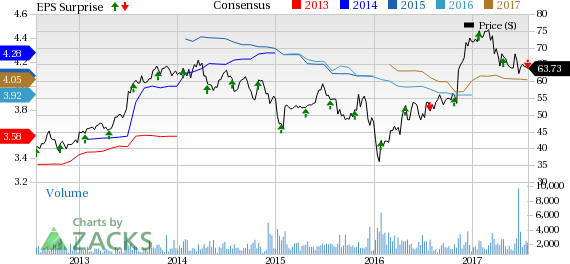

Shares of Prosperity Bancshares Inc. (NYSE:PB) tanked 3.4% following the release of its second-quarter 2017 results. Earnings per share of 99 cents lagged the Zacks Consensus Estimate by a penny. However, the figure compared unfavorably with the prior-year quarter’s earnings of 98 cents. Results included purchase accounting adjustments for both periods.

Lower revenues and continued margin pressure were the primary reasons for the dismal performance. However, lower expenses, a decline in provisions for loan losses and improving loans and deposits supported the results to some extent.

Prosperity Bancshares’ net income rose marginally year over year to $68.6 million.

Revenues & Expenses Decrease

Net revenue of $180 million for the reported quarter lagged the Zacks Consensus Estimate of $187.1 million. Moreover, the figure declined 3.7% from the prior-year quarter.

Net interest income fell 3.9% year over year to $152.2 million, primarily due to a decrease in loan discount accretion.

Also, net interest margin, on a tax equivalent basis, decreased 23 basis points (bps) to 3.14%.

Non-interest income declined 2.4% year over year to $27.8 million. This fall was mainly due to the net loss on sale of assets, partly offset by the gain on sale of securities.

Non-interest expenses were down 3.5% year over year to $76.4 million. Decrease in salaries and benefits and core deposit intangibles amortization were the main reasons for the lower expenses.

Loans & Deposits Increase

As of Jun 30, 2017, total loans were $9.9 billion, up 1.3% from the prior quarter. Total deposits rose marginally from the previous quarter to $17.1 billion.

Credit Quality Improves

As of Jun 30, 2017, total nonperforming assets were $47.6 million, down 8.7% year over year. Also, the ratio of allowance for credit losses to total loans was down 2 bps year over year to 0.85%.

Further, net charge-offs totaled $3.1 million, down 48% from the year-ago quarter. Also, provision for credit losses declined more than 54.2% from the prior-year quarter to $2.8 million.

Capital Ratio Strengthens, Profitability Ratios Deteriorate

As of Jun 30, 2017, Tier-1 risk-based capital ratio came in at 14.80% compared with 13.66% as of Jun 30, 2016. Moreover, total risk-based capital ratio was 15.49%, up from 14.37% at the end of the year-ago quarter.

Also, common equity tier 1 capital ratio was 14.80%, up from 13.66% in the prior-year quarter.

The annualized return on average assets was 1.22%, down from 1.24% in the prior-year quarter. Similarly, annualized return on common equity was 7.36% compared with 7.70% in the prior-year quarter.

Our Viewpoint

Prosperity Bancshares’ margins remain under pressure owing to its liability sensitive balance sheet, despite the improving rate scenario. Also, elevated expense levels and exposure to risky loan portfolio will likely weigh on the financials.

Currently, Prosperity Bancshares carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Associated Banc-Corp (NYSE:ASB) reported second-quarter 2017 earnings per share of 36 cents, in line with the Zacks Consensus Estimate. Results benefited primarily from an improvement in revenues and lower provision for credit losses, which were offset by higher expenses.

Commerce Bancshares, Inc.’s (NASDAQ:CBSH) its second-quarter 2017 earnings of 75 cents per share easily surpassed the Zacks Consensus Estimate of 70 cents. Results were mainly driven by higher net interest income and non-interest income. However, a rise in expenses and provision for loan losses were the undermining factors.

First Republic Bank’s (NYSE:FRC) second-quarter 2017 earnings per share came in at $1.06, missing the Zacks Consensus Estimate of $1.09. Higher revenues during the quarter were primarily responsible for the bottom-line improvement. On the other hand, higher expenses and provisions remained a headwind.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Commerce Bancshares, Inc. (CBSH): Free Stock Analysis Report

Associated Banc-Corp (ASB): Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB): Free Stock Analysis Report

FIRST REPUBLIC BANK (FRC): Free Stock Analysis Report

Original post

Zacks Investment Research