Coca-Cola Company (NYSE:KO) is scheduled to report fourth-quarter earnings ahead of the bell February 14. Below, we will dive into how KO has been faring on the charts, and take a look at what the options market is pricing in for the shares' post-earnings move.

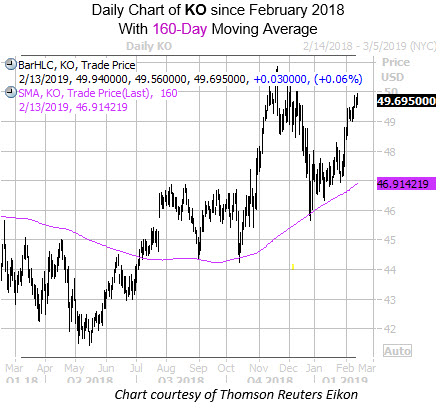

Last seen trading up 0.1% at $49.69 -- and within striking distance of its Nov. 20 high of $50.84 -- the beverage giant has added over 20% since hitting its May bottom near $41.50. Notably, the 160-day moving average has emerged as a baseline of support for the shares, containing their fourth-quarter pullback.

From a long-term perspective, options traders have been put-heavy toward the PepsiCo Inc (NASDAQ:PEP) rival. Specifically, the stock's 50-day put/call volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), EXEL of 1.15 ranks in the 92nd percentile of its annual range. This indicates a healthier-than-usual thirst for bearish bets on Coca-Cola in the past 10 weeks.

Lastly, digging into the blue chip's earnings history, Coca-Cola stock has closed higher the day after four of its last eight earnings reports, including the last two in a row, enjoying a 2.5% lift in October. Looking broader, the shares have averaged a 1.3% swing the day after reporting, regardless of direction. This time around, KO options are pricing in a 3.6% swing for Thursday's trading -- double the norm.