- ProPicks AI turned one year old this month with market-beating results.

- This article is part of a series on the top 10 best-performing stocks picked by our AI this year.

- Today, we focus on the stock ranked number 2, Nvidia, and see how ProPicks detected improving fundamentals amid a parabolic run.

When a stock zooms higher as quickly as Nvidia (NASDAQ:NVDA) has, savvy investors inevitably start to wonder: does this growth truly reflect the stock’s fundamentals, or is there an element of ‘irrational exuberance’ at play here?

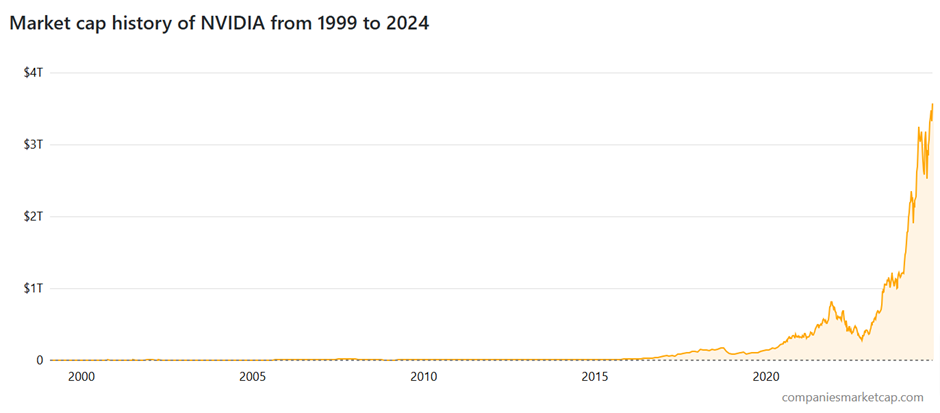

That is precisely the case for the chipmaking powerhouse, which has defied all expectations, more than tripling its market cap from $1.11 trillion in November 2023 to $3.65 trillion a year later.

Now the world’s most valuable company as of this writing, the behemoth company has surpassed even names such as Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT).

While many - including myself - believed the stock was ripe for a sell many times along the way, ProPicks AI saw otherwise, prompting investors to reassess the stock's fundamentals with every monthly rebalance along the way.

In this article, part of our series on the Top-10 picks from our AI this year, we will discuss how ProPicks AI's machine learning model saw that the remarkable climb in share price was primarily accompanied by a combination of powerful price momentum, surging revenue, and unmatched efficiency metrics - making Nvidia our #2 top-performing pick of the year.

By the way (SPOILER ALERT), ProPicks AI is still holding the stock as part of its ‘Beat the S&P 500’ strategy, notching another fantastic 27.7% gain in the first week of November alone.

If you want to find out the right time to sell the stock, I suggest you follow our monthly updates here for less than $9 a month. This way, when the fundamentals finally flash lower - assuming they ever do - you may be one of the first to spot the change in trend.

Now let's dive into how ProPicks' conviction in the stock paid off even after the stock’s parabolic rise before the addition to the ProPicks strategy as a part of the monthly rebalance.

Why Did ProPicks Add Nvidia to ‘Beat the S&P 500’ Strategy After the Stock’s 190% Surge in 11 Months?

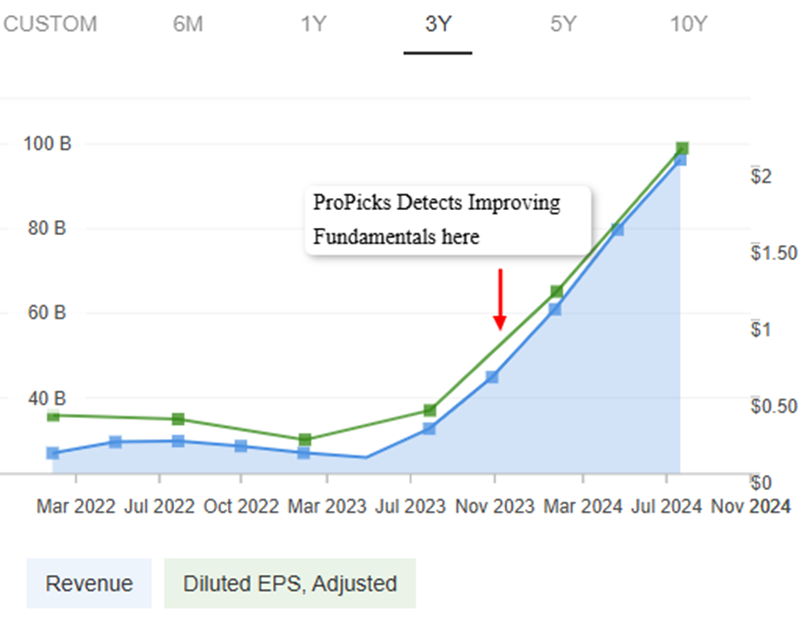

ProPicks saw Nvidia’s price surge as more than just a speculative rally—it recognized that the company’s fundamentals were strengthening alongside the rise.

Leading up to the stock’s inclusion in the ‘Beat the S&P 500’ strategy on November 1, 2023, Nvidia had already surged an impressive 190% since the start of the year.

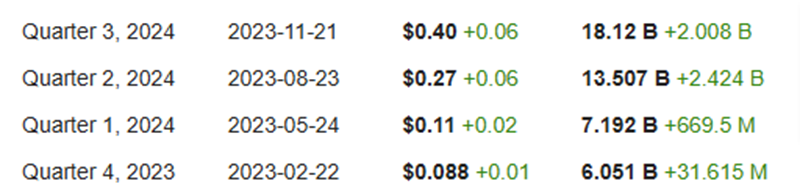

While the price shot up, Nvidia’s fundamentals also improved, with the company consistently beating earnings estimates ahead of the Q3 2024 report, which came out on November 21, 2023.

Source: InvestingPro

The Q3 report came under intense scrutiny due to high expectations, and concerns were mounting over US export restrictions on advanced AI chips to China, potentially affecting Q4 prospects.

With a 190% gain, three strong quarterly earnings in the bag, and looming export concerns, many investors anticipated a correction and some profit-taking.

The Q3 2024 report came out, and Nvidia crushed earnings once again. The company’s CFO, Colette Kress stated that Nvidia is well-positioned to “more than offset” the decline in sales in China.

That’s when ProPicks AI made its move, adding Nvidia to the ‘Beat the S&P 500’ strategy.

Source: InvestingPro

By analyzing vast data sets, ProPicks recognized that key fundamentals were improving, and it paid off: Nvidia went on to exceed expectations in Q4 2024, Q1 2025, and Q2 2025, continuing its winning streak.

Source: InvestingPro

Nvidia’s near-monopoly in data center chips, essential for AI model training, paired with a high-quality client base and impressive gross profit margins exceeding 60%, created a powerhouse foundation.

These solid fundamentals drove the company’s revenue to more than double—from $44 billion in November 2023, when it was added to the ProPicks strategy, to $96 billion later in 2024.

These key factors signaled to ProPicks AI that Nvidia still had room to run, despite the fears of many investors that the stock might be about to put in a top and consolidate sideways for a while before the next move comes.

Only a week into the current month, Nvidia has already surged 27.7%. Since being added to the ProPicks strategy, the stock delivered a 176% return overall, as of October 22, 2024.

Bottom Line

While Nvidia's impressive gains in 2023 had some investors wary of a potential peak, ProPicks saw the stock’s rally as grounded in strong, improving fundamentals, not just market enthusiasm.

Nvidia’s unmatched position in data center chips, a high-quality client base, and industry-leading profit margins fueled revenue growth that doubled within nine months after ProPicks added it in November 2023.

This insight, based on analyzing key metrics and identifying underlying drivers, translated into a significant 200%+ gain for our premium users since its inclusion.

To find out the right time to sell, you can track timely rebalances for just under $9 a month using this link.

And the Grand Moment Has Come!

I will be streaming live with Andy Pai, the creator of InvestingPro, next Tuesday, November 12, to discuss how ProPicks AI works under the hood and reveal our number one pick of the year.

Do not miss out on this special occasion. Stay tuned to our YouTube channel for more updates!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.