Discount retailer Dollar General Corp. (NYSE:DG) is up 0.2% at $106.40 in afternoon trading, as traders gear up for the company's second-quarter earnings, scheduled to surface before the market opens, tomorrow, Aug. 30. Below we will take a look at how DG has been performing on the charts, and dive into what the options market has priced in for the shares' post-earnings moves.

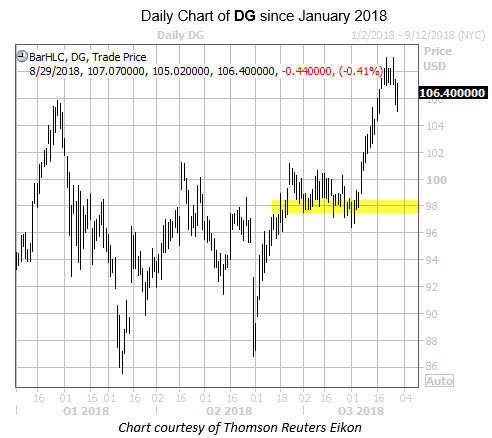

Since hitting a fresh record high of $109.05 on Monday, Dollar General stock has pulled back slightly. Meanwhile, the retailer landed in Schaeffer's Senior Quantitative Analyst Rocky White's list of 25 worst S&P stocks to own during Labor Day week. Regardless, the retailer has picked up 14% year-to-date, recently breaking out of its June-August sideways trend with help from a floor of support at the $98 level.

Looking at the stock's earnings history, DG has closed lower the day after the company reported in four of the last eight quarters, including a 9.4% plunge in late May. Over the past two years, the shares have averaged a 6.5% move the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 8.5% move for Thursday's trading.

According to data from the Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), put options traders have been circling Dollar General stock. Specifically, DG's 10-day put/call ratio of 5.52 ranks in the lofty 98th percentile of its annual range, meaning puts have been purchased over calls at a 6-to-1 rate.

The put-skew is very evident when you zero in on near-term options traders, too. This is per the equity's Schaeffer's put/call open interest ratio (SOIR) of 4.37, which ranks in the 99th percentile of its annual range. This indicates that options players have been more heavily skewed toward puts over calls on DG just 1% of the time during the past year.

Switching gears, analyst sentiment has been extremely optimistic toward DG. Of the 16 firms covering the retailer, 11 sport "buy" or "strong buy" recommendations. Plus, the stock's average 12-month price target of $111.09 comes in at a 4% premium to current levels.