We closely follow the bond insurers because they remain an important part of the municipal market, and they are integral to our Insured Puerto Rico Strategy.

Cumberland exited all uninsured Puerto Rico exposure in 2011, as it was clear that population loss and economic circumstances combined with the heavy indebtedness and dysfunctional governance would result in deteriorating credit quality.

In 2014 we saw an opportunity to invest in insured Puerto Rico backed by Assured Guaranty or National (MBIA), because headline risk had caused yields to rise higher than warranted given the claims-paying ability of the insurers.

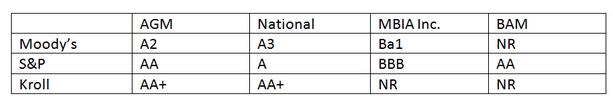

Assured Guaranty Municipal (AGM) and National Public Finance Guarantee (National or NPFG) have very strong claims-paying resources and insure billions of dollars of mostly low-risk municipal bonds. On June 6, 2017, S&P placed National and Build America Mutual (BAM) on CreditWatch negative based on competitive position and lack of business-line diversification, particularly in the case of National. Market participants were surprised, because in the early 2000s the rating agencies’ concern that the financial guarantors were not diversified enough misled the insurers to expand into subprime and other asset-backed securities that soured and led to downgrades of the bond insurers, which had previously had AAA ratings.

On June 26th S&P downgraded National to A from AA- based on its very low market share compared with AGM and BAM, while – importantly for our strategy – affirming that National continues to have very strong claims-paying resources.

- Current Ratings

Prior to the financial crisis, the bond insurance industry insured over 50% of municipal bond new issues. Market penetration, or percentage of insured bonds to all new bond issues, is now under 10% (though the figure could grow with higher interest rates or increased credit concerns). AGM and National write less business than is running off, and the companies are not releasing capital at as fast a rate as previously. Thus leverage of claims-paying resources to insured book has been decreasing.

Bond insurers have very strong claims-paying resources for several reasons:

- They possess a large book of high-quality investments relative to bonds insured, a result of having been in business for over 40 years.

- Stress testing by the companies and the rating agencies shows that claims could be paid in many stressful scenarios.

- Insurers are regulated by state insurance commissions, which constrain the amount of capital that can be released – although the insurers have capital well in excess of required minimums to meet internal and external stress testing.

- Premiums are collected up front and earned over the life of the bonds, so that the companies continue to have earnings even if no new business is written.

- Insureds pay only regularly scheduled principal and interest; payments are not subject to acceleration.

- Any claims paid are contractually required to be repaid over time, so the insurer may not be paid on time but will eventually be paid in full.

- Insurers have strong underwriting and surveillance capabilities.

- They have experience with workouts. The large exposure represented and the fact that the companies are protecting bondholders generally gives them a greater voice in negotiations.

- Bond insurers often become part of the solution when an issuer needs market access at a lower cost after emerging from bankruptcy.

The National downgrade caused a blip up in yields of insured Puerto Rico paper, with slight widening in MBIA-insured bonds but not to levels beyond those seen at other points in the past few years. We continue to like the story of insured Puerto Rico municipal bonds. We disagree with S&P’s approach on ratings, as they are reviewing business prospects and not claims-paying ability, which they themselves admit is still very strong. At 4.00–4.50% tax-free yields (depending on maturity and calls), we feel that the overall market still presents opportunity.