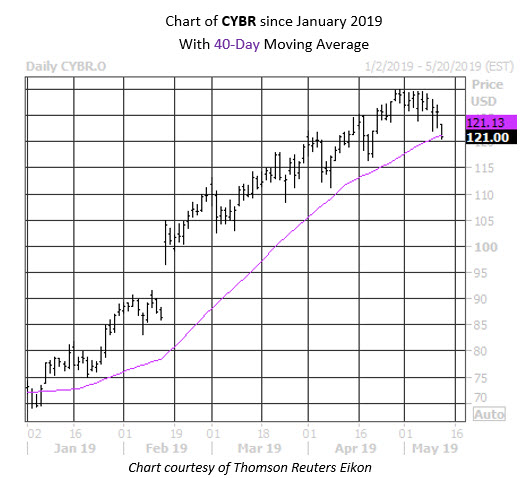

On the charts, the cybersecurity stock has carved out a channel of higher highs since breaching the $70 level at the start of the year. And while the shares have shed 5.5% so far in May, the pullback has found support at its 40-day moving average. Year-over-year, CYBR has more than doubled.