Shares of Proofpoint Inc. (NASDAQ:PFPT) went up sharply in the after-hours trade and bounced back from a slight drop during the normal trading session, as the computer security software firm reported better-than-expected second-quarter top-line results and raised its outlook for 2017.

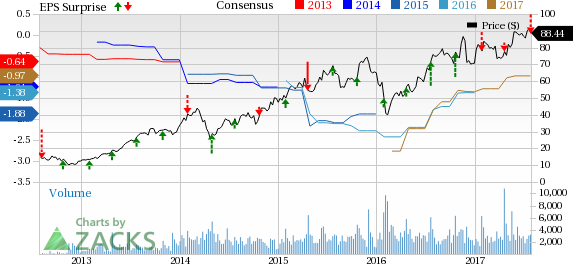

Moreover, although the company’s bottom-line results fell short of estimates, it came in line with the year-ago quarter. The company’s adjusted loss per share (excluding all one-time items but including stock-based compensation) came in at 39 cents, wider than the Zacks Consensus Estimate of 26 cents.

However, on a non-GAAP basis, the company reported earnings of 17 cents per share, marking approximately three-fold jump from the year-ago quarter’s earnings of 6 cents. The year-over-year improvement was primarily stemmed by solid top-line growth and efficient cost management, which were partially offset by higher share counts.

Following the earnings announcement, shares of Proofpoint gained approximately 3.5% in the after-hours trading session. Notably, the stock has gained 25.2% year to date, substantially outperforming the 17.9% rally of the industry it belongs to.

Quarter in Detail

Proofpoint reported total revenue of $122.3 million, up 36.1% year over year, mainly driven by customer additions, improved add-on-sales and strong renewal rate. The company’s revenues also surpassed the Zacks Consensus Estimate of $120.4 million and also came ahead of its guidance range of $118–$120 million.

Total billings during the quarter also jumped 45% year over year to $146.3 million. Renewal rates also remained well over 90% during the second quarter.

Non-GAAP gross profit surged 39.8% from the year-ago quarter to $94.4 million. Moreover, non-GAAP gross margin expanded 200 basis points (bps) to 77.1%, primarily driven by higher sales and efficiency improvements across the company’s cloud operations.

Furthermore, the company efficiently managed its operating expenses this quarter. As a percentage of revenues, non-GAAP operating expenses declined to 69.7% from 71% in the year-ago quarter. In dollar terms, however, the figure increased 33.6% to $85.3 million.

Owing to higher revenues and efficient cost management, Proofpoint’s non-GAAP operating income for the quarter jumped year over year to $9.1 million from $3.7 million recorded in second-quarter 2016. Operating margin expanded 280 bps to 7.4%, primarily due to higher gross margin and lower operating expenses as a percentage of revenues.

Non-GAAP net income, therefore, increased to $9.1 million from $2.5 million reported in the prior-year quarter. Net income margin advanced 460 bps to 7.4%.

Balance Sheet & Cash Flow

Proofpoint exited the quarter with cash and cash equivalents, and short-term investments of approximately $429.5 million, slightly up from the previous quarter balance of $412.9 million. Accounts receivable were $75.6 million compared with $62.4 million at the end of first-quarter 2017.

During the first half of 2017, the company generated operating cash flow of $67 million. Free cash flow for the first two quarters came in at $44.1 million.

Outlook

Buoyed by better-than-expected top-line result, Proofpoint provided encouraging outlook for the third quarter and raised guidance for the full year. For 2017, the company now anticipates revenues in the range of $503–$506 million, up from the earlier guidance range of $496–$500 million. Currently, the Zacks Consensus Estimate for revenues is pegged at $500.55 million.

Billings’ guidance for the year has also been revised upward and is now anticipated to come between $625 million and $628 million. Earlier, it was projected to remain in the range of $619–$623 million.

Similarly, non-GAAP earnings per share are now estimated to come between 62 cents and 64 cents, up from the previous guidance range of 56–59 cents. Free cash flow for the year is now projected to be in the range of $100–$107 million, up from the earlier projection of $98–$106 million. The company intends to incur capital expenditure in the range of $44–$46 million in 2017.

Coming to the third-quarter outlook, the company anticipates reporting revenues in the range of $130–132 million, and billings between $162 million and $164 million. Currently, the Zacks Consensus Estimate for revenues is pegged at $129.6 million.

GAAP and non-GAAP are expected to be 72% and 77%, respectively. Non-GAAP net income is anticipated to come in the range of $8.0–$9.0 million, or 16–18 cents per share. Proofpoint projects reporting loss in the range of $24.8–$28.2 million or 56–64 cents per share, on a GAAP basis.

Free cash flow is projected to be in the range of $26–$28 million, while capital expenditure to be approximately $12 million during the third quarter.

Our Take

Proofpoint reported mixed results for second-quarter 2017, wherein its top line fared better than the Zacks Consensus Estimate but the bottom line didn’t. However, on a year-over-year basis, the company witnessed improvement on both the counts. Furthermore, an optimistic third-quarter outlook and upbeat full-year guidance are encouraging.

Proofpoint is a leading security-as-a-service provider that focuses on cloud-based solutions for threat protection, compliance, archiving & governance, and secure communications. The company’s sustained focus on launching products, acquisitions and partnerships have helped it register over 35% revenue growth consistently for the last few quarters.

Nonetheless, since it continues to invest in sales and marketing, we anticipate this to remain a drag on the company’s bottom line in the near term. Intensifying competition and an uncertain macroeconomic environment add to its woes.

Currently, Proofpoint carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Applied Optoelectronics, Inc. (NASDAQ:AAOI) , Broadcom Limited (NASDAQ:AVGO) and Mellanox Technologies, Ltd. (NASDAQ:MLNX) , all sporting a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected EPS growth rates for Applied Optoelectronics, Broadcom and Mellanox Technologies are 18.8%, 13.6% and 13.1%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Proofpoint, Inc. (PFPT): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post