The Zika virus is back in the headlines. And it’s becoming harder and harder to ignore... especially because a viable Zika vaccine hasn’t reached the market yet.

At last count, 14 Zika cases have been reported in Florida. It’s not the first time U.S. citizens have contracted the virus, but it is the first time it’s been contracted from local mosquitos.

The Florida government is working to quarantine the site of the outbreak. But at this point, it’s likely these Zika-carrying mosquitos are here to stay.

The media is delivering round-the-clock coverage of “Zikamania.” And believe it or not, there is an upside...

One that could generate some big short-term gains for your portfolio.

We’re talking about investing in an indispensable $24 billion industry.

As much as people hate getting shots, the risk of serious illness has a funny way of propelling us toward the nearest doctor’s office.

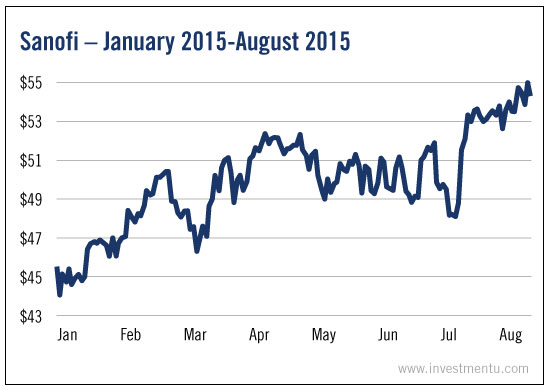

Historically, vaccine manufacturers perform well during health crises. Take, for example, the meningitis outbreak of 2015.

Sanofi (PA:SASY), the company behind the meningitis vaccine Menactra, started the year with a $44.55 share price.

By August, the stock was worth $53.48.

A 20% jump.

Now to combat Zika, two companies have joined forces...

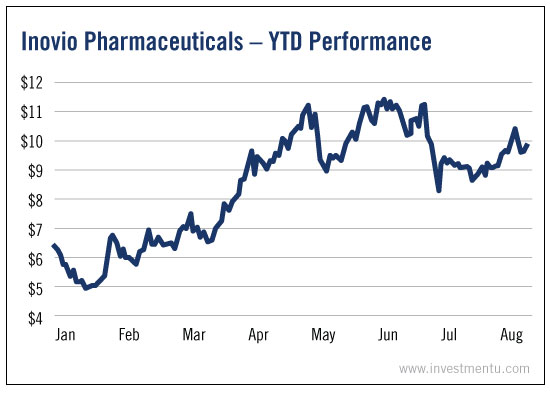

Inovio Pharmaceuticals Inc (NASDAQ:INO) and GeneOne Life Science Inc (KS:011000) just announced that their Zika vaccine has been approved for a Phase 1 human trial.

Year to date, Inovio shares are up 55%. And the stock should continue to gain with every piece of positive news.

Sanofi is also working to develop a Zika vaccine. And it has got one heck of a research partner...

The U.S. Army.

The beauty of this partnership is that it will legitimize Sanofi’s vaccine to a global audience. After all, the success of a vaccine depends on the approval of various governments.

For example, if Brazil approves Sanofi’s vaccine, that will expand the company’s client base by about 1.5 million people.

The World Health Organization estimates that 3 to 4 million Zika infections could appear in the Americas this year. The pressure is on to develop a working vaccine.

Whether it’s Inovio or Sanofi that gets approval first, both companies - and their shareholders - stand to book some major short-term gains.