Principal Financial Group, Inc.’s (NYSE:PFG) second-quarter 2017 record operating net income of $1.31 per share beat the Zacks Consensus Estimate of $1.22 by 7.4%. The bottom line also improved 31% year over year.

Shares have rallied 12.6% in the after-market trading hours, reflecting sturdy results.

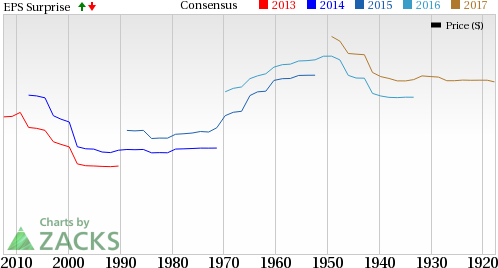

Principal Financial Group Inc Price, Consensus and EPS Surprise

The company’s investment performance remained strong. Moreover, the company expanded its solution set alongside strengthening relationships with customers and distributors in the quarter. The company also displayed a balanced approach to capital management.

Including net realized capital gains of 25 cents, net income available to common stockholders was $1.06 per share, down 3.6% year over year.

Behind the Headlines

Operating revenues rallied 10.4% year over year to $3.3 billion. This improvement was driven by higher premiums and other considerations, fees and other revenues, plus net investment income.

Total expenses rose 7.7% year over year to $2.8 billion. This was primarily due to the increase in benefits, claims and settlement expense.

Principal Financial’s Asset Under Management (AUM) as of Jun 30, 2017 was a record $629 billion, up 10% year over year.

As of Jun 30, 2017, book value per share (excluding AOCI other than foreign currency translation adjustment) was $35.52, up 4.2% year over year.

Segment Update

Retirement and Income Solution: Revenues were up approximately 13.3% year over year to about $1.7 billion.

Operating earnings surged 25.2% year over year to $243.8 million.

Principal Global Investors: Revenues of $355.5 million improved nearly 1.2% from the prior-year quarter.

Operating earnings dipped 1.8% year over year to $115.4 million due to lower performance fees.

Principal International: Revenues slightly inched up 0.02% year over year to $319.4 million in the quarter.

Operating earnings improved 12.2% year over year to $78.4 million.

U.S. Insurance Solution: Revenues increased 6.9% year over year to $970.6 million.

Operating earnings of $104.4 million were up 0.7% year over year.

Corporate: Revenues of ($19.8) million compared unfavorably with ($17.5) million in the year-ago quarter.

Operating loss of $47.5 million was narrower than a loss of $54.5 million in the year-ago quarter.

Dividend and Share Repurchase Update

The company paid $130 million in dividends and deployed $26.4 million to buy back 0.4 million shares in the second quarter. Total capital utilized was $165.9 million.

The board of directors of Principal Financial announced a dividend of 46 cents per share for the third quarter. The dividend will be paid on Sep 29.

Principal Financial targets 2017 capital deployment of $800 million to $1.1 billion.

Zacks Rank

Principal Financial presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Stocks

Among other players from the finance sector that have reported their second-quarter earnings so far, both Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc’s. (NYSE:FNF) bottom line beat their respective Zacks Consensus Estimate, while The Progressive Corporation (NYSE:PGR) missed the same.

The Hottest Tech Mega-Trend of AllLast year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Principal Financial Group Inc (PFG): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post