Andrew Lo, of the Massachusetts Institute of Technology, recently wrote a stimulating discussion of two seemingly contrary “laws”: Moore’s and Murphy’s. This is his lighthearted way of looking at the not-at-all lighthearted question of how risks must and may be managed within the world financial system.

Moore’s law is a generalization stated by the eponymous Gordon E. Moore, the co-founder of Intel (O:INTC), to the effect that the number of transistors per integrated circuit doubles every year. He first made this observation in 1965, and he projected that this rate would continue for another ten years. Ten years later, he wrote that he had been right, but he thought this exponential growth would be a bit more modest going forward, that the power of circuits would double thereafter only in every-two-year intervals. That has also held roughly valid, though recently the CEO of Intel, Brian Krzanich, said that “our cadence today is closer to two and a half years than two.”

As of 2014 (I take this datum from Wikipedia, so don’t blame Andrew Lo for it!), the most sophisticated available processor, the Xeon Ivy Bridge-EX contained 4.3 billion transistors. Back in 1975 the corresponding number was: 60,000.

Technological Impetus

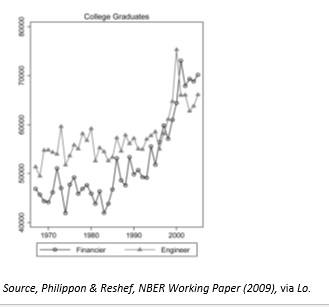

Meanwhile, the increasing economic importance both of technology and of finance is well reflected in the graph below, which is panel c of Lo’s Fig. 5. It shows the annual income of all college graduate engineers and financiers, stated in constant 2000 U.S. dollars. Both lines took off dramatically around 1994, and, though each suffered a pull-back when the dotcom book came to a sudden end, neither is about to return to its pre-1994 level.

The technological impetus expressed in Moore’s law has contributed greatly to productivity, economic growth, and the quality of life of the human species through the period since the initial observation. Of course it is a “law” only in a loose metaphorical sense but, then, the same is true of Murphy’s!

Murphy’s Law, “whatever can go wrong, will go wrong,” is even better known and even easier to grasp, than Moore’s. The two laws seem to be antithetical: Moore’s law suggests something that is going right with the world, Murphy’s urges pessimism. But the difference isn’t all that great. Lo, in an earlier paper he co-authored with Andrei Kirilenko, suggested a technology-specific form of Murphy’s law: “Whatever can go wrong, will go wrong faster and bigger when computers are involved.”

Computers are very much involved with the markets, and Moore’s law constantly re-creates the platform on which we act out Murphy’s law for one another’s bemusement. Lo mentions in this connection “firesales, flash crashes, botched initial public offerings, cybersecurity breaches, catastrophic algorithmic trading errors, and a technological arms race that has created new winders, losers, and systemic risk in the financial ecosystem.”

The Population of the Species

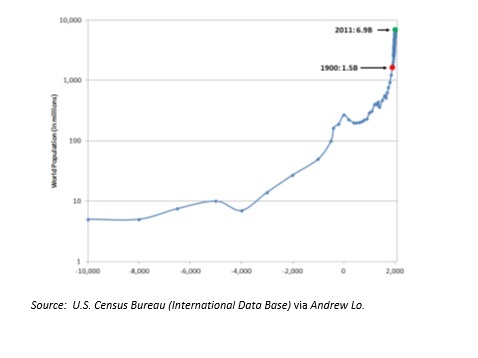

Figure 2 in Lo’s paper is presented below. It is semi-logarithmic plot of the estimated world population from 10,000 to 2011. The portion of the rising line since 1900 (that is, the portion above the red dot) looks a lot like a simple vertical swoosh. The best estimate of the world’s population in 1900 is that it was 1.5 billion. A little more than one century later, the corresponding number is 7 billion. So many more people means so much more need for effective financial services, and so much more intermediation to be done between the savers that make capital financing possible and the entrepreneurs who make it effective. So exploiting the greater communicative effectiveness made possible by Moore’s law isn’t really an option, it is an imperative.

Lo’s discussion suggests a kind of ever-lasting treadmill. Or, as Lo more allusively calls it, a “Red Queen’s Race.” The faster the financial world adopts new technologies, driven by the increasing demand from an increasing population, the more risks it will create and confront: risks that it can only resolve or at least manage only through a discerning use of the new technology.

As an illustration, Lo discusses secure multi-party computation, a developing technique for sharing certain types of information while preserving confidentiality. Through this technique, the financial world, aided by increasing computing power, can “provide the information that adaptive regulation requires, without feeling burdened or threatened by regulatory intrusion.”