Progressive Corp. (NYSE:PGR) being one of the major auto insurers in the country is also bundling home insurance. Efforts by the company to further penetrate customer households through cross-selling auto policies are likely to pay off.

Its policies in force (PIF) remain health as most of the business lines show improvement.

In addition, several initiatives by the company aimed at providing consumers with distinctive new auto insurance options and capitalizing on new opportunities, pave the way for growth.

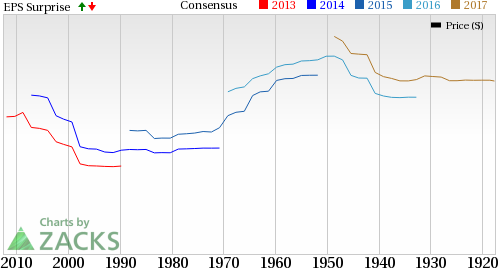

Though the company faces competition, positive tidings have been driving bullish sentiments as reflected through increasing estimates. Progressive does have a decent history when it comes to earnings as the stock has beaten estimates in two of the last four quarters with an average beat of nearly 7%.

Currently, Progressive has a Zacks Rank #2 (But), but that could definitely change following Progressive earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank stocks here.

We have highlighted some of the key stats from this just-revealed announcement below.

Earnings: Progressive earnings miss by a penny. Our consensus called for EPS of 60 cents, and the company reported EPS of 59 cents.

Key Stats to Note: Premiums written continue to post solid numbers, increasing 14% year over year in the reported quarter. Combined ratio improved 360 basis points in the quarter.

Policies in force (PIF) remained healthy, with the Personal Lines segment increasing 6% year over year to 15.4 million. Commercial Lines increased 4% year over year to 0.6 million.

Check back later for our full write up on this PGR earnings report later!

5 Trades Could Profit "Big-League" from Trump PoliciesIf the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course. Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research