Recently there has been a proliferation of articles attributing the decline of GDP to weak productivity growth. Cause and effect, or more crap from pundits?

Follow up:

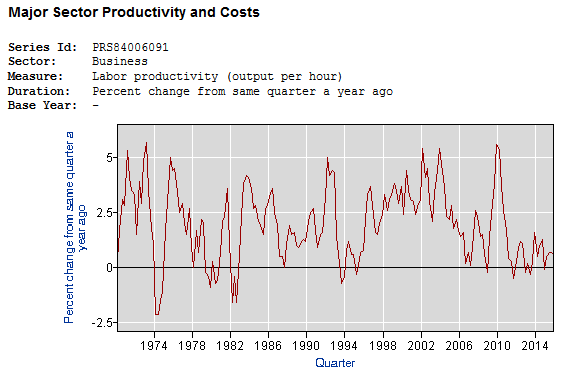

The concern of the productivity pundits is that productivity growth has fallen into the toilet....

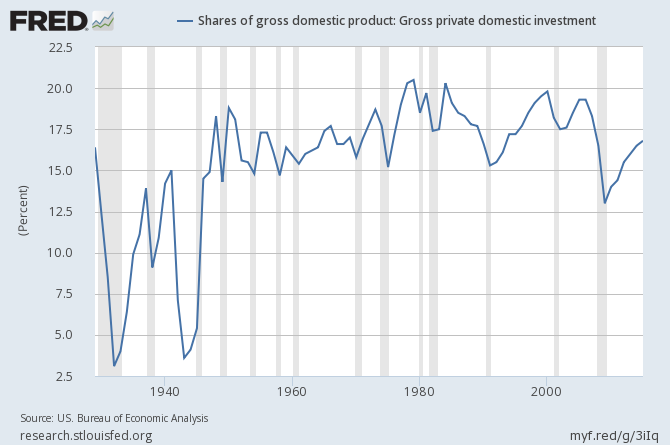

..... and believe the cause of poor productivity is the recent weak investment by the private sector. Consider that investment adds to GDP so we can say that if the private sector really pumped significant money into GDP - GDP would rise.

As an industrial engineer, for me the formula for productivity is very basic.

The problem with an engineer's view of productivity is that although the formula is very simple, the application can very complex. The identification of the inputs vary wildly between locations and businesses. Outputs are relatively easier to identify.

Economists want to measure productivity because they have defined productivity growth as THE dynamic of economic growth. From Wikipedia:

In macroeconomics the approach is different. In macroeconomics one wants to examine an entity of many production processes and the output is obtained by summing up the value-added created in the single processes. This is done in order to avoid the double accounting of intermediate inputs. Value-added is obtained by subtracting the intermediate inputs from the outputs. The most well-known and used measure of value-added is the GDP (Gross Domestic Product). It is widely used as a measure of the economic growth of nations and industries. GDP is the income available for paying capital costs, labor compensation, taxes and profits.

Understand that to an economist - GDP is THE measure of value added.

Productivity by economists definition is strictly a cost calculation. It does not measure any optimizations for poor business conditions or points of manufacture. Using the economists definition, productivity would improve by investing in a bridge to nowhere.

Most readers know my disdain for GDP as it does not measure the economic conditions being faced by the median Joe Citizen. I know of no measure which says Joe Citizen is worse off in 1Q2016 - yet GDP implies average Joe is worse off.

The problem with economic discussion of productivity is that it is essentially GDP - not technology or measurement or anything that has to do with real productivity. Does anyone care?

Other Economic News this Week:

The Econintersect Economic Index for April 2016 again insignificantly improved but remains relatively weak. The index continues near one of the lowest values since the end of the Great Recession. This marginal index improvement is due to data being compared against relatively soft data - both month-over-month and year-over-year. Our employment six month forecast is for slightly weaker employment growth for April - and the long term decline in the employment forecast remains in play.

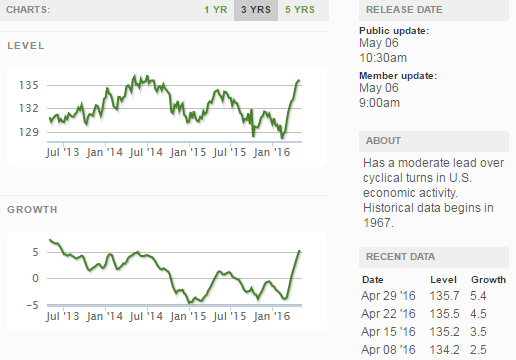

Economic Cycle Research Institute (ECRI) Weekly Leading Index (WLI) Growth Index is now in positive territory and forecasting a marginally strengthening economy six months from now.

Current ECRI WLI Growth Index

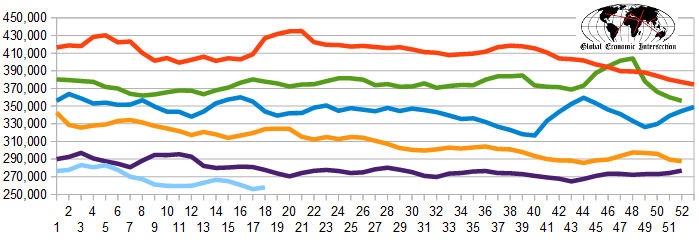

The market expectations for weekly initial unemployment claims (from Bloomberg) were 256,000 to 271,000 (consensus 262,000), and the Department of Labor reported 274,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 256,000 (reported last week as 256,000) to 258,000. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Ultra Petroleum, Fairway Group Holdings, Midstates Petroleum Company, Aeropostale, CHC Group, Hong Kong and PRC-based Kaisa Group Holdings (Chapter 15)

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: