The May 1st bank holiday on the continent made sure that the European session was a fairly quiet one yesterday, with news from the US the main driver of movement later in the day. With Europe off, the focus definitely shifted to the UK and US with one’s manufacturing sector found wanting and the other not.

UK manufacturing deteriorated in April with the PMI reading for the sector coming in at 50.5, the lowest since December. This was the 5th consecutive month of alternating improvements and deteriorations in the sector and confirmed the “bouncing along the bottom” nature of the UK economy has continued in April. Manufacturing contributed negatively by 0.1% to GDP in Q1 when the PMI averaged 51.9 so this reading of 50.5 could indicate that a similar drag may occur in Q2 unless an improvement is forthcoming.

It’s obvious that the Q1 GDP figure was a horror show but the market seems reluctant to believe that the UK is in recession and if it is, that it will be a short one. The -0.2% print stood so far apart from other data such as the PMI surveys and it is on this basis that some analysts, myself included, believe that we will see the upcoming revisions will move the number into positive territory and this could be contributing to the recent GBP strength.

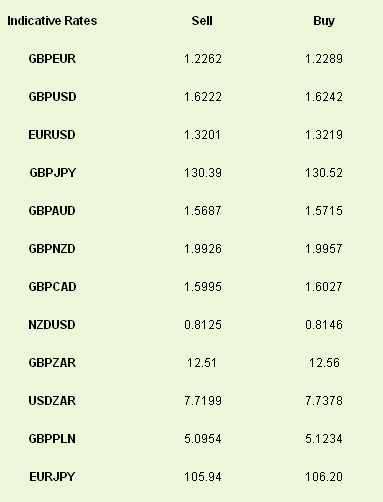

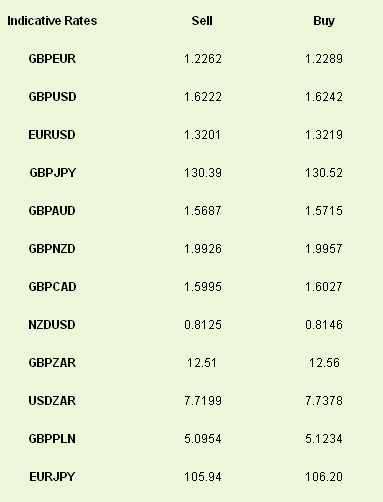

As a result sterling dipped versus the majors but, overnight it has been bought back by traders looking to push it higher. Hence GBP/EUR is once again moving back towards recent record highs.

The dollar has also bounced back following its manufacturing ISM number. The sector grew at the fastest pace in nearly a year with new orders hitting a 12-month high while the unemployment component hit a 10-month zenith. This, combined with the two strong Chinese PMI seen in the past 24hrs pushed equities higher in the US and Asia, with that good sentiment expected to help Europe today.

The eurozone plays catch-up today as we get a slew of manufacturing data from them. Continent-wide and individually it would be a great surprise if any of these readings showed some form of expansion with the average expected at the 46.3 level. EUR/USD is trading heavily and further bad news could see further losses for the single currency.

We also get a look at the US jobs market with ADP employment at 13.15 ahead of Friday’s NFP number while US factory orders are due at 15.00.

UK manufacturing deteriorated in April with the PMI reading for the sector coming in at 50.5, the lowest since December. This was the 5th consecutive month of alternating improvements and deteriorations in the sector and confirmed the “bouncing along the bottom” nature of the UK economy has continued in April. Manufacturing contributed negatively by 0.1% to GDP in Q1 when the PMI averaged 51.9 so this reading of 50.5 could indicate that a similar drag may occur in Q2 unless an improvement is forthcoming.

It’s obvious that the Q1 GDP figure was a horror show but the market seems reluctant to believe that the UK is in recession and if it is, that it will be a short one. The -0.2% print stood so far apart from other data such as the PMI surveys and it is on this basis that some analysts, myself included, believe that we will see the upcoming revisions will move the number into positive territory and this could be contributing to the recent GBP strength.

As a result sterling dipped versus the majors but, overnight it has been bought back by traders looking to push it higher. Hence GBP/EUR is once again moving back towards recent record highs.

The dollar has also bounced back following its manufacturing ISM number. The sector grew at the fastest pace in nearly a year with new orders hitting a 12-month high while the unemployment component hit a 10-month zenith. This, combined with the two strong Chinese PMI seen in the past 24hrs pushed equities higher in the US and Asia, with that good sentiment expected to help Europe today.

The eurozone plays catch-up today as we get a slew of manufacturing data from them. Continent-wide and individually it would be a great surprise if any of these readings showed some form of expansion with the average expected at the 46.3 level. EUR/USD is trading heavily and further bad news could see further losses for the single currency.

We also get a look at the US jobs market with ADP employment at 13.15 ahead of Friday’s NFP number while US factory orders are due at 15.00.