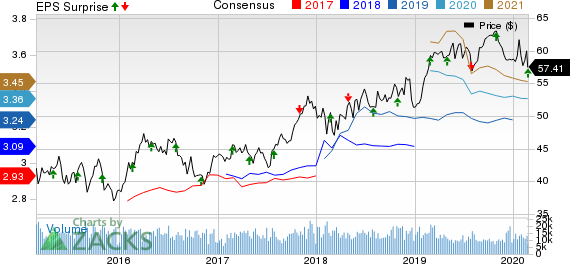

Public Service Enterprise Group Inc. (NYSE:PEG) , or PSEG, reported fourth-quarter 2019 adjusted operating earnings of 64 cents per share, which surpassed the Zacks Consensus Estimate of 62 cents by 3.2%. The bottom line also improved 14.3% on a year-over-year basis.

Including one-time adjustments, the company reported quarterly earnings of 86 cents per share compared with 39 cents in fourth-quarter 2018.

For 2019, the company reported adjusted operating earnings of $3.28 per share, which surpassed the Zacks Consensus Estimate of $3.26 by 0.6%. The full-year bottom line also improved 5.1% from a year ago and exceeded the mid-point of the company’s projected range of $3.20-$3.30 per share.

The upside can be attributed to Public Service Enterprise’s continued focus on operating excellence and cost discipline.

Total Revenues

Revenues of $2,478 million in the quarter missed the Zacks Consensus Estimate of $2,854 million by 13.2%. However, the figure inched up 0.4% from the year-ago quarter’s $2,468 million.

Highlights of the Release

During the fourth quarter of 2019, the company reported operating income of $507 million, up from $501 million in the year-ago quarter. Total operating expenses were $1,971 million, up 0.2% from the year- ago quarter.

Interest expenses in the reported quarter were $152 million.

Segment Performance

PSE&G: Segment earnings were $276 million, up from $239 million in the prior-year quarter. PSE&G’s results in the quarter were driven by enhanced investments in transmission..

PSEG Power: Segment adjusted earnings were $52 million compared with $57 million in the prior-year quarter. The downside was due to scheduled decline in capacity prices in PJM and ISO-New England in the second half of 2019.

PSEG Enterprise/Other: Segment adjusted earnings were $2 million against loss of $12 million in the prior-year quarter. The year-over-year upside can be attributed to lower taxes.

2020 Guidance

The company issued its 2020 guidance. Adjusted earnings are projected to be $3.30-$3.50 per share. The Zacks Consensus Estimate for earnings is currently pegged at $3.36, lower than the mid-point of the company’s guided range.

PSE&G’s operating earnings are anticipated to be $1,310-$1,370 million. The company expects PSEG Power operating earnings to be $345-$435 million.

Zacks Rank

PSEG currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

CMS Energy (NYSE:CMS) reported fourth-quarter 2019 adjusted earnings per share (EPS) of 68 cents, up 70% from the year-ago quarter’s reported figure of 40 cents. The bottom line, however, missed the Zacks Consensus Estimate of 69 cents.

NextEra Energy (NYSE:NEE) reported fourth-quarter 2019 adjusted earnings of $1.44 per share, lagging the Zacks Consensus Estimate of $1.54 by 6.5%.

Dominion Energy (NYSE:D) reported fourth-quarter 2019 operating earnings of $1.18 per share, beating the Zacks Consensus Estimate of $1.16 by 1.7%.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

CMS Energy Corporation (CMS): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Original post