Applied Materials, Inc. (NASDAQ:AMAT) is set to report fiscal first-quarter 2018 results on Feb 14. In the last reported quarter, it delivered a positive earnings surprise of 1.04%.

The company’s surprise history has been pretty impressive. It beat estimates in each of the trailing four quarters, with average positive earnings surprise of 5.43%.

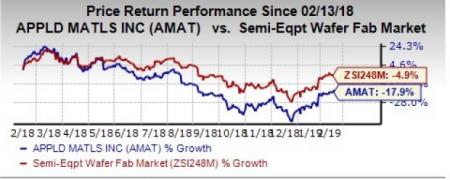

Notably, over the past year, Applied Materials’ shares have lost 17.9% in comparison with the industry’s decline of 4.9%.

Let’s see how things are shaping up for this announcement.

Strong Demand for Services

The company is efficiently delivering key enabling technology to logic and foundry customers, given well-differentiated products along with high market share. Service is an important part of Applied Materials’ portfolio that grew significantly in the last reported quarter. The Applied Global Services (AGS) segment increased 2.4% sequentially and 17.6% from the prior-year quarter. The segment is expected to perform well in the quarter to be reported as well, driven by improved device and yield performance.

The Zacks Consensus Estimate for AGS for the fiscal first quarter is pegged at $943 million. The same for Semiconductor Systems Group (SSG) is pegged at $2.2 billion for the to-be-reported quarter.

Strength in Display to Drive Revenues

The company has attained considerable success in expanding beyond semiconductors, particularly in display. New display technologies such as OLED are opening new market opportunities for Applied Materials. The available market opportunity is now more than 10 times than that of the traditional LCD.

In the last reported quarter, the Display segment was down 5.3% sequentially but up 3.7% from the year-ago level, contributing 17.5% to its total revenues. The segment is expected to be driven by significant opportunities, courtesy of investments in areas such as artificial intelligence, big data, cloud infrastructure, Internet of Things (IoT), virtual reality and smart vehicles.

The Zacks Consensus Estimate for the Display segment for the quarter to be reported is pegged at $501 million.

What Our Model Suggests

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 or 5 (Sell rated) stocks are best avoided, especially if these have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Applied Materials currently has a Zacks Rank #3 (Hold) and an Earnings ESP of 0.00%, making surprise prediction difficult.

Stocks to Consider

We see a likely earnings beat for each of the following companies in the upcoming releases.

Walmart Inc. (NYSE:WMT) has an Earnings ESP of +5.55% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Square, Inc. (NYSE:SQ) has an Earnings ESP of +5.95% and a Zacks Rank #2.

Gogo Inc. (NASDAQ:GOGO) has an Earnings ESP of +9.46% and a Zacks Rank #3.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

Square, Inc. (SQ): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Gogo Inc. (GOGO): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research