ProShares – best known for its leveraged and inverse ETF lineup – has a little less than 150 products spread across various categories such as Inverse Bonds, Inverse Equities, Currency, Financials Equities, Hedge Fund, Volatility and Leveraged Commodities.

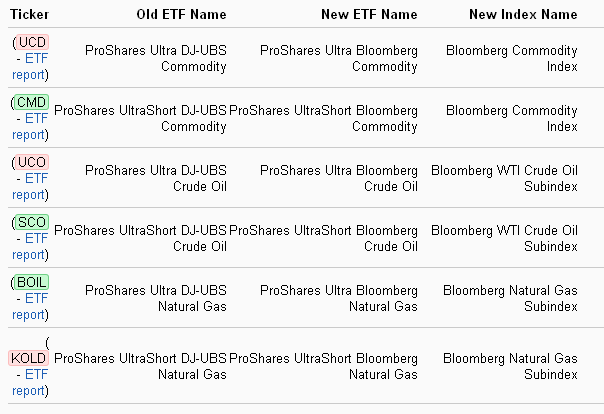

Among these, six of the issuer’s leveraged commodity ETFs have recently undergone an index change from the DJ-UBS commodity indexes to the Bloomberg Commodity Index family.

Though these ETFs are now trading with a new name they have retained their old symbols. Below, we have highlighted the new names and indexes for these ETFs.

Investors should keep in mind that only the names of these funds have changed. These funds still have the same investment objectives and moreover the methods for selecting index components remain unchanged.

Of the above highlighted ETFs, UCD provides two times (2x) leveraged exposure to the daily performance of multiple physical commodities. The fund has returned 15% since the start of the year and has amassed $4.4 million since its inception in November 2008

Also, CMD is an inverse equivalent of UCD and seems to be quite unpopular with an asset base of just $3.2 million.

The ProShares Ultra DJ-UBS Crude Oil (ARCA:UCO), however, provides leveraged (2x) exposure to futures contracts of crude oil and the product SCO is just its inverse equivalent. UCO has returned an excellent 22% return in the year-to-date frame.

Lastly, the product ProShares Ultra DJ-UBS Natural Gas (NYSE:BOIL) provides leveraged exposure to natural gas futures contract, while ProShares UltraSh. DJUBS Ntrl Gas (NYSE:KOLD) is its bearish equivalent.

Bottom Line

The change in the names of these funds and their corresponding indexes were primarily due to the fact that Bloomberg has taken over the operation of UCO's index and has renamed the previous UBS indices.

As such, there has been no major change in the style and the objective of these funds. They continue to trade under the same ticker, with the same strategy but with a minor change in fund name and a different index.