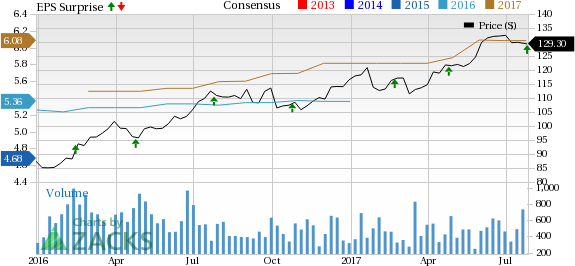

PS Business Parks, Inc. (NYSE:PSB) reported second-quarter 2017 adjusted funds from operations (“FFO”) of $1.55 per share, surpassing the Zacks Consensus Estimate of $1.52.

Moreover, the figure came in 14% higher than $1.36 recorded in the prior-year quarter. The rise was stemmed from higher net operating income (NOI), reduced interest expenses and savings from lower preferred distributions.

Total operating revenue came in at around $99.9 million, reflecting 3.8% growth from the prior-year figure. However, it missed the Zacks Consensus Estimate of $100.8 million.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share.

Quarter in Detail

Same Park rental income was up 4.5% year over year, while Same Park operating expenses increased 2.9%. As a result, Same Park NOI climbed 5.2% year over year, mainly on the back of improving rental rates and occupancy.

Annualized Same Park realized rent per square foot rose 4.4% year over year to $15.27. Same Park weighted average occupancy in the quarter was 93.7%, up 20 basis points (bps) year over year.

Liquidity

PS Business Parks exited second-quarter 2017 with cash and cash equivalents of $5.4 million, lower than the prior-year end tally of $128.6 million. The company’s available balance under its $250-million unsecured credit facility at the end of the reported quarter was $149 million.

Dividend Update

Concurrent with its second-quarter earnings release, the company announced a regular quarterly dividend of 85 cents per share, same as the prior payout. The dividend is payable on Sep 28 to shareholders of record as of Sep 13, 2017.

Conclusion

We are encouraged by the better-than-expected FFO performance of PS Business Parks. The company’s diversified portfolio and its ample liquidity augurs well for long-term growth. Further, healthy fundamentals in the multi-tenant flex, office, and industrial asset categories are anticipated to drive growth, while portfolio repositioning strategies will likely help the company emerge stronger. However, pricing pressure in certain markets, intense competition from developers, owners and operators, and hike in interest rate remain key concerns.

PS Business Parks currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In addition, the stock has gained 11% year to date, outperforming the 4.3% growth of the industry it belongs to.

We now look forward to the earnings releases of other REITs like Cousins Properties Incorporated (NYSE:CUZ) , Ventas, Inc. (NYSE:VTR) and CyrusOne Inc (NASDAQ:CONE) . While Cousin Properties will announce its results on Jul 27, Ventas and CyrusOne are slated to report Q2 numbers on Jul 28 and Aug 2, respectively.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Ventas, Inc. (VTR): Free Stock Analysis Report

Cousins Properties Incorporated (CUZ): Free Stock Analysis Report

PS Business Parks, Inc. (PSB): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Original post

Zacks Investment Research