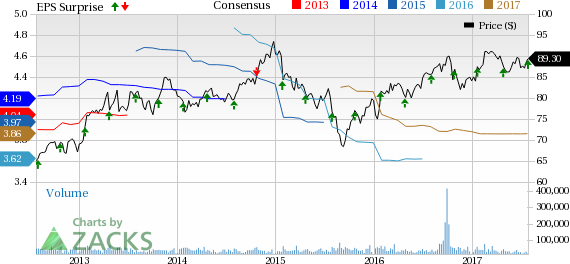

The Procter & Gamble Company (NYSE:PG) , popularly known as P&G, reported fourth-quarter fiscal 2017 financial results, wherein earnings and revenues surpassed expectations.

P&G’s fiscal fourth-quarter core earnings of 85 cents per share beat the Zacks Consensus Estimate of 78 cents by 9%. The bottom line also increased 8% from the prior-year quarter. Currency-neutral core earnings per share (EPS) also improved 8%. The upside was driven by cost-saving initiatives taken by the company across the board.

Sales in Details

P&G’s reported net sales of $16.08 billion surpassed the Zacks Consensus Estimate of $16.00 billion. The top line, however, remained unchanged compared with the year ago level. Foreign exchange had a negative impact of 2% on sales.

Organically (excluding the impact of acquisitions, divestitures and foreign exchange), revenues grew 2% on the back of a 2% increase in organic volumes.

Of the five business segments, two registered positive organic sales growth. Beauty and Fabric & Home Care segments registered organic sales growth of 5% each in the quarter in the group. Grooming and Health Care segments, on the other hand, posted 1% organic sales decline each.

Margins

Core gross margin decreased 10 basis points (bps) to 49.3%, as productivity cost was more than offset by headwinds such as increased commodity costs, unfavorable geographic and product mix, and product reinvestments.

Core selling, general and administrative expense (SG&A) margin decreased 220 bps (as a percentage of sales) to 30.2% driven by productivity savings from overhead, agency fee and ad production costs. Core operating margin increased 210 bps year over year.

Total productivity cost savings were 350 bps in the quarter. P&G has been cutting costs aggressively to reduce spending across all areas like supply chain, research & development, marketing and overheads.

Fiscal 2017 Highlights

Core EPS came in at $3.92 in the fiscal year, up 7% year over year. Currency-neutral core EPS grew 11%.

Fiscal 2017 net sales were $65.1 billion, unchanged from fiscal 2016. Organically, sales increased 2%, driven by a 2% rise in organic shipment volume.

Financials

As of Jun 30, 2017, the company’s cash and cash equivalents were $5.6 billion, declining from $7.1 billion at the end of fiscal 2016 (as of Jun 30, 2016). Long-term debt was $18.04 billion as of Jun 30, 2017, down from $18.95 billion at the end of fiscal 2016.

Cash flow from operating activities was $12.8 billion in fiscal 2017, down from $15.4 billion a year ago.

Fiscal 2018 Guidance

The Cincinnati, OH-based company expects its organic sales growth in the range of 2–3% for fiscal 2018. The core earnings per share growth is projected at 5–7% compared with fiscal 2017 core earnings of $3.92 per share.

P&G carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Peer Releases

Mondelez International, Inc. (NASDAQ:MDLZ) is slated to report its second quarter numbers on Aug 2.

The Kraft Heinz Company (NASDAQ:KHC) and B&G Foods Inc. (NYSE:BGS) are scheduled to report its second quarter results on Aug 3.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

See these stocks now>>

B&G Foods, Inc. (BGS): Free Stock Analysis Report

Mondelez International, Inc. (MDLZ): Free Stock Analysis Report

The Kraft Heinz Company (KHC): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Original post

Zacks Investment Research