Are you ready for the next crisis? We have weathered Greece leaving the euro, and rising interest rates. Well, actually neither of those things have happened. But Puerto Rico did actually default Monday on a debt payment. Will this be the straw that breaks the Muni market? On first look, no, not at all.

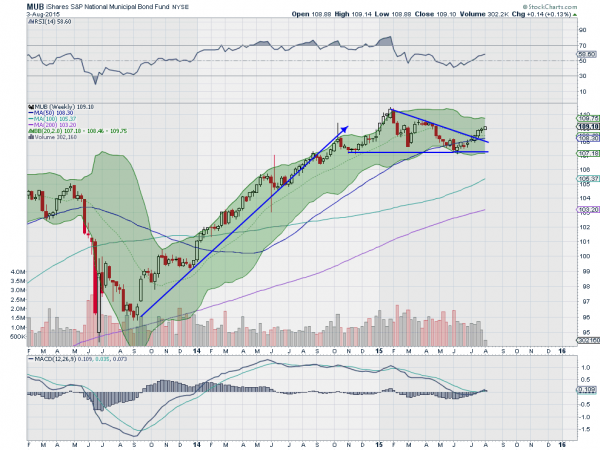

The weekly chart above of the Municipal Bond ETF (NYSE:MUB) shows that there was some trepidation when the thought of Puerto Rico defaulting surfaced earlier this year. But since early June the price has been moving higher.

The RSI turned up at the start of June as well. And it is now firmly into the bullish zone. The other momentum indicator, the MACD, just printed a bullish cross two weeks ago, also supporting further upside. How far can it go? On a broad scale the ETF is breaking a descending triangle, giving it a target of 111.50, but the longer move higher into that triangle consolidation suggests that a move to 120 is in the cards.

So Puerto Rico defaults and the Muni market yawns.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.