Puerto Rico is back in the news as it attempts to reorganize its financial activities. PR wants to avoid default but may not be able to. Instead, this $70 billion issuer of bonds wants to diminish the economic fallout if there is a debt restructuring. At Cumberland, we expect that some restructuring is inevitable.

A measure already underway is Puerto Rico’s attempt to make its new and forthcoming $900 million note sale subject to New York law. The story, “Puerto Rico seeks to make $900 mln note deal subject to New York law,” can be viewed by clicking on this link: http://money.msn.com/business-news/article.aspx?feed=OBR&date=20140918&id=17945765. Readers can form their impressions from the story. We have no inside information and will not be participants in this note deal. The outcome of this initiative will be revealed within a matter of days or weeks. Puerto Rico is under heavy pressure to complete this gap financing.

Another immediate issue is the price reaction over developments connected to Puerto Rico Electric Power Authority (PREPA) debt. First, there is a group of hedge funds and others who have joined in a nondisclosure agreement (NDA) with PREPA. We wrote about PREPA and the NDA recently. Here is the link to our earlier piece: http://www.cumber.com/commentary.aspx?file=091414.asp. A Bloomberg story on PREPA, impending debut restructuring, and the price response that has occurred in PREPA bonds can be viewed at http://www.bloomberg.com/news/2014-09-10/puerto-rico-power-debt-highest-since-june-with-alixpartners-hire.html.

Moody’s downgraded PREPA’s ratings from Caa2 to Caa3 on Sept. 17. Their report on the downgrade had this to say about PREPA’s status:

The downgrade considers the uncertainty that persists regarding the details of the expected restructuring plan by PREPA, the implementation risk that continues regarding PREPA's ability to execute on its multi-year fuel conversion plan as well our belief that any such debt restructuring will involve some degree of impairment for bondholders. The downgrade to Caa3 further incorporates a belief that the expected recovery rate could approximate 65% to 80% in the event of a default, which we believe is highly likely. While the recently entered Forbearance Agreement provides time for parties to work on a consensual restructuring plan, we believe that any restructuring proposal will be influenced, to some degree, by the Commonwealth's politics, particularly given the weakened and lackluster state of the Puerto Rico economy. We also believe that implementation risk is high with respect to completing the multi-year fuel conversion plan, an important element for PREPA, and portions of this risk are outside of the PREPA's management control. The extensions of PREPA bank lines to March 31, 2015, and the Forbearance Agreement addressed immediate issues, but longer-term structural and liquidity issues remain….

We still believe that a restructuring is most likely in the early part of 2015, and the timeline and milestones spelled out in the Forbearance Agreement support this. However, there is the possibility that a restructuring announcement could happen sooner and PREPA could avail itself of the new Recovery Act if negotiations among bondholders, PREPA and the government break down.

The Caa3 rating and the negative outlook incorporate this uncertainty. The negative outlook also considers the uncertainty and obstacles to executing on a complex restructuring plan as well as the long-term capital investment program focused on converting oil-based power generation to natural gas in the face of a very challenging economic environment within the Commonwealth.

The PREPA bond price has rallied from less than 40 cents on the dollar face amount to more than 55 cents on the dollar. Why are the prices higher? We asked that question in our original piece, and we ask it again. Is there a liquidity shortage in trading the bonds because the players who are part of the NDA have accumulated a very large block and cannot trade their bonds with the public? Or is there some fundamental change that improves the creditworthiness of PREPA? We are not aware of such a change if it exists. But those under the NDA may know something we do not know. These are questions without answers. Information about PREPA and the group is difficult to obtain. We will include citations about this as today’s discussion continues.

Meanwhile, the Commonwealth of Puerto Rico is involved in a debate over its tax structure. The speaker of the political assembly in Puerto Rico has introduced a tax reform proposal that will replace sales taxes currently used to secure the pledges on the Puerto Rico Sales Tax Financing Corporation (by its Spanish acronym, COFINA) debt. That type of debt is not currently eligible for restructuring under Puerto Rico law. It is deemed to be a senior-secured claim on Puerto Rico revenue. The political forces are attempting to introduce a value-added tax instead of a sales tax. The driving force behind that effort is House Speaker Jaime Perello.

Arguments in favor of a value-added tax include capturing revenue that is currently avoided by tax evasion and implementing a broader tax structure on consumption taxes while altering the form of other taxes. Some estimates show that Puerto Rico would raise hundreds of millions in additional revenue by using this European version of consumption taxation.

Value-added taxes are a subject of debate. They are widely used in many jurisdictions worldwide, but they are not used in the US. There is no federal restriction that we can see preventing Puerto Rico from introducing a value-added tax system. How the commonwealth alters the pledges it made with sales tax revenue to secure COFINA bonds is another matter. This is another intricate legal structure as to the collateral security of the bonds. Will the market reprice COFINA debt with some added risk premium due to the uncertainty created by this proposed tax change? We shall find out soon enough.

The point we want to make is that tax proposals and alterations in Puerto Rico have come with some frequency. The excise tax was devised in this way. Puerto Rican subsidiaries of American corporations can pay the tax to the Commonwealth of Puerto Rico and receive a direct credit on their federal corporate income tax liability to the US government. That is an indirect form of subsidy to Puerto Rico. In that particular instance, the Obama administration has the power either to have that tax reviewed by the IRS (housed within the US Treasury Department) or to defer the review of the tax.

The IRS has not yet reviewed that tax structure. Puerto Rico therefore continues to collect that tax. The Puerto Rican corporations paying the tax to the Commonwealth of Puerto Rico continue to take the credit against their US federal income tax liability. This indirect subsidy constitutes a fairly large portion of Puerto Rico’s budget.

The point about tax changes is that they introduce high uncertainty. When they alter bond structures, it is not clear whether the nature of the pledges to secure the bonds is impaired or enhanced.

Politicians’ statements during the debate about taxes are quite different from the eventual consequences, intended or unintended, that result after the tax laws are changed. Tests of legal structures in Puerto Rico courts versus US mainland courts or New York financial law will also impact outcomes in the ongoing saga of Puerto Rican debt. Here is the link to the new proposed tax system that is being discussed in Puerto Rico right now: http://www.cb.pr/prnt_ed/proposed-new-tax-system-to-focus-on-fewer-more-efficient-taxes-10410.html. Thank you to Phil Cunningham for sending me the link to the Caribbean Business journal report on the proposed value-added tax.

It is important to understand that all of Puerto Rico’s debt is under pressure because of its low credit rating. Under the new Basel III rules, banks cannot hold Puerto Rican debt and claim the value for high-quality liquid asset tests. Brokerage and underwriting firms avoid the debt. Their compliance departments require customers to sign waivers and verify that any order given to a broker is an “unsolicited” order. Institutional holders of Puerto Rican debt find themselves pressured on a continuing basis. Very often, the mutual fund industry is a net seller of Puerto Rican debt, which acts to depress its prices. Puerto Rican debt exclusions are common in the financial services industry.

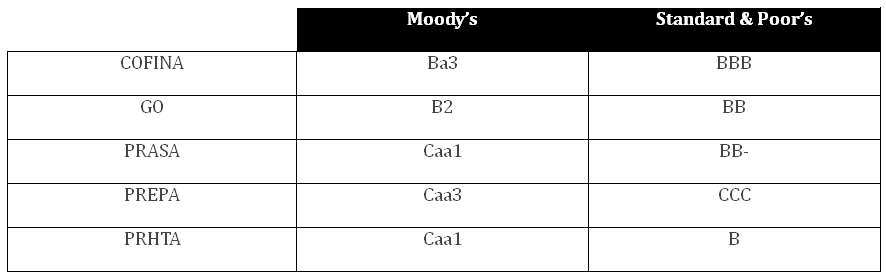

Uninsured Puerto Rican debt falls into the below-investment grade credit rating categories nearly universally. Michael Comes, Cumberland Advisors’ Vice President of Research and Portfolio Manager – Fixed Income, follows this data closely. He has summarized the current rating status. Note that similar ratings come from other raters who are public about their views of Puerto Rico, like Fitch. More privately oriented raters like Kroll tend to make their pronouncements part of their private client activity.

Cumberland Advisors’ internal rating system on Puerto Rican debt confirms its junk bond status. Our internal debt rating mechanisms are proprietary. As a general rule, we look on all Puerto Rican debt as troubled. We have yet to see pathways that could reverse the economic deterioration. Puerto Rico’s island population of 3.6 million struggles with a weakening economy and shoulders an extraordinary debt load. Puerto Rico is the third largest sovereign debtor in the US, excluding the federal government. Only California and New York have more outstanding bonded indebtedness than Puerto Rico does. Most rating services have Puerto Rico on negative watch for further downgrades. The ratings that Michael Comes has assembled follow:

Reporting and information flows on Puerto Rican debt come from several sources. The rating agencies publish from time to time, though much of that work is available only by private subscription. The news reports of rating agency activity on Puerto Rico find their way into the financial press. Bloomberg is one of those reporting sources. Another trade publication that is widely followed by the bond investing group and that has a long-standing history of journalistic expertise related to bonds, and particularly municipal bonds, is The Bond Buyer.

On August 20, 2014, Bond Buyer journalists Kyle Glazier and Robert Slavin broke the story about the forbearance agreement and NDA that was put in place by PREPA. At the time they broke the story, details about PREPA and the NDA were not yet clear. Subsequently, on August 27, 2014 they published a follow-up story, “PREPA Pacts Reinforce Banks’ Priority Over Bondholders.” That story outlined in greater detail the issues involving the forbearance agreement on credit lines with banks. It also mentioned the NDA that is now so widely known.

What is interesting is that the authors were able to insert the link of the entire forbearance agreement in their later story. I believe it is an excellent piece of journalism. It thoroughly explains the forbearance and structure involved with PREPA. The link to the story is here: http://www.bondbuyer.com/news/regionalnews/prepa-pacts-reinforce-banks-priority-over-bondholders-1065640-1.html.

I would like to thank Kyle and Robert for helping me obtain permission to reproduce the story. Furthermore, I would like to thank Michael Scarchilli, Editor in Chief for The Bond Buyer, for granting us permission to present it to our readers in its entirety.

The link to the forbearance agreement is available at the end of the August 27, 2014 story at Bond Buyer. We have included that link here as well for easy viewing: http://www.gdb-pur.com/documents/BondholderForbearanceAgreementEXECUTED.pdf. The participants in the forbearance agreement are listed on pages 47 to 50. Some of the mutual funds and holders of Puerto Rican debt are listed.

Investors who want to know the conditions of those funds or the holders may scan the list themselves. Take any questions directly to the funds involved, not to us.

Note that the bond insurers are participants here. They represent certain classes of bondholders. By participating they are able to negotiate on behalf of all the bondholders that they insure. Some of the other holders hold uninsured bonds, so their agendas may be in conflict. This remarkable restructuring attempt is undertaken under an agreement in which various entities are temporarily giving up their right to assert claims. It could work out a repayment restructuring system for what may be the largest such municipal debt restructuring in American history.

Detroit made headlines in its bankruptcy proceedings, as did others over the last few years. Puerto Rico’s $70 billion debt exceeds, by multiples, the amount of troubled municipal debt that has been resolved since the California city, Vallejo, used municipal bankruptcy to restructure its debts a few years ago.

Cumberland Advisors continues to have a specialized, managed approach with Puerto Rican debt. In that specialized approach, we scrutinize the credit enhancement guarantees of the bond insurers and the internal interconnectedness of Puerto Rican debt among the commonwealth’s various agencies, its governing body, the government’s development bank, and other entities. We believe there is opportunity in some Puerto Rican debt because the entire Puerto Rico market is in disarray. It is functioning without normal structure and liquidity.

We also realize there are certain series of Puerto Rican debt that have very high default risk. The key is researching and determining the structure of a bond in great detail: what secures the payment, the likelihood of payment being obtained if the underlying credit, such as PREPA or others, defaults, and how that restructuring will occur.

As with all markets that are in turmoil, investors are confronted with degrees of risk that they have to assess along with opportunity. In Puerto Rican debt one can find both. One must get under the hood and down among the wires, valves, gears, and pistons to explore the relationship in financial terms in the greatest of detail.