The Progressive Corporation (NYSE:PGR) will release second-quarter 2017 results before the opening bell on Jul 18. Last quarter, this company delivered a 1.47% negative earnings surprise. Let’s see how things are shaping up for this announcement.

Factors Influencing this Past Quarter

Progressive’s top line is expected to have benefited from improved premiums as well as the investment income in its second quarter.

The company’s diversified product portfolio, coupled with a competitive pricing, has probably aided a solid retention ratio.

Policies in force across Personal and Commercial Lines are expected to have remained healthy in the quarter to be reported.

However, overall expenses are estimated to have increased due to higher losses and loss adjustment expenses, rise in policy acquisition costs and escalating other underwriting expenses.

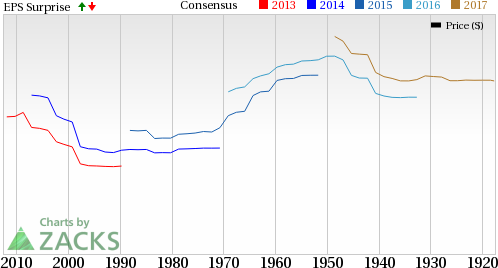

With respect to an earnings trend, the company delivered positive surprises in two of the last four quarters, but with an average negative surprise of 4.95%.

The company’s share price has been trending up over the last few days and is currently trading at $45.58. We wait to see how the stock performs, post the earnings release.

Earnings Whispers

Our proven model does not conclusively show that Progressive is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP as well as a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. However, this is not the case here as elaborated below.

Zacks ESP: Progressive has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at 60 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Progressive has a Zacks Rank #1, which increases the predictive power of ESP. However, a 0.00% Earnings ESP makes the surprise prediction difficult.

Importantly, the Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

Other Stocks to Consider

Some other stocks worth considering in the P&C insurance space with the right combination of elements to post an earnings beat this quarter are:

Everest Re Group Ltd. (NYSE:RE) is set to report its second-quarter earnings on Jul 24. The stock has an Earnings ESP of +1.52% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Travelers Companies, Inc. (NYSE:TRV) has an Earnings ESP of +0.96% and a Zacks Rank #3. The company is set to report its second-quarter earnings on Jul 20.

Chubb Limited (NYSE:CB) has an Earnings ESP of +0.40% and a Zacks Rank #3. The company is slated to post its second-quarter earnings on Jul 25.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

D/B/A Chubb Limited New (CB): Free Stock Analysis Report

Everest Re Group, Ltd. (RE): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research