The Progressive Corporation (NYSE:PGR) reported earnings per share of 52 cents for January 2018, soaring 73% year over year. Moreover, the bottom line is driven by an improved top line.

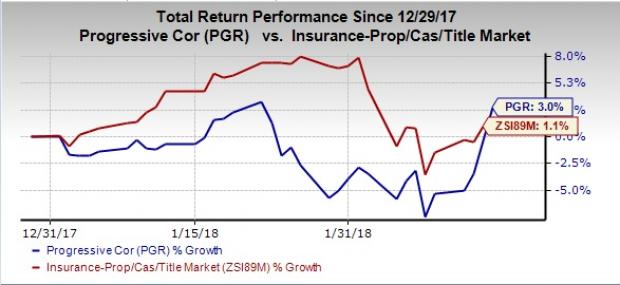

Year to date, Progressive’s shares have gained 3%, outperforming the industry’s 1.1% increase. This share price rise was courtesy of the company’s sustained strong results.

Numbers in January

Progressive recorded net premiums written of $2.7 billion in the month, up 22% from $2.2 billion in the year-ago period. Net premiums earned were about $2.7 billion, up 18% from $1.8 billion last January.

Net realized gains on securities in the quarter were $181.1 million, skyrocketing from $9.4 million in the prior-year quarter.

Combined ratio — percentage of premiums paid out as claims and expenses — improved 230 basis points year over year to 87.4%.

Total operating revenues came in at $2.9 billion. The top line improved 18% year over year owing to an 18% increase in premiums, 27% higher investment income, 15% growth in fees and other revenues plus a 21% rise in service revenues.

Total expenses shot up 15% to nearly $2.4 billion. This increase can be primarily attributed to 15% higher losses and loss adjustment expenses, 17% climb in policy acquisition costs and a 16% jump in other underwriting expenses.

In January, policies in force were impressive in both Vehicle and property business. In its vehicle business, Personal Auto segment improved 13% year over year to nearly 11.9 million. Special Lines inched up 1% from the year-earlier month to 4.3 million.

In Progressive’s Personal Auto segment, both Direct Auto and Agency Auto expanded 14% to 6.1 million and 13% to nearly 5.7 million, respectively.

Progressive’s Commercial Auto segment rose 7% year over year to 0.6 million. The Property business had about 1.6 million policies in force in the reported month, up 27% year over year.

Progressive’s book value per share was $16.49 as of Jan 31, 2018, up nearly 17% from $14.10 as of Jan 31, 2017.

Return on equity in the trailing 12 months was 22.5%, improved 510 bps from 17.4% in January 2017. Debt-to-total-capital ratio improved 220 bps year over year to 25.6% as of Jan 31, 2018.

Zacks Rank and Other Insurers

Progressive carries a Zacks Rank #2 (Buy). Investors interested in the property and casualty insurance industry can also look at Infinity Property and Casualty Corporation (NASDAQ:IPCC) , NMI Holdings Inc. (NASDAQ:NMIH) and CNA Financial Corporation (NYSE:CNA) .

Infinity Property and Casualty provides personal automobile insurance products in the United States. The company’s average four-quarter positive surprise is 262.25% and it sports a Zacks Rank #1 (Strong Buy). Shares have gained 11.1% year to date, outperforming the industry’s rally. You can see the complete list of today’s Zacks #1 Rank stocks here.

NMI Holdings provides private mortgage guaranty insurance services in the United States. The company’s average four-quarter positive surprise is 11.72% and it carries a Zacks Rank of 1. Shares have risen 11.8% year to date, outperforming the industry’s increase.

CNA Financial provides commercial property and casualty insurance products, primarily in the United States. The company delivered an average four-quarter beat of 46.88%. Shares of the company have inched up 0.6% year to date. The stock has a Zacks Rank of 2.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Progressive Corporation (The) (PGR): Free Stock Analysis Report

CNA Financial Corporation (CNA): Free Stock Analysis Report

Infinity Property and Casualty Corporation (IPCC): Free Stock Analysis Report

NMI Holdings Inc (NMIH): Free Stock Analysis Report

Original post

Zacks Investment Research