In 1986, I visited the Philippine Stock Exchange. There were few, if any, computers on the floor. Black markers registered trading activity on a giant whiteboard. And the feeling that I came away with was that I had caught a glimpse of an incomplete science experiment.

Today, however, a number of frontier economies have upped their level of sophistication. The Philippines recently benefited from credit agency upgrades to its sovereign debt. Direct investment by foreigners has been bountiful. What’s more, stock investors have pursued the up-n-comer for greater total return potential. Year-over-year, ETF enthusiasts have garnered roughly 53% from a dedication to iShares MSCI Philippines (EPHE).

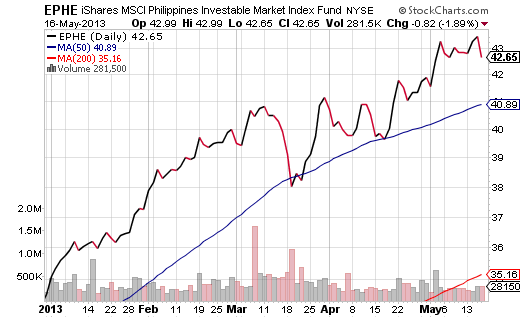

That said, EPHE seems to be running on fumes. The Relative Strength Factor (RSF) score for this exchange-traded vehicle has stayed in the top 5% of all exchange-traded funds for most of 2013, making it vulnerable to a volatile “risk-off” change of heart. Even in the local equities market where one might track the Philippine Stock Exchange Index (PCOMP), the relative strength data have flashed bright yellow warning lights.

Granted, the iShares MSCI Philippines Fund (EPHE) is hardly the only overbought ETF on a technical basis, nor is it alone in its questionable fundamentals. Yet it is one of a select group of unleveraged ETFs that have risen more than 25% in the calendar year. That fact alone may make it ripe for profit takers and short sellers.

In truth, downside risks have been largely absent in 2013. The fact that many view Thursday’s stock asset stumble as an aberration is reason enough to take a harder look at the year’s fastest price appreciators. How vulnerable are they?

With the S&P 500 shedding 0.5% on the contemplation of the Federal Reserve slowing the pace of monetary stimulus, the biggest losers did tend to come from the year’s highest fliers. The irrepressible WisdomTree Japan Hedged Equity (DXJ) had nearly 46% on the year prior to shedding 1.2% on Thursday. Homebuilders via iShares DJ Home Construction (ITB) had been up roughly 23% year-to-date before suffering a 1.6% decline. The iShares MSCI Philippines Fund (EPHE) gave up 1.9% in the session.

It’s not uncommon for investors to take profits on ETFs that have far exceeded expectations. The bigger question is, how long should you hold onto the extreme winners that have treated you so well? Are you in danger of falling in love, the way some did with dot-com tech companies last decade? If you were one of the early adopters of a high-flying ETF, do you have an approach for making a graceful exit or will you cling to a misguided notion of hold-n-hope? Hopefully, you have an actual plan for managing downside risk.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Profit Takers Bid Farewell To Highest-Flying Stock ETFs. Should You?

Published 05/17/2013, 03:08 AM

Updated 03/09/2019, 08:30 AM

Profit Takers Bid Farewell To Highest-Flying Stock ETFs. Should You?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.