- Reports Q2 2022 results on Wednesday, Jan. 19, before the market opens

- Revenue Expectation: $20.34 billion

- EPS Expectation: $1.66

When Procter & Gamble (NYSE:PG) reports its latest earnings tomorrow morning, investors will focus on the consumer product giant’s ability to keep its global markets well supplied when the Omicron variant of the COVID virus is compounding supply-chain disruptions.

From furniture makers to grocers, the world’s biggest companies are using their deep pockets, sprawling global operations, and commanding market share, to insulate themselves from the global supply-chain meltdown.

Still, the impact of the lingering supply-chain obstacles can’t be completely avoided. P&G expects $2.3 billion in after-tax expenses this fiscal year—an increase from the prior expectation of $1.9 billion—due to cost escalations from elevated commodity and freight prices.

“We experienced the full impact of rising commodity and transportation costs this quarter,” Chief Financial Officer André Schulten said on a conference call in October.

P&G, however, is in a good position to insulate itself from these bottlenecks due to its ability to raise prices and to spend on supply-chain fixes. The Cincinnati-based P&G, which among a host of other recognizable supermarket staples makes Tide detergent and Crest toothpaste, has started to charge more for razors and certain beauty and oral-care products. These price hikes come in addition to earlier moves to start charging more for an array of household necessities from diapers to toilet paper.

Stock Near Record High

That's perhaps the main reason investors have ignored supply headwinds when it comes to Procter & Gamble. Its shares hit a record high early this month, after gaining about 11% in the past three months.

The stock closed on Friday at $159.81; US markets were closed on Monday for a holiday.

P&G’s brand strength, its global reach, and business restructuring in recent years, have made the company a high-growth consumer staple business that has many more years of solid growth ahead.

The current inflationary environment, in our view, will help to fuel further gains in sales as consumers are willing to pay for what they want amid the elevated demand for household essentials during the pandemic. Barclays analyst Lauren Lieberman maintained a “buy” rating on Procter & Gamble on Jan. 13 and set a price target of $178.00.

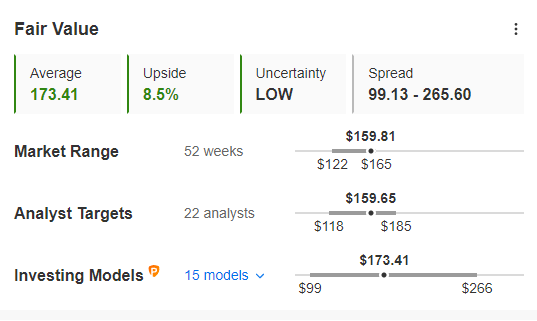

Source: InvestingPro

InvestingPro’s fair value model offers a more robust picture, assigning a fair value of $173.41 to the stock with a broader potential spread.

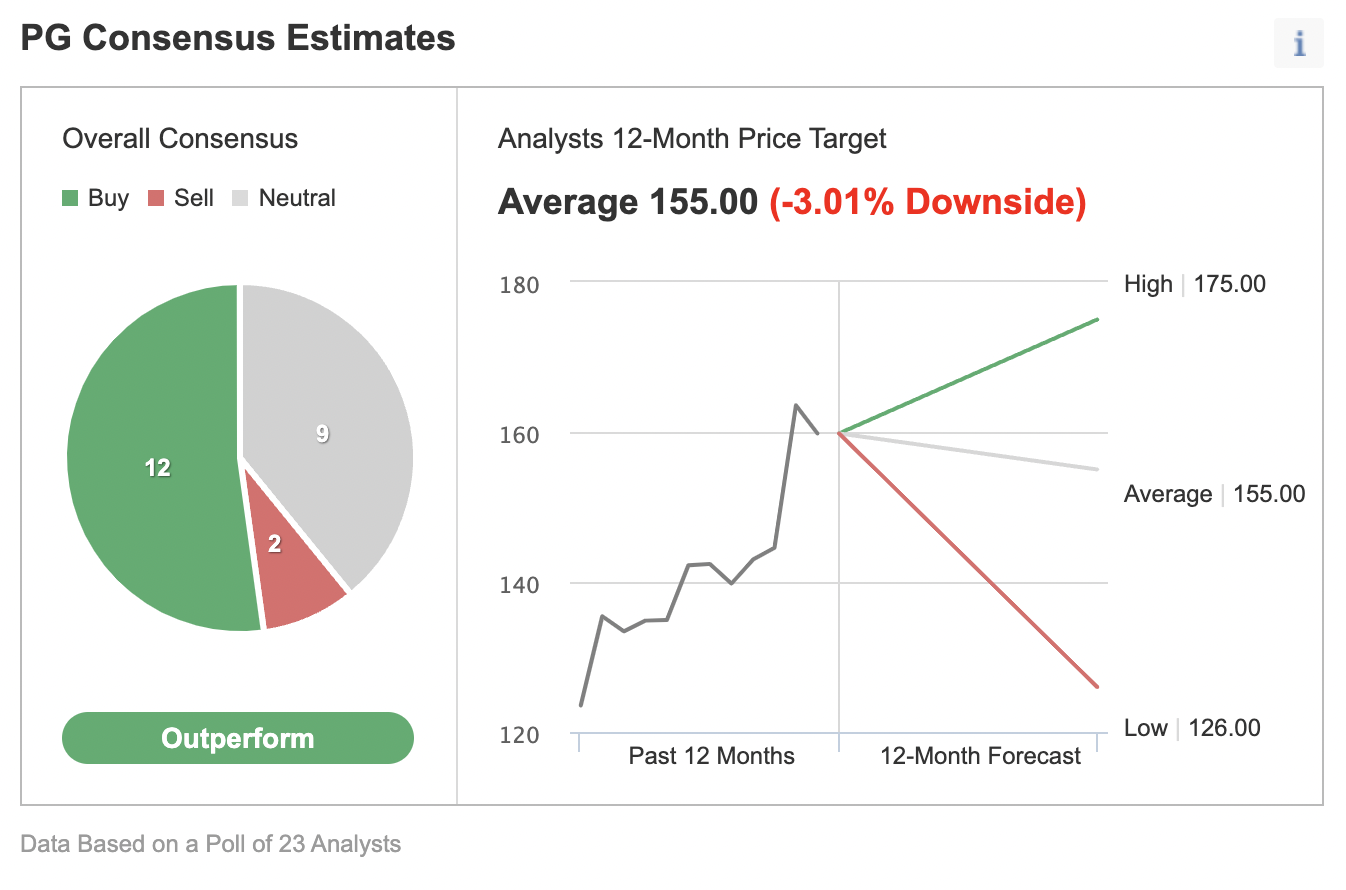

Analysts, in general, are bullish on P&G's share performance prospects.

Chart: Investing.com

Of 23 analysts polled by Investing.com, 12 give its shares an “outperform” rating.

That said, there is still little chance that P&G will be able to produce a big earnings beat for its previous quarter as commodity and freight costs will likely continue to weigh on full-year earnings.

According to the company’s latest estimate, these factors could cut annual earnings by $0.90 per share. If it weren’t for the huge inflation issues, full-year earnings would be about 15% higher than the company’s current EPS forecast.

Bottom Line

A potential earnings miss tomorrow shouldn’t discourage long-term investors, in our view. The company is well-positioned to deal with supply disruptions and commodity inflation due to its strong and diversified product portfolio and consumer willingness to pay more for its brands.