Sancho Panza, Don Quixote’s peasant squire in the classic novel by Cervantes, declared that a wise man should not “venture all his eggs in one basket.”

But Warren Buffett famously contradicted that advice.

Buffett says, “Put all your eggs in one basket, but watch that basket closely.”

Which guy should we trust - the American billionaire or the Spanish peasant?

Buffett made his billions by doing exactly what he advises. He put all of his eggs in one basket and then watched that basket closely.

This strategy works brilliantly if your basket happens to be the United States stock market during one of the greatest economic booms the world has ever seen.

As Buffett himself readily admits, he was born in the right place at the right time.

“I was born in 1930,” Buffett explained to a Fortune reporter a while back. “I won the ovarian lottery. I was born in the United States... I was born white... I was born male... I had all kinds of luck.”

Thanks to Buffett’s winning “lottery ticket,” he launched his investment career near the beginning of a decades-long economic boom... and the American basket treated his eggs very well.

Will the U.S. stock market reward investors as handsomely over the next few decades as it did during the sweet spot of Buffett’s career?

Probably not, would be my guess. That’s why I’d put my money on the peasant, not the billionaire. There are a couple of very good reasons to toss a few eggs into non-U.S., non-dollar baskets.

Give Your Portfolio a Dose of Diversity

First, America’s economic growth over the next three or four decades is unlikely to match its growth during the past three or four decades. Many of the world’s emerging markets are likely to post growth rates that tower above the U.S.

Second, the U.S. dollar recently hit a 13-year high. That means foreign stocks are “on sale” in U.S. dollar terms.

The dollar could become even stronger, of course. But weakness seems to be the path of least resistance, especially since the Trump administration has signaled its desire to see the dollar move lower.

Don’t panic - a weak dollar isn’t all bad. It would “supercharge” the returns you could make from foreign stocks.

That’s the magic of a falling dollar.

But you don’t have to do anything “crazy” or exotic to benefit from dollar weakness. You don’t have to wire money to the Cayman Islands and then invest in some far-flung foreign market.

You could simply buy an exchange-traded fund like the iShares MSCI Canada (NYSE:EWC). In fact, I would recommend doing exactly that. If the Canadian dollar strengthens against the U.S. dollar, that would boost its share price.

As we saw eight years ago, it’s a win-win.

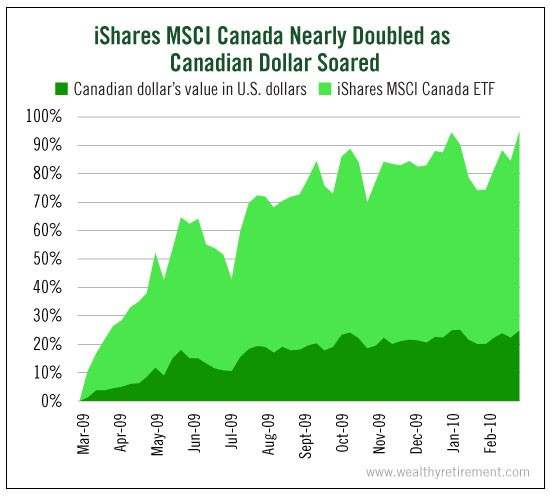

In the depths of the 2008-2009 global stock market collapse, the Canadian dollar’s value fell to a low of US$0.765.

Then, over the ensuing 12 months, the Canadian dollar soared 25% against the U.S. dollar.

This huge currency gain, on top of a simultaneous rally in Canadian stocks, powered the fund to achieve total returns of more than 90% between March 2009 and March 2010.

Today, the Canadian dollar is worth just US$0.729 - even lower than it was in the depths of the financial crisis. You don’t have to be a math whiz to see the potential upside.

Bottom line: A weakening dollar is nothing to fear. Instead, it’s an opportunity to supercharge your investment returns. When a foreign country’s stock market and currency rally simultaneously, profits can pile up quickly.