Every so often an article is produced that is so misleading that it must be addressed. The latest is from Sol Palha via the Huffington Post entitled: Buffett Indicator Is Predicting A Stock Market Crash: Pure Nonsense. Sol jumps right in with both feet stating:

Insanity equates to doing the same thing over and over again and hoping for a new outcome. These predictions have been off the mark for almost 10 years. One would think that would be enough for the experts to re-examine the situation, but instead, they use the same lines they used 10 years ago. One day they will get it right, as even a broken clock is correct twice a day.

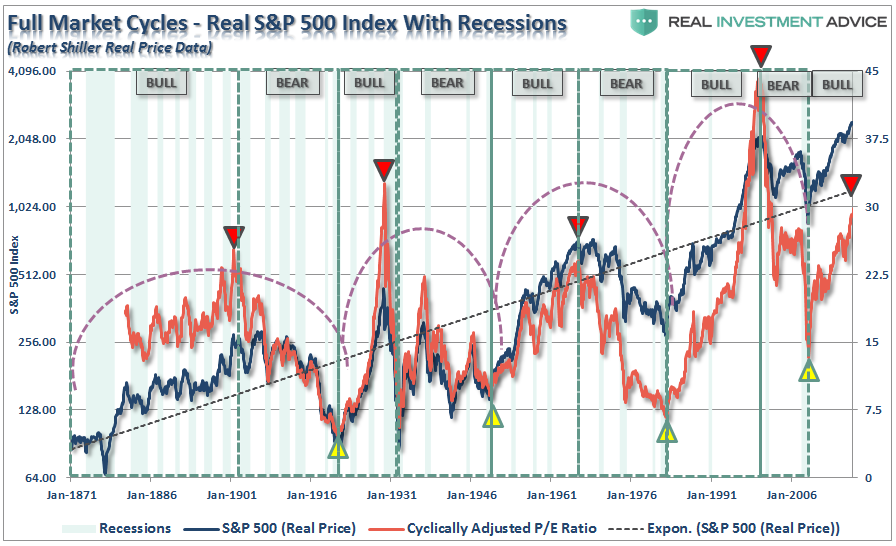

Sol should be careful of throwing stones in glass houses. While we are indeed currently in a very bullish trend of the market, there are two halves of every market cycle.

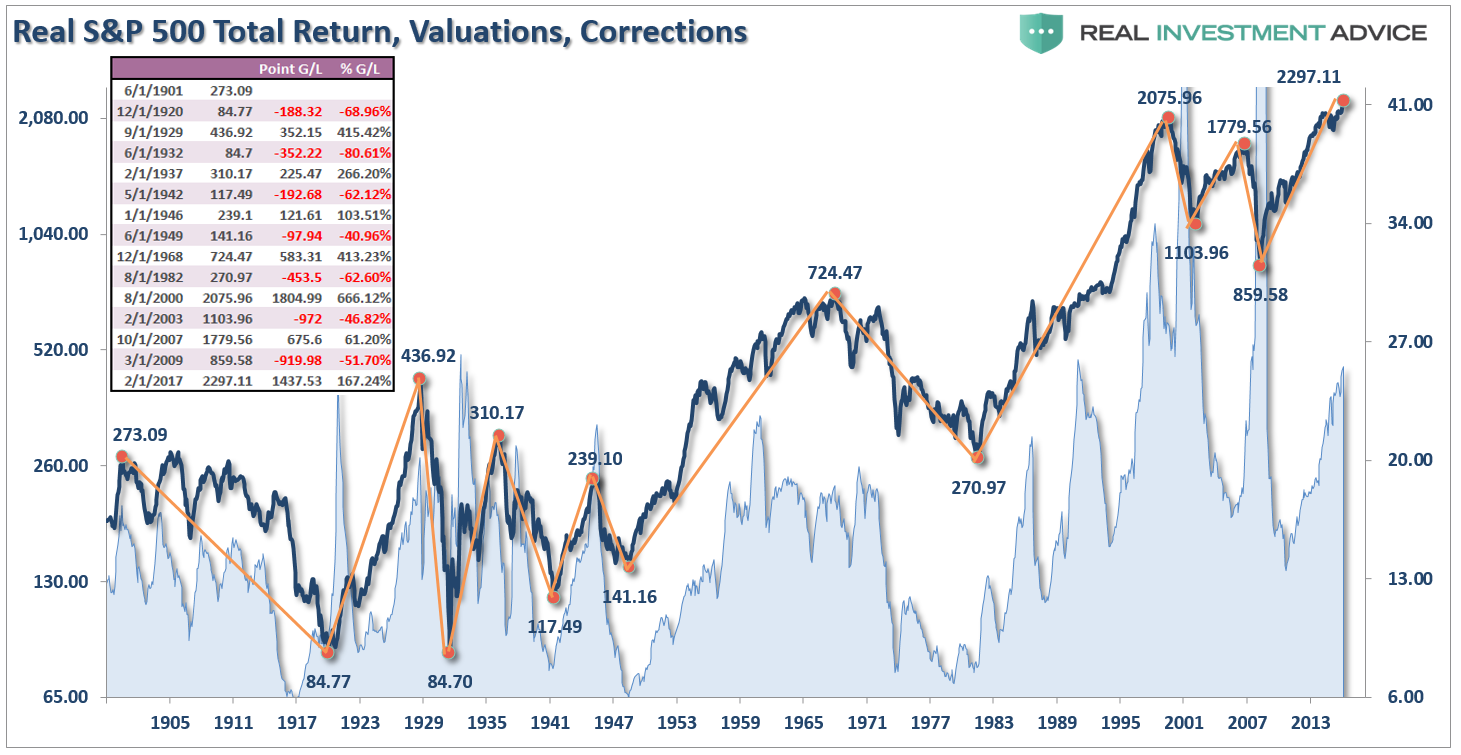

In the end, it does not matter IF you are ‘bullish’ or ‘bearish.’ The reality is that both ‘bulls’ and ‘bears’ are owned by the ‘broken clock’ syndrome during the full-market cycle. However, what is grossly important in achieving long-term investment success is not necessarily being ‘right’ during the first half of the cycle, but by not being ‘wrong’ during the second half.

With valuations currently pushing the 3rd highest level in history, it is only a function of time before the second-half of the full-market cycle ensues.

That is not a prediction of a crash.

It is just a fact.

The Buffett Indicator

It is also the issue of valuation that leads Sol astray in his article which focuses on one of Warren Buffett’s favorite measures of valuation: Market Capitalization to Gross Domestic Product.

Sol err’s in the following statement:

Some Experts point out that Warren Buffet is betting on a Stock Market Crash. This claim is based on the fact that Buffett is sitting on $86 billion in cash. They use this information to create the illusion that this Buffett Indicator is predicting a stock market crash.

First, valuations DO NOT predict market crashes.

Valuations are predictive of future returns on investments from current levels.

Period.

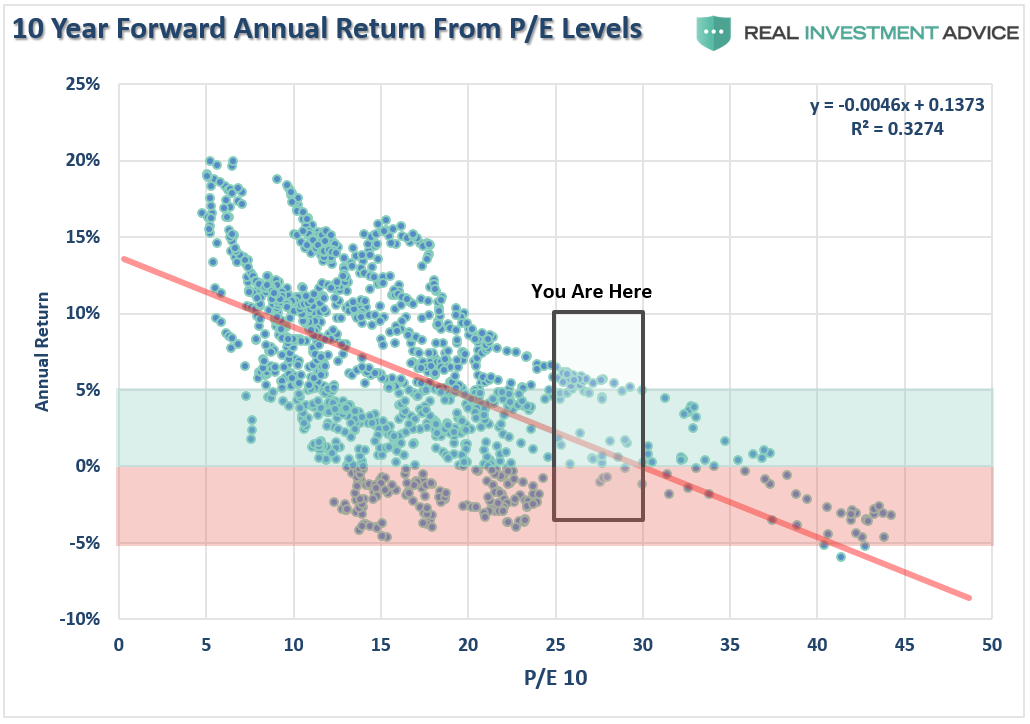

I recently quoted Cliff Asness on this issue in particular:

Ten-year forward average returns fall nearly monotonically as starting Shiller P/E’s increase. Also, as starting Shiller P/E’s go up, worst cases get worse and best cases get weaker.

If today’s Shiller P/E is 22.2, and your long-term plan calls for a 10% nominal (or with today’s inflation about 7-8% real) return on the stock market, you are basically rooting for the absolute best case in history to play out again, and rooting for something drastically above the average case from these valuations.

We can prove that by looking at forward 10-year total returns versus various levels of PE ratios historically.

Asness continues:

It [Shiller’s CAPE] has very limited use for market timing (certainly on its own) and there is still great variability around its predictions over even decades. But, if you don’t lower your expectations when Shiller P/E’s are high without a good reason — and in my view, the critics have not provided a good reason this time around — I think you are making a mistake.

And since we are discussing Mr. Buffett, let me remind Sol of one of Warren’s more insightful quotes:

Price is what you pay, value is what you get.

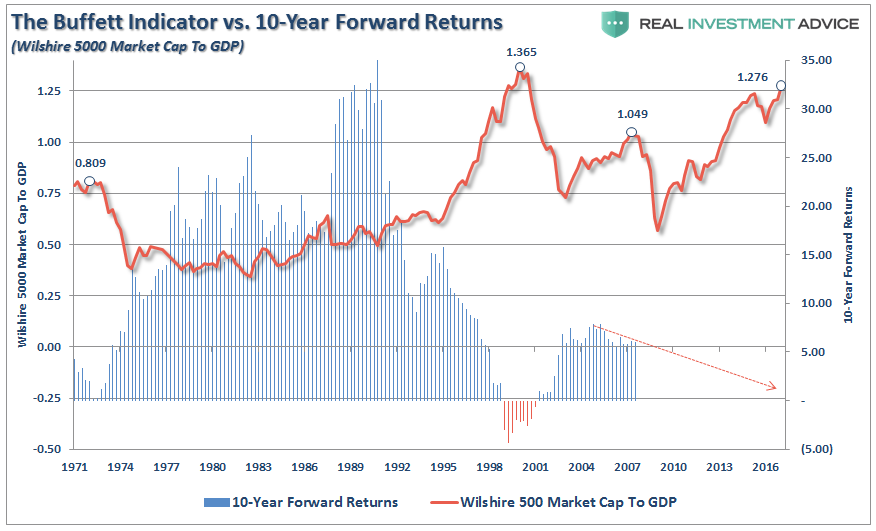

Importantly, however, let’s take a look specifically at the “Buffett Indicator.”

Not surprisingly, like every other measure of valuation, forward return expectations are substantially lower over the next 10-years as opposed to the past 10-years.

The $86 Billion Question

Of course, while Sol didn’t make the connection between Buffett’s $86-billion in cash and forward-return estimates, he did get Buffett’s reasoning correct.

Just because Warren Buffett is sitting on billions of cash does not mean he is waiting for the market to crash. He is probably waiting for a good deal; that’s all.

Some might point out that it’s the biggest hoard of cash the company has ever built up and that this indicates Buffett is nervous. Being nervous does not equate to betting on a stock market crash. Buffett is a value player and he is looking for a deal, so correction not crash might be all he is waiting for.

Unfortunately, “good deals” based on valuation levels and market crashes have typically been highly correlated.

But more importantly, Sol also misses an important point made by Buffett in terms of value investing:

Buffett Does not believe stocks are overpriced; hence he is not expecting a stock market crash.

However, he goes on to quote Buffett suggesting the possibility.

While Buffett agrees the market can go through period of turbulence, he stated that ‘no one can tell you when these traumas occur.'

And then states these “traumas” could range from mild to “extreme.”

Sounds like a crash to me.

But then he makes the most interesting point.

In a recent article, Buffett stated that stocks were on the cheap side; one does not make a comment like this if one believes the stock market is going to crash.

That point doesn’t quite square with Buffett holding his largest cash pile in the history of the firm.

Buffett is a businessman that runs an investment company. Yelling “fire in a crowded theater” would likely not be well accepted well by his investors and legions of avid followers.

In the business, this is called “talking your book.”

However, what a portfolio manager says (“stocks are cheap”) and what they do ($86 billion in cash) are two very different things.

As the old saying goes: “Follow the money.”

Fundamentals Don’t Matter

I will agree with Sol on his point that fundamentals don’t matter at the moment.

In a market that where momentum is driving an ever smaller group of participants, fundamentals are displaced by emotional biases. Such is the nature of market cycles and one of the primary ingredients necessary to create the proper environment for an eventual crash.

Notice, I said eventually.

I do agree with Sol that markets are indeed currently bullish and therefore, as an investment manager, portfolios should remain tilted towards equities currently.

But such will not always be the case.

As David Einhorn once said:

The bulls explain that traditional valuation metrics no longer apply to certain stocks. The longs are confident that everyone else who holds these stocks understands the dynamic and won’t sell either. With holders reluctant to sell, the stocks can only go up – seemingly to infinity and beyond. We have seen this before.

There was no catalyst that we know of that burst the dot-com bubble in March 2000, and we don’t have a particular catalyst in mind here. That said, the top will be the top, and it’s hard to predict when it will happen.

Is this time different?

Probably not.

James Montier summed it up perfectly in “Six Impossible Things Before Breakfast,”

Current arguments as to why this time is different are cloaked in the economics of secular stagnation and standard finance workhorses like the equity risk premium model. Whilst these may lend a veneer of respectability to those dangerous words, taking arguments at face value without considering the evidence seems to me, at least, to be a common link with previous bubbles.

While investors insist the markets are currently NOT in a bubble, it would be wise to remember the same belief was held in 1999 and 2007. Throughout history, financial bubbles have only been recognized in hindsight when their existence becomes “apparently obvious” to everyone. Of course, by that point, it was far too late to be of any use to investors and the subsequent destruction of invested capital.

This time will not be different. Only the catalyst, magnitude, and duration will be.

Investors would do well to remember the words of the then-chairman of the Securities and Exchange Commission Arthur Levitt in a 1998 speech entitled “The Numbers Game:”

While the temptations are great, and the pressures strong, illusions in numbers are only that—ephemeral, and ultimately self-destructive.