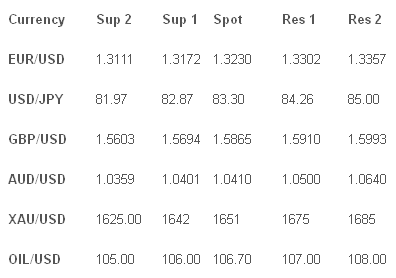

U.S. Dollar Trading (USD) a very quiet day on the markets with little fresh news to inspire direction. US stocks came under slight pressure as investors locked in profits from the recent rally and the USD/JPY was the main mover down with the Yen crosses as resistance above Y84 held a second attempt. Looking ahead, Weekly Jobless Claims forecast at 354k vs. 351k previously.

The Euro (EUR) some negative news from the Eurozone regarding Spanish banks exposure to Portugal inspired the EUR/USD reversal from 1.3280 to 1.3180. With US stocks also under pressure the EUR/JPY tested Y110 with the USD/JPY pullback. The outlook is for more range trading but the immediate downside is seen limited. The Sterling (GBP) the GBP/USD reversed in Europe as well after a surprise 7-2 MPC vote with two members wanting even more QE at the last meeting. The EUR/GBP was unaffected and demonstrated the resilience of the Pound in recent sessions and GBP/AUD extended gains to test 1.5200. Looking ahead, February UK Retail Sales forecast at -0.4% vs. 0.9% previously. Also ECB President Draghi speaks.

The Japanese Yen (JPY) the USD/JPY was a big mover overnight falling from Y84 with US interest rates retreating as Bernanke failed once again overnight significantly change his dovish tune. The Yen crosses came under heavy pressure as well with AUD/JPY and EUR/JPY leading on the way down. Support is expected soon and the Yen weakness trend is seen continuing in the medium term. Australian Dollar (AUD) the AUD/USD found good selling above 1.0500 with the China news continue to weigh and US stock falls and negative Euro News also adding to the downside. The outlook is mixed with further downside favored if Chinese data continued to soften. Looking ahead, Chinese March HSBC PMI slumps to 48.1 vs. 49.6 previously.

Oil & Gold (XAU) Gold kept quiet overnight with the $1650-60 range holding firm and the market ending unchanged. Oil was bullish after bouncing off $106 closing above $107.

Pairs to watch

EUR/JPY pullback better levels to buy?

AUD/USD Chinese PMI to show further slowdown?

TECHNICAL COMMENTARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Profit Taking Halts Risk Rally

Published 03/22/2012, 07:00 AM

Updated 03/09/2019, 08:30 AM

Profit Taking Halts Risk Rally

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.