Prothena Corporation plc (NASDAQ:PRTA) reported a loss of 46 cents per share in the second quarter of 2017, narrower than the year-ago loss of $1.18 and the Zacks Consensus Estimate loss of 89 cents.

Moreover, quarterly revenues came in at $26.8 million, surpassing the Zacks Consensus Estimate of $18.9 million and were up from $0.3 million in the year-ago quarter.

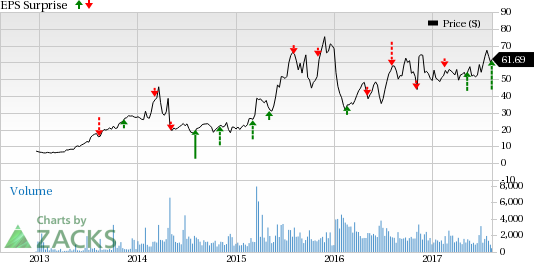

Prothena’s stock has moved up 25.4% in the year so far compared with the industry’s gain of 8.7%.

Quarter in Detail

The increase in revenue was primarily due to achievement of a clinical milestone from Roche Holding (SIX:ROG) AG (OTC:RHHBY) of $30.0 million (of which $26.6 million was recognized as collaboration revenue and $3.4 million was recognized as an offset to research and development expenses).

R&D expenses were $34.0 million, up 5.2% year over year primarily due to higher clinical trial and personnel cost offset in part by lower external expenses for product manufacturing.

General and administrative expenses were $10.9 million, up 34.2% year over year due to higher personnel costs.

2017 Outlook

Prothena expects net cash from operating and investing activities in the range of $160–$170 million. The projected range includes the milestone from Roche earned in the second quarter of 2017 upon initiation of the phase II study of PRX002. The company expects to end 2017 with approximately $375 million in cash, cash equivalents and restricted cash (midpoint).

Pipeline Updates

Prothena continues to progress with its pipeline candidates. The company is evaluating its lead candidate NEOD001 in the phase III VITAL Amyloidosis study in newly diagnosed treatment-naïve patients with AL amyloidosis and cardiac dysfunction. Enrolment was completed in the VITAL study. The original target enrolment of 236 patients was exceeded and 260 patients have been randomized into the study.

Prothena is also evaluating the candidate in a phase IIb study, PRONTO, in previously treated patients with AL amyloidosis and persistent cardiac dysfunction. The company completed enrolment in this study and top-line results from the study are expected following the 12-month study period in the second quarter of 2018.

Moreover, Prothena is evaluating PRX002, in collaboration with Roche, for the treatment of Parkinson’s disease and other related synucleinopathies. The company initiated a phase II study, PASADENA, on PRX002 in patients suffering from Parkinson`s disease which triggered a $30 million milestone payment from Roche to Prothena.

The company expects to report top-line data from a phase Ib multiple ascending dose, proof-of-biology study on PRX003 in patients with psoriasis in Oct 2017.

Alongside, Prothena is also working to advance PRX004 in a phase I study in patients with ATTR amyloidosis. The candidate is expected to enter clinic in mid-2018.

Our Take

The narrower-than-expected loss in the second quarter was encouraging. The company’s efforts on developing its pipeline are encouraging. We expect investor focus to remain on further updates from its late-stage candidate, NEOD001.

Zacks Rank & Key Picks

Prothena currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the health care sector are Aduro Biotech, Inc. (NASDAQ:ADRO) and Gilead Sciences, Inc. (NASDAQ:GILD) . Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates narrowed from $1.46 to $1.36 for 2017 over the last 30 days. The company delivered positive earnings surprises in two of the four trailing quarters with an average beat of 2.53%.

Gilead’s earnings per share estimates increased from $7.92 to $8.53 for 2017, over the last 30 days following strong results in the second quarter. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 8.18%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Roche Holding AG (RHHBY): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Prothena Corporation PLC (PRTA): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research