Oil prices are plummeting today on reports the Organization of the Petroleum Exporting Countries (OPEC) and Russia are considering ramping up crude production to offset supply drops from Iran and Venezuela. At last check, July-dated crude futures are down 4.2% at $67.75 per barrel. Options traders are betting on even stiffer headwinds for black gold, with put volume on the VanEck Vectors Oil Services (NYSE:OIH) running at an accelerated clip today.

Most recently, around 15,000 OIH puts have changed hands -- three times what's typically seen at this point in the day, and nearly double the number of calls that are on the tape. The June 26.50 put is most active, and it looks like the bulk of the almost 5,700 contracts traded here are being bought to open for a volume-weighted average price of $0.59. If this is the case, breakeven for put buyers at the close on Friday, June 15 -- when front-month options expire -- $25.91 (strike - premium paid).

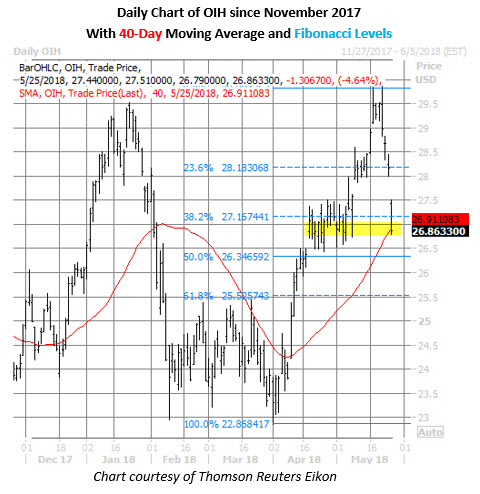

On the charts, OIH had been rallying hard off its early April lows, topping out at an annual high of $29.87 on May 22. However, the shares of the oil exchange-traded fund (ETF) have now retraced more than 38.2% of this recent surge, and are pacing toward their worst daily loss since Feb. 8. And while the $26.80 region -- which currently coincides with the fund's 40-day moving average -- has recently emerged as support, next week has historically been bearish for oil stocks.

Widening the sentiment scope reveals today's heavy put buying is nothing new in OIH's options pits. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the fund's 10-day put/call volume ratio of 1.22 ranks in the elevated 92nd annual percentile. Given the ETF's recent run higher, though, some of this activity is more protective in nature.

Regardless, now is a prime time to buy premium on OIH, considering its Schaeffer's Volatility Index (SVI) of 26% ranks in the 17th annual percentile. In other words, low volatility expectations are being priced into near-term options.

Plus, OIH, has a Schaeffer's Volatility Scorecard (SVS) reading of 98 out of a possible 100. This means the shares have tended to make outsized moves over the past year relative to what the options market was expecting -- allowing traders to maximize the benefit of leverage.