On Wednesday, 5/8/2013, U.S. stocks recorded gains for a 5th consecutive session. In fact, the S&P 500 logged its 12th gain in 14 trading days, rising 6% since a mid-April hiccup and reaching yet another all-time peak.

Equally intriguing, the last week has witnessed a renewed interest in foreign equities. In spite of a deepening recession in Europe, questions about China’s growth, declining worldwide demand for commodities and little evidence of a self-sustaining global economy, some investors are filling their suitcases with overseas shares.

Valuation “wonks” might describe the phenomenon in simplistic terms; that is, investors obviously recognize that the earnings yields are compelling. The problem with this assertion is the fact that price-to-earnings bargains relative to U.S. stocks have existed for at least two years. More likely, investors love activist central banks and they expect foreign central banks to lower rates and/or devalue currencies.

Back in December, before many folks caught up with the trend, I discussed why a hedged investment in Japanese stocks had enormous potential. (Note: Review December 20 column, “A Foreign Stock ETF For a Rapidly Declining Currency.” Since that time, WisdomTree Japan Hedged Equity (DXJ) has packed on an astronomical 41.5%. Similarly, one should not be surprised when declining foreign currencies help pique desire for foreign equities.)

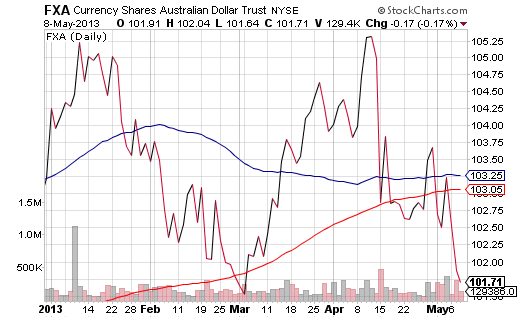

Recently, the European Central Bank (ECB) cut its target rate from 0.5% to 0.25%. The Bank of Australia also lowered its benchmark to 2.75%. New Zealand’s central bank explained that it is actively intervening in its currency markets to reduce the value of the New Zealand dollar. And while Thailand has yet to act to depreciate the “baht,” its central bank is widely expected to cut rates or implement other measures to devalue its currency.

Rate cutting, quantitative easing and obvious efforts to devalue currencies are the primary reason for stock price appreciation in the United States and Japan since the bull’s 3/09 inception. In contrast, less aggressive central bank activity in some countries and regions have hindered interest in the market-based securities of those areas. WisdomTree India Earnings (EPI) has been one of the biggest year-to-date losers due to the country’s trade deficits, inflationary woes and currency appreciation.

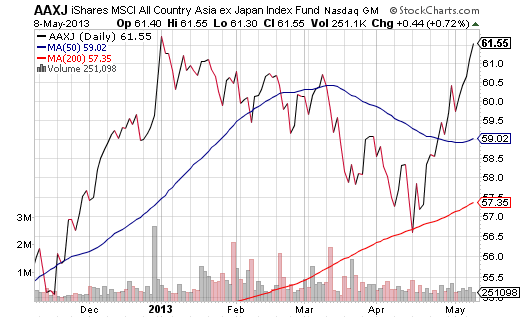

There is a reason that many are suddenly smitten with funds like iShares MSCI Pacific (EPP) and iShares MSCI All-Country Asia excl Japan (AAXJ). In essence, it is the signals being sent out of by the central banks and governments of Asia-Pacific sovereign nations. They plan on fighting back.

Countries like South Korea, the Philippines and Thailand rely on exports to fuel their growth. And while more mature countries such as Australia and New Zealand may be less dependent on exports than emerging market counterparts, Australia and New Zealand depend a great deal on exporting natural resources/materials. It follows that, alongside, the massive decline in the Japanese yen, investors should expect a substantial increase in Asia-Pacific central bank intervention to depreciate respective currencies.

Although stock investors may be looking out at the currency landscape and placing trades accordingly, Currency ETFs representing countries in the Asia Pacific region have yet to make dramatic moves. But they will. In fact, some analysts believe that a fallout from these currency wars may be less than 18 months away. Nevertheless, you might want to steer clear from excessive exposure to Asia Pacific currencies where central bankers are determined to knock them down several pegs.

The problem for investors going forward is determining how long to continue investing in the Stock ETFs of depreciating currencies. One can go with WisdomTree Europe Hedged Equity (HEDJ) to protect against the possibility of a rapidly declining euro; one can go with WisdomTree Japan Hedged Equity (DXJ) to protect against a rapidly declining yen. And perhaps one can short CurrencyShares Australia Dollar (FXA) while simultaneously owning iShares MSCI Australia (EWA).

In the end, however, a race to the bottom in the currency wars could wreak havoc on the global financial system. An astute investor better know how and when to exit riskier assets if he/she expects to be successful over the longer-term.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Protecting ETF Portfolios from the Currency Wars

Published 05/09/2013, 03:27 AM

Updated 03/09/2019, 08:30 AM

Protecting ETF Portfolios from the Currency Wars

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.