Key Themes at Play in the Markets:

Risk conditions have deteriorated after the latest reports by Bloomberg/WSJ indicate US President Trump is set to go ahead imposing tariffs on $200b worth of Chinese goods. The decision may come as soon as this Monday, according to sources familiar with the matter. Amid the prospects of more taxation, China is mulling to cancel further trade talks scheduled for coming weeks.

The reaction by markets last Friday saw a classic risk aversion move, as clearly depicted by the rise in the US Dollar index (DXY), the drop in the US 30-Year yield and the drop in US equities. The Chinese Yuan, as a barometer of the trade tensions, also dropped to currently exchange hands at 6.88USD, evaporating the prior day’s gains on fears of an immediate blow in trade talk hopes.

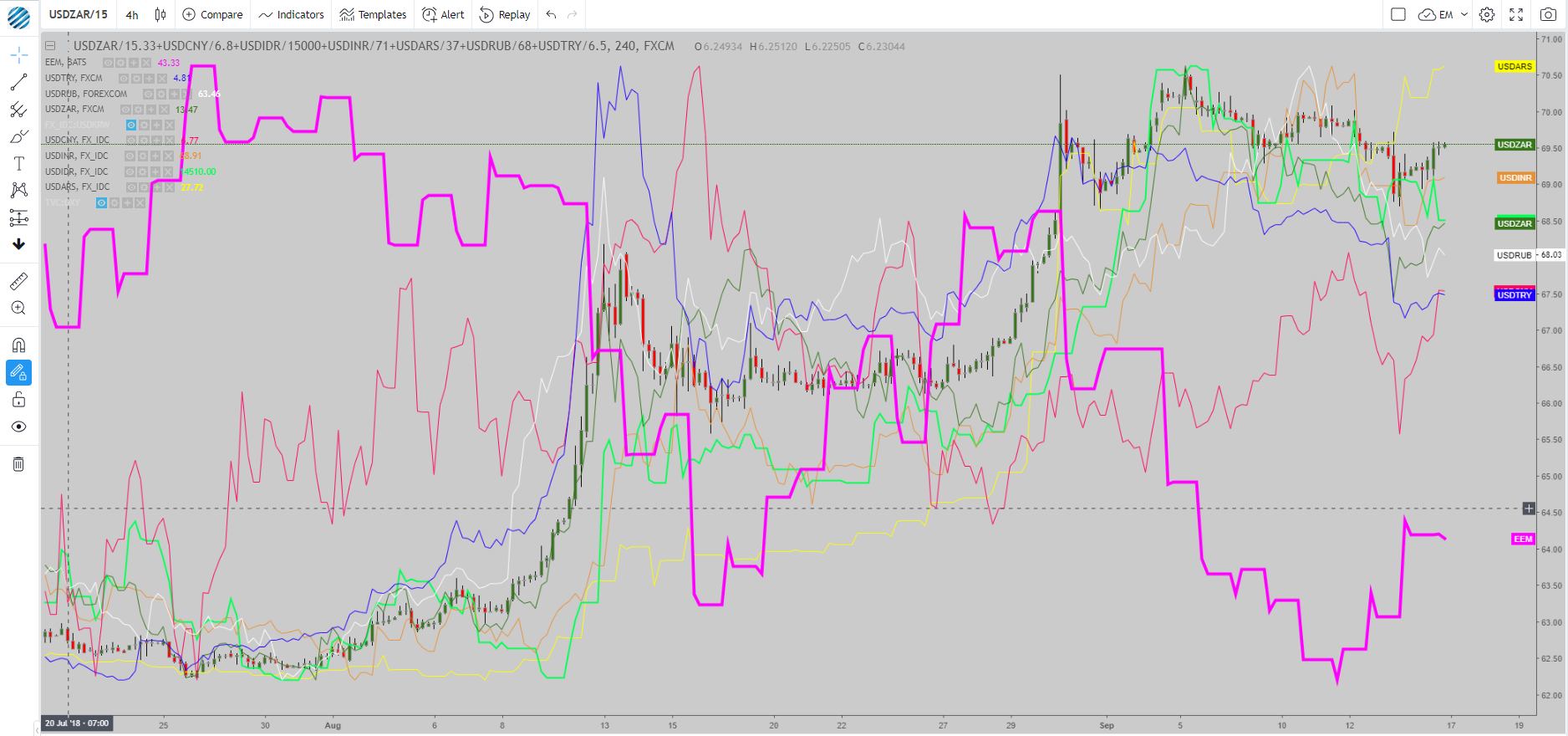

Emerging markets are not out of the woods by any stretch of the imagination either, and as the chart below shows, when factoring in the currencies associated to the largest share of EM countries, the chart found support at the lows from late August and may soon re-target 70.00.

The opening of markets on Monday, against feared gaps, has been surprisingly steady with limited moves. A report by the WSJ that a 10% tariff level vs 25% expected is set to be initially imposed may have contributed to contain further losses for now. However, the risk of no further talks between the two parties in coming weeks should offset what some may argue as positive news.

Last Friday’s US retail sales saw a clear headline miss, coming at 0.1% vs 0.4%, but after further inspection, it suggests the overall reading was a decent one. We saw the prior two months revised up, with the critical control group revised to 0.8% last month vs 0.5%. The immediate reaction by the USD was to be bid higher, hence the market seemed to agree with that rationale.

The August preliminary University of Michigan consumer sentiment, which is one of the Fed’s favorite indicator to gauge consumers’ confidence, skyrocketed above 100.00 vs 96.6 exp, sending the number near recent highs. The positive reading is another positive input for the Fed to stay its course on rate hikes.

Fed’s Evans made some important remarks last Friday, which reinforces the emerging view that heading into 2019, there is a risk that the Fed raises rates above the long-term neutral rate of about 2.5%. According to Evans, it’s entirely natural to think short-term neutral may rise above the long-run estimate. The comments resonate by the watershed speech by Fed’ Brainard last week, who was the first to lay the foundation for this new view of higher rate expectations in the next 12 months.

The overall environment makes the US Dollar a serious contender to stay bid all else being equal. Not only the market is slowly but surely coming to terms with a widening of the US vs G8 Central Bank divergences, but risk-off flows emanating from the strains in trade wars is set to benefit the USD too.

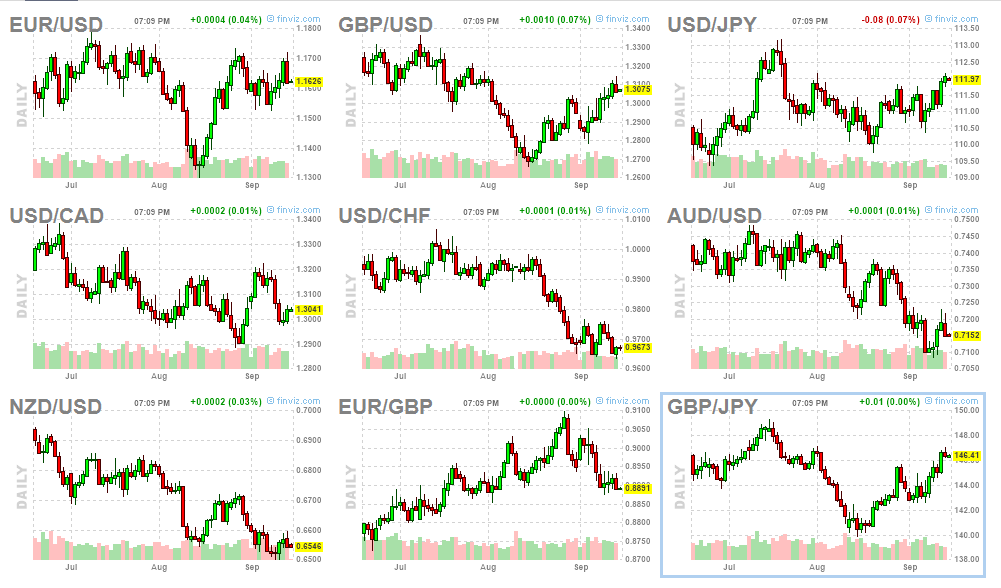

Based on the price action seen in the USD on Friday, the currency is potentially shaping up for further gains, with Thursday’s ECB-led gains in the EUR/USD completely erased. The exchange rate adjusts a notable divergence spotted between the price and a lower German vs US bond yield spread. The close at the highs of the day by the USD in other pairs bodes well for the currency and communicates reluctance to stay short the USD heading into this coming week, as risk headlines loom.

source: finviz.com

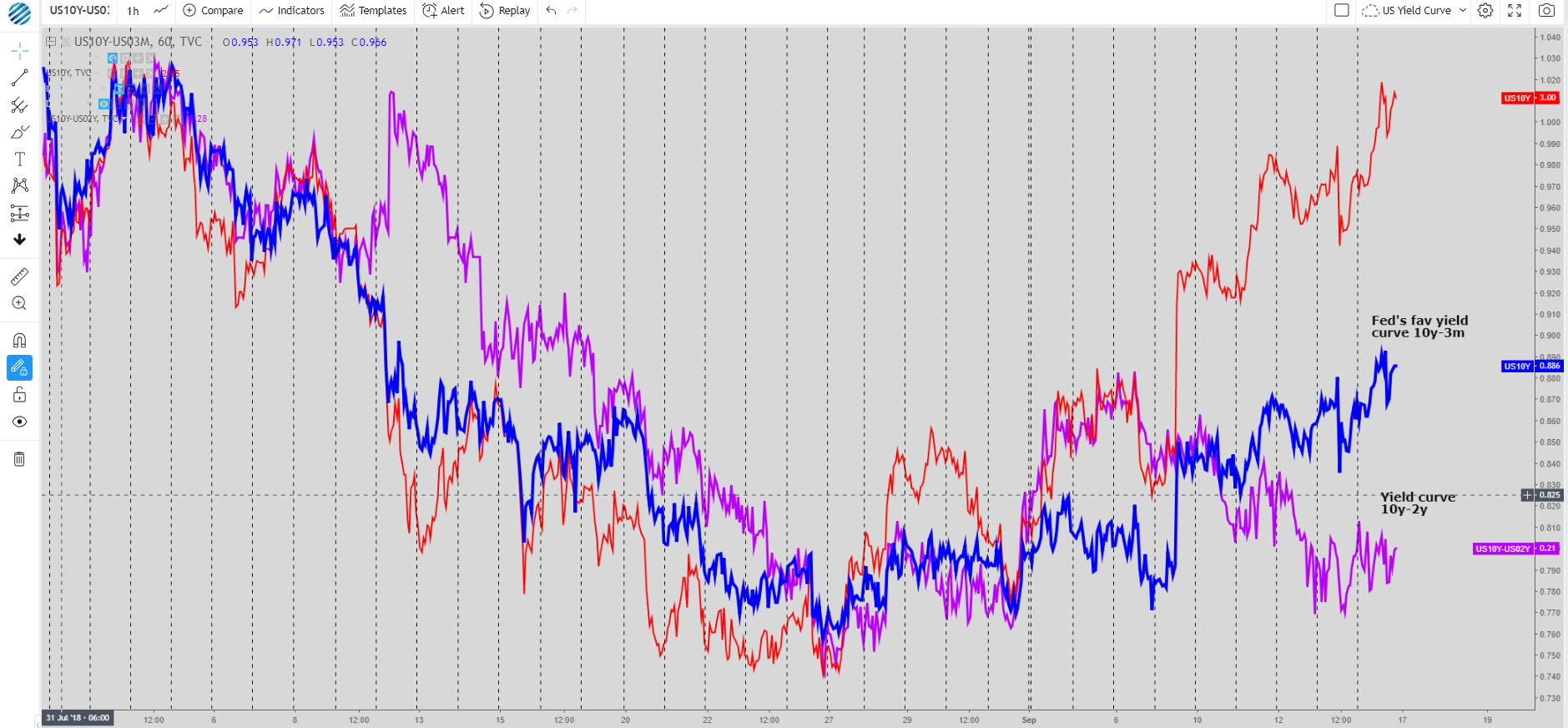

In the fixed income markets, it’s worth noting the rise in the United States 10-Year bond yield towards the highest since late July ‘18 at 3%. A break above would be a major milestone that may ignite further strength in the USD. The shape of the US yield curve comparing 10s vs 3m, as the Fed likes to monitor, also keeps steepening towards 0.9%, while the 10y vs 2y continues to divergence, contained around 0.21%.

A corner of the world CAD traders will be keeping an eye is in Washington, where trade negotiations between the US and Canada continue. The latest we know is that there will be no further conversations on Monday. If this were to extend, it may not sit well for CAD sentiment, even if in the grand scheme of things, both parties appeared to make overall progress last week.

Another asset with an influence on the Canadian Dollar and global inflation for this matter is Oil, with the price hovering around 69.00 after an aggressive rejection above 70.00 last week. The situation in the Hurricane Florence has stabilized with a downgrade to Category 1 storm, despite the disruption in production is thought to be significant. The driver to see the rejection of higher prices has been the pick up in trade rhetoric.

On the Brexit front, the barrage of headlines as of late have arguably provided a bit of a cushion for the sterling, as perma bears lose faith on their short-term bearish conviction after being whipsawed out of the markets in several occasions this Sept. Remember, judging by the 25 delta RR in the options market, along with the reactions on the Sterling to both positive and negative Brexit news, the market remains overcommitted to a bad Brexit outcome, hence why the most bang for one’s buck has been to the upside. Nonetheless, trading the Sterling remains a headline minefield, so be extra careful.