The second week of November gave bulls their first weekly win in the PSEi Composite, even as the market lacked overall direction.

The PSE Index closed Friday with a 0.26 percent gain, led by Financials and Mining and Oil stocks. Friday’s advancers-decliners ratio was quite even at 86 to 90, while 37 issues were unchanged. On a weekly basis, the index edged up by 0.16 percent.

Key Areas List

The Key Areas list of the PSE index has not changed.

Key areas to watch:

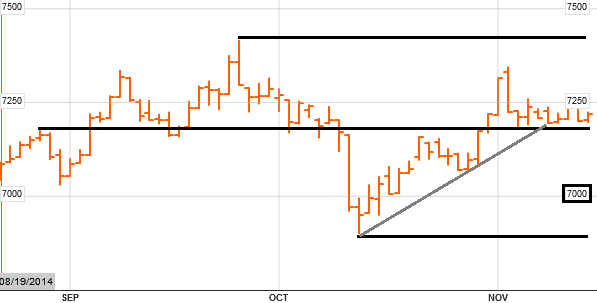

Resistance: 7,400-7,500

Support: 7,200, 7,000, 6800-6900

PSE Index Reference charts:

http://www.tradingphoenix.net/2013/12/30/psei-the-year-ahead/

The Script

Given that the index moved up and down within a tight range around 7,200 this week, we could conclude that the index was practically directionless this week.

The 0.16 percent weekly advance of the PSE Index is not something bulls can be proud of. In fact, it is quite worrying as they were not able to take advantage of this directionless week. The potential ascending trendline and scenario (Premium Subscribers) did not form positively, however 7,200 has largely stayed intact despite downside attempts. Premium Subscribers should review that link as well as the Quarterly Analysis throughout November so you can be reminded of the risks towards the year-end.

In the coming week, I would like to see the index stay above 7,200. Ideally, bulls would try to thrust through 7,300 and create a new high. An attempt at the highs is good enough, but I hope they could solidify it by month-end.