Dave & Buster's Entertainment, Inc. (NASDAQ:PLAY) continues to perform well on the back of the unique customizable experience that it offers across four platforms, “Eat, Drink, Play and Watch.” The company’s distinctive model also generates favorable store economics and strong return. However, its limited international presence and high costs of operations remain concerns.

In the first quarter of 2019, the company’s earnings and revenues missed the Zacks Consensus Estimate, after delivering a beat in the trailing four quarters. Also, comparable store sales (comps) lagged expectations. Furthermore, Dave & Buster's lowered its guidance for the fiscal year.

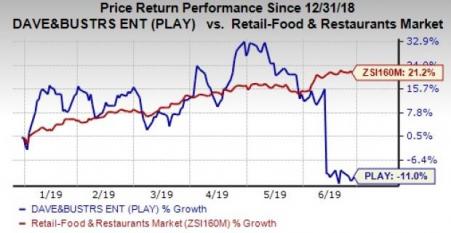

Notably, the company’s shares have lost 11% so far this year, underperforming the industry’s 21.2% rally.

Let us delve deeper into reasons that suggest that investors should hold the stock for the time being.

Growth Catalysts

Dave & Buster’s continue to impress investors with solid top-line growth. The company’s various sales-building initiatives and increased focus on distinguished offerings set it apart from other restaurants. In the first quarter of fiscal 2019, its revenues rose 9.5% from the prior-year quarter number. This upside was primarily driven by consistent unit growth, and robust Amusements and Other revenues as well as Food and Beverage revenues.

Apart from great food or beverages, the company’s entertainment business has been driving growth. Notably, amusement and other revenues accounted for 59.2% of total revenues in the first quarter of fiscal 2019. In fact, it is a major reason for Dave & Buster’s success. Further, the segment’s revenues grew 11.9% year over year.

This is because increased dependence on gaming has cushioned the company from headwinds arising from consumer discretionary spending that characterizes the restaurant industry and is, in turn driving market share and comps. Also, the shift toward increased focus on amusement is driving the company’s earnings, given its higher-margin business. It is, in fact, this unique model that sets it apart and we expect the company’s entertainment business to carry the growth story forward.

Dave & Buster's continues to pursue a disciplined new store growth strategy in new and existing markets, given the broad appeal of its brand. Management believes that it can grow the concept to more than 200 units in North America over time. Dave & Buster’s launched seven stores in the fiscal first quarter in Louisville, KY; North Hills (Pittsburgh), PA; Thousand Oaks, CA; Daytona Beach, FL; Fairfax, VA; Ft. Myers, FL; and Sevierville, TN. In fiscal 2019, management expects to open 15-16 stores in new locations, with 12% unit growth.

Concerns

The company’s non-franchised model makes it susceptible to increased expenses. Since all the restaurants are owned and operated by Dave & Buster’s, instead of signing franchise agreements and putting the cost burden on the franchise, the company is solely responsible for expenses of operating the business. In fiscal 2018, total operating costs increased 13.4% year over year. In the first quarter of fiscal 2019, operating margin declined roughly 170 basis points (bps) year over year to 15.9%. Also, operating costs increased 11.8% year over year.

Further, Dave & Buster’s restaurants are located in the United States and Canada, and it has no exposure in international markets. While several other fast-casual restaurateurs like McDonald’s (NYSE:MCD) , Domino’s (NYSE:DPZ) and Yum! Brands (NYSE:YUM) are capitalizing on the emerging market potential, Dave & Buster’s seems to be slow on this front. We believe that the company needs to expand presence beyond the United States to offset the impact of cut-throat competition in the saturated domestic market.

Dave & Buster’s currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

McDonald's Corporation (MCD): Free Stock Analysis Report

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Original post

Zacks Investment Research