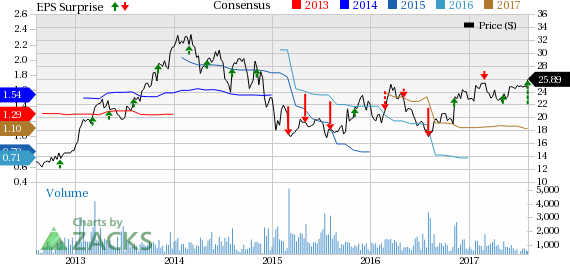

Primoris Services Corporation’s (NASDAQ:PRIM) second-quarter 2017 earnings soared a whopping 320% year over year to 42 cents per share. Earnings beat the Zacks Consensus Estimate of 31 cents.

The company posted record revenues of $631 million, which surged 38% from the prior-year quarter. Revenues also surpassed the Zacks Consensus Estimate of $566 million.

The main driver behind the both top- and bottom-line growth was the outstanding work performed by the Pipeline & Underground segment’s Rockford division. Primoris also witnessed significant year-over-year revenue growth in its Utility & Distribution and Power, and Industrial & Engineering segments.

Cost of sales jumped 32% to $546.7 million from $413.5 million in the year-ago quarter. Gross profit improved 95% year over year to $84.5 million. Gross margin expanded 390 basis points (bps) year over year to 13.4%.

Selling, general and administrative expenses flared up 41% year over year to $46 million. Operating profit improved significantly to $38.5 million from $10.8 million recorded in the prior-year quarter. Consequently, operating margin advanced 360 bps year over year to 6%.

Segment Performance

Power, Industrial, and Engineering: Net sales increased 24.6% to $157.8 million from $126.6 million in the year-ago quarter. Gross profit improved 28.7% to $18 million from $14 million recorded in the year-ago quarter.

Pipeline and Underground: Sales increased significantly year over year to $134.6 million. The segment reported a gross profit of $39.4 million compared with $6.5 million in the year-earlier quarter.

Utilities and Distribution: Net sales grew 35.5% year over year to $212.9 million. Gross profit was up 41.6% to $32.3 million from the prior-year quarter.

Civil: Sales increased 8% year over year to $125.8 million. The segment reported a loss of $5.4 million compared with a loss of $0.1 million in the comparable quarter last year.

Financial Update

Primoris had cash and cash equivalents of $111.8 million at the end of the second quarter compared with $135.8 million as of 2016 end. The company generated cash flow from operations of $116.3 million during the six-month period ended Jun 30, 2017, compared with $5.5 million in the comparable period last year.

Long-term debt, excluding the current portion, was $183 million as of Jun 30, 2017, compared with $203.4 million as of Dec 31, 2016.

Primoris reported total backlog of $2.8 billion as of Jun 30, 2017, flat with the Dec 31, 2016 figure.

On Aug 2, the board of directors declared 5.5 cents per share dividend to stockholders of record on Sep 29, 2017, payable on Oct 14.

Outlook

Based on an expected second-quarter 2018 commencement date for a major pipeline project in backlog, anticipated levels of customer maintenance, MSA spending and new project awards, Primoris estimates that for the four quarters ending Jun 30, 2018, net income will be between $1.05 and $1.25 per diluted share. However, persistent uncertainty in the energy markets remains a headwind for the company.

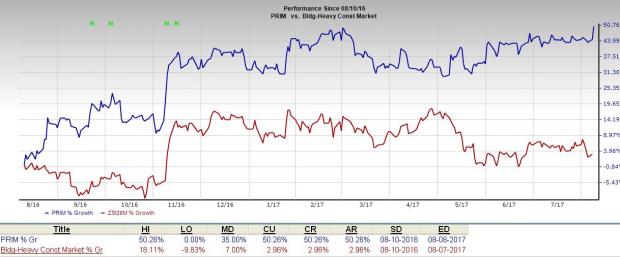

Share Price Performance

Over the past one year, Primoris outperformed the industry which it belongs to. The company’s shares gained around 50.26% during this period compared with roughly 2.96% growth recorded by the industry.

Zacks Rank & Other Key Picks

Currently, Primoris carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the sector include Sterling Construction Company, Inc. (NASDAQ:STRL) , KB Home (NYSE:KBH) and MasTec, Inc. (NYSE:MTZ) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sterling Construction has expected long-term growth rate of 11.00%.

KB Home has expected long-term growth rate of 16.66%.

MasTec has expected long-term growth rate of 14.00%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

MasTec, Inc. (MTZ): Free Stock Analysis Report

Primoris Services Corporation (PRIM): Free Stock Analysis Report

Sterling Construction Company Inc (STRL): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Original post