Proto Labs, Inc. (NYSE:PRLB) is scheduled to report second-quarter 2017 results on Jul 27, before the market opens.

Over the last one month, Proto Labs shares yielded a return of 7.49%, outperforming 5.48% gain incurred by the industry.

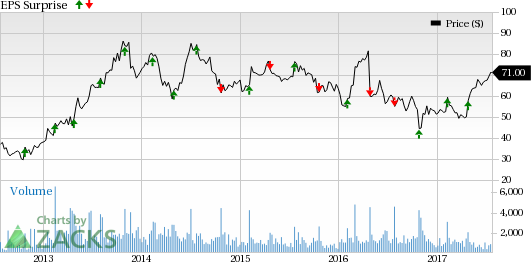

The company has an average positive earnings surprise of 5.37% for the last four quarters.

Let us see how things are shaping up for Proto Labs this quarter.

Factors to Influence Q2 Results

Proto Labs believes that its efforts to bolster sales and enhance operational efficiency will prove conducive to its second-quarter results. Also, an efficient management and marketing team, as well as emphasis on research and development of improved products, will likely stoke the growth momentum.

Inorganic initiatives have been important for Proto Labs’ expansionary policy. For instance, the Alphaform business is anticipated to strengthen the company’s 3D printing operations in Europe moving ahead. In addition, the expansion of manufacturing facilities in North Carolina and Japan, as well as increase in its Liquid Silicone Rubber and lathe offerings, will likely be advantageous for the quarters ahead.

Despite such positives, Proto Labs is exposed to risks arising from global economic uncertainties and stiff competition from other prototype manufacturers. Furthermore, any failure in the research and development of new products, or inability to meet the specific requirements of the customers might severely thwart its profitability.

Based on the existing market conditions, the company anticipates reporting adjusted earnings within the range of 45–51 cents in second-quarter 2017.

Earnings Whispers

Our proven model does not conclusively show that Proto Labs is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP of Proto Labs is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 43 cents.

Zacks Rank: Proto Labs’ favorable Zacks Rank #3, when combined with 0.00% ESP, makes surprise prediction difficult.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies in the sector that you may want to consider as our model shows these have the right combination of elements to post an earnings beat this quarter:

AGCO Corporation (NYSE:AGCO) , with an Earnings ESP of +2.89% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

AptarGroup, Inc. (NYSE:ATR) , with an Earnings ESP of +2.06% and a Zacks Rank #2.

Caterpillar, Inc. (NYSE:CAT) , with an Earnings ESP of +3.18% and a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Proto Labs, Inc. (PRLB): Free Stock Analysis Report

Original post

Zacks Investment Research