When addressing the inability of monetary policy to actually produce its “inflation” target, the FOMC has been left to hiding. They fully and openly admit the role of oil prices in the depression of calculated inflation starting late 2014 because they reason that it somehow doesn’t apply strictly within their mandate (as if it was specifically written for monetary policy to create 2% steady inflation, except if oil prices don’t want to cooperate). However, that is decidedly not the full extent of their own professed failure; and they know it, but refuse to specify.

In these past few FOMC meetings where no action has been taken, even the more “hawkish” like October, the policy statement has been updated with the addition of “partly.” The latest iteration was:

Inflation has continued to run below the Committee’s longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. [emphasis added]

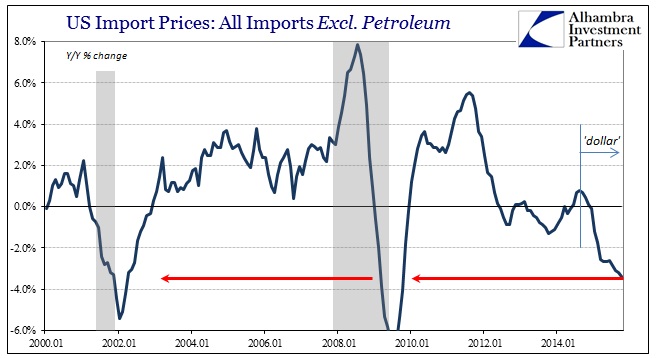

While economists and most of the media seems content to take that statement at face value, given that “inflation” has been undercutting, often severely, the 2% target not for a few months but rather a few years you would think there would be more open inquisition about what that unsaid “partly” might be. It isn’t hard to find, either. Just this week, updates for both import prices and the PPI domestically offer much further analysis in that direction. In fact, both of those factors and pieces of the consumer price process are highly complementary even if the FOMC refuses the obviousness.

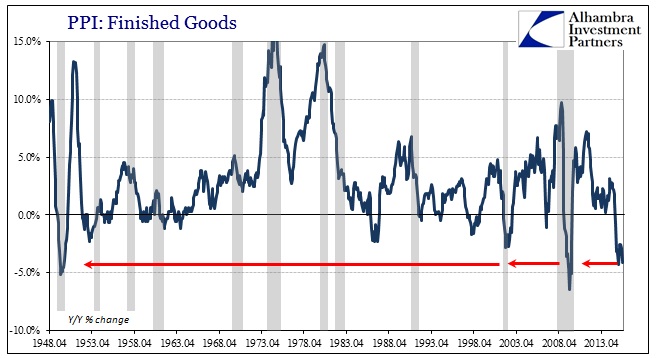

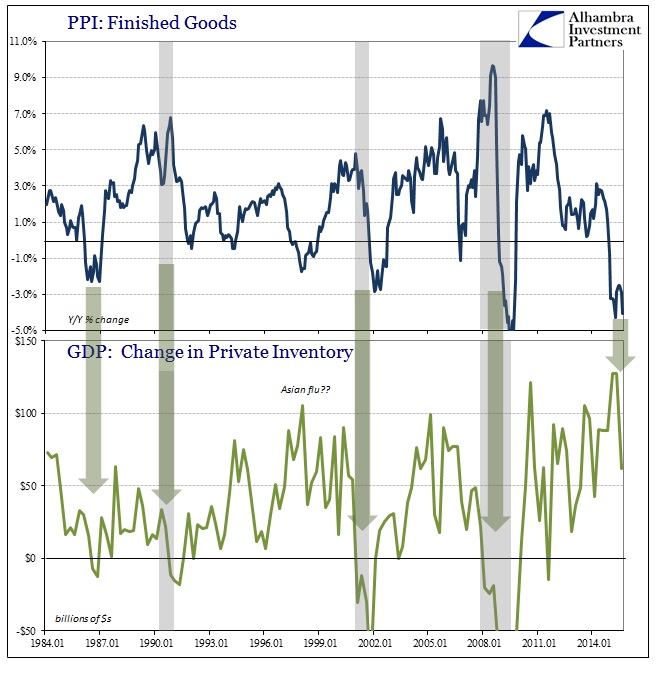

For one, the general PPI follows recessions quite closely. You simply don’t see persistently negative producer prices, year-over-year, outside of them. History is quite clear upon that fact, which intuitively flows from the recessionary idea of overcapacity relative to the sales environment and the plug in between – inventory.

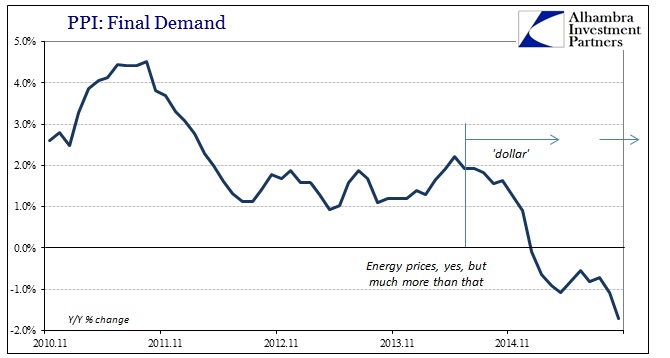

In fact, producer prices have fallen now by October rather uncomfortably close to the lowest levels of the Great Recession. In more recent months, that has followed also quite closely the two discrete “dollar” waves that were punctuated only narrowly in the summer (which economists and Yellen prematurely held out in extreme extrapolation as “proof” that this distinct even was “transitory”). With the grand revisit of disruption and turmoil starting in July, these price indices again amount to that financial factor clearly intruding in the real economy.

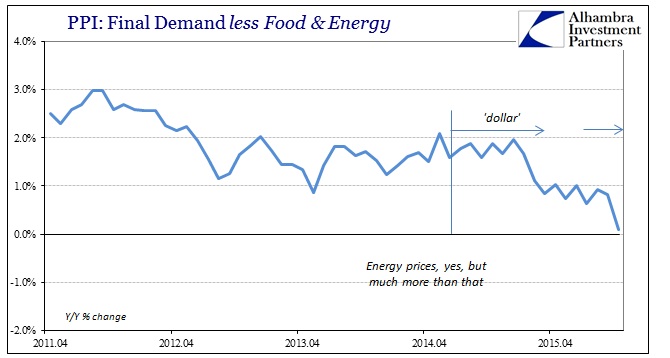

But while Janet Yellen refers to that as distinctly energy, she doesn’t openly address that this price pattern is much more than that; especially past the summer. Non-petroleum producer prices have ceased to expand, and in October fell to just about zero for the first time.

Again, that can only relate to the vast inventory pile that has now reached epic proportions. The Q3 GDP report suggested that the inventory reversal has begun, but given its unprecedented buildup (as well as that reversal, in GDP terms, takes the form of not an actual decline in inventory but rather just a slower but continued accumulation) added to the action in producer prices, the signals of greater stress are becoming plainly visible.

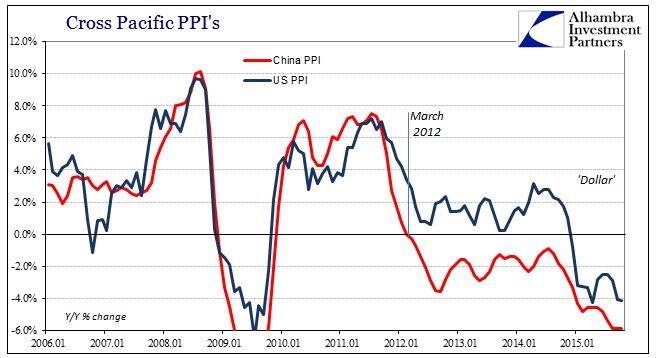

As inventory has accumulated, and sales falling off at each level of the supply chain, discounting becomes the primary factor to clear production imbalance as the last step before general and severe cutbacks. That such a view might extend to import prices, ex petroleum, is simply the American tendency to import production. In truth, the US PPI is almost indistinguishable from China’s, which is a wholesale violation of orthodox economic theory that suggests only closed and unique economic systems.

Instead, the production discounting represented by the US PPI and the same process represented in China, in almost the same timing and degree, can only be related to one single, globally vital factor – US consumers. The world has been flush with “stimulus” intended to create robust “aggregate demand” and economists have even gone so far as to insist that it worked particularly here in the US. But production discounting both domestically and in China is adamant that it hasn’t, an interpretation that actually extends as far back as 2012. Now both sides, again linked by only the US consumer, are equally determined that such degradation has been heightened to a new extreme just in 2015; one that will not relent. The rest of these PPI indications simply link that depression in “demand” to the “dollar.”

In the end, it is little wonder the FOMC wishes to leave out this “part” of their examination of their own failures. To include it would be to completely extinguish their sacred belief in their own abilities as well as the far more important recovery narrative. It is increasingly clear the recovery ended in 2012, and that it was further reversed in 2015 to an as-yet undefined economically descendent purpose; one that looks more and more recessionary by the month, here as well as the rest of the world.