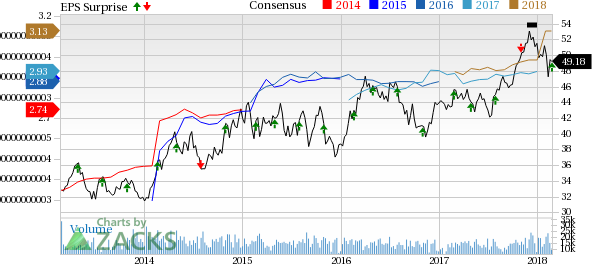

Public Service Enterprise Group Inc. (NYSE:PEG) or PSEG delivered fourth-quarter 2017 adjusted operating earnings of 57 cents per share, which surpassed the Zacks Consensus Estimate by a penny. The bottom line also improved 5.6% on a year-over-year basis.

Excluding one-time adjustments, the company reported quarterly earnings of $1.88 per share against a loss of 19 cents in fourth-quarter 2016.

In 2017, the company reported adjusted operating earnings of $2.93 per share, which surpassed the Zacks Consensus Estimate of $2.91 by 0.7%. The bottom line also rose 1% on a year-over-year basis.

Total Revenues

Revenues of $2,096 million in the quarter missed the Zacks Consensus Estimate of $2,357 million by 11.1%. However, the figure rose 0.3% from the year-ago figure of $2,090 million.

During the reported quarter, electric sales volume improved 1.5% to 9,542 million kilowatt-hours, while gas sales volume decreased 9.2% to 950 million therms.

For electric sales, results reflected a 1.1% rise in the commercial and industrial sector, 2.5% rise in residential sector, 2.7% fall in street lighting and 2% drop in interdepartmental sector.

Total gas sales volume in the reported quarter declined on 40.8% drop in non-firm sales volume of gas, while firm sales volume of gas improved 4.8%.

In 2017, the company reported revenues of $9.08 billion that missed the Zacks Consensus Estimate of $9.33 billion. However, the figure rose 0.3% from the year-ago figure of $9.06 billion.

Highlights of the Release

During the fourth quarter, the company reported operating income of $362 million compared with operating loss of $175 million in the year-ago quarter. Total operating expenses were $1,734 million, down 23.4% from the year-ago quarter figure.

Interest expenses in the reported quarter were $102 million compared with $97 million in the year-ago quarter.

Segment Performance

PSE&G: Segment earnings were $220 million, up from $193 million in the prior-year quarter.

PSEG Power: The segment earnings were $610 million against a loss of $302 million a year ago.

PSEG Enterprise/Other: The segment earnings were $126 million compared with $11 million in the third quarter of 2016.

Financial Update

As of Dec 31, 2017 cash and cash equivalents were $313 million compared with $423 million as of Dec 31, 2016.

Long-term debt as of Dec 31, 2017 was $13,068 million, up from the 2016-end level of $11,395 million.

Public Service Enterprise Group generated $3,261 million in cash from operations in 2017, down from the year-ago figure of $3,311.

2018 Guidance

The company issued 2018 guidance. Adjusted earnings are projected in the range of $3.00-$3.20.

PSE&G’s operating earnings are anticipated in the band of $1,000-$1,030 million. The company expects PSEG Power operating earnings guidance in $485-$560 million range.

Additionally, PSEG Enterprise/Other’s operating earnings expectations are projected at $35 million.

Zacks Rank

Public Service Enterprise Group carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

Duke Energy (NYSE:DUK) reported fourth-quarter 2017 adjusted earnings of 94 cents per share, beating the Zacks Consensus Estimate of 91 cents by 3.3%.

PG&E Corporation’s (NYSE:PCG) adjusted operating earnings per share of 63 cents in fourth-quarter 2017 missed the Zacks Consensus Estimate of 69 cents by 8.7%.

CenterPoint Energy (NYSE:CNP) reported fourth-quarter 2017 adjusted earnings of 33 cents per share, which beat the Zacks Consensus Estimate of 30 cents by 10%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG): Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG): Free Stock Analysis Report

Original post

Zacks Investment Research