Building growth momentum

The first half focus on underpinning the balance sheet funded H2 portfolio growth, the momentum of which should be maintained this year. Primary Health Properties (PHP.L) secured £250m of debt facilities; refinancing a £175m club facility from RBS/Santander and issuing a £75m unsecured seven-year retail bond, which has funded £110m of portfolio growth in 2012 and £6.3m so far this year. Unutilised debt and £18.4m (net of costs) of equity issued in 2012 leaves £83m of headroom to fund a potential £82m acquisition pipeline over the next two to three months. Another c £80m under discussion for the next 12 months would require new facilities and possibly new equity. The prime objective is to fully restore dividend cover. That will take a few years to achieve, but we anticipate 0.5p/share annual dividend growth in the meantime. Until earnings are rebuilt that will adversely affect NAV/share, but portfolio growth currently delivers a surplus initial rental yield over finance cost and fees which with rent reviews, and potentially lower financing rates on swap expiry, should positively influence cover.

FY12 acquisitions deliver 20% growth in rent roll

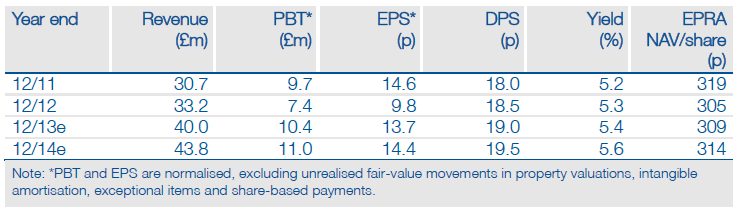

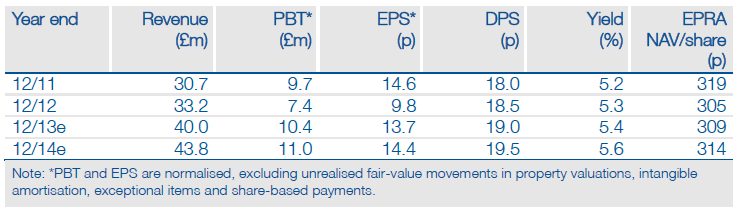

The portfolio of 183 assets including commitments was valued at over £645m (2011: £540m) at the year end, with rents received in the year 8.1% ahead at £33.2m (FY11: £30.7m). The total annual rent roll – assuming all properties were held for a full year – is £38.9m, 20% up y-o-y. The terms of the external valuation reflect a steady investment market, with the average net initial yield at 5.72% (2011: 5.74%).

Sensitivities: FY13 portfolio growth

Adjusted forecasts reflect the timing of acquisition and rent reviews and build in another £50m of portfolio additions in both FY13 and FY14, well within the investment pipeline and available funding. PHP expects to exceed this; we will revisit forecasts as acquisitions are secured. Rental growth was 2.4% on reviews completed last year (FY11: 3%). We assume a slightly lower rate, nearer 2% pa, for this year and next.

Valuation: 5.4% prospective yield, cover rebuilding

The 0.5p dividend increases demonstrate a commitment to progressive distributions, despite the lack of cash cover, and make restoration of the latter the key strategic target. PHP expects to close the gap over the next three years from (a) the positive cash flow impact of acquisitions at just below 6% yields financed by debt at c 3.5%; (b) the benefit of rent reviews at c 2.0% pa; (c) lower ‘cash drag’, due to use of funds held on deposit; and (d) expiry of interest rate swaps from 2016 (averaging c 4.75%) which enables it to reset relatively high-cost debt to current market interest rates.

To Read the Entire Report Please Click on the pdf File Below.

The first half focus on underpinning the balance sheet funded H2 portfolio growth, the momentum of which should be maintained this year. Primary Health Properties (PHP.L) secured £250m of debt facilities; refinancing a £175m club facility from RBS/Santander and issuing a £75m unsecured seven-year retail bond, which has funded £110m of portfolio growth in 2012 and £6.3m so far this year. Unutilised debt and £18.4m (net of costs) of equity issued in 2012 leaves £83m of headroom to fund a potential £82m acquisition pipeline over the next two to three months. Another c £80m under discussion for the next 12 months would require new facilities and possibly new equity. The prime objective is to fully restore dividend cover. That will take a few years to achieve, but we anticipate 0.5p/share annual dividend growth in the meantime. Until earnings are rebuilt that will adversely affect NAV/share, but portfolio growth currently delivers a surplus initial rental yield over finance cost and fees which with rent reviews, and potentially lower financing rates on swap expiry, should positively influence cover.

FY12 acquisitions deliver 20% growth in rent roll

The portfolio of 183 assets including commitments was valued at over £645m (2011: £540m) at the year end, with rents received in the year 8.1% ahead at £33.2m (FY11: £30.7m). The total annual rent roll – assuming all properties were held for a full year – is £38.9m, 20% up y-o-y. The terms of the external valuation reflect a steady investment market, with the average net initial yield at 5.72% (2011: 5.74%).

Sensitivities: FY13 portfolio growth

Adjusted forecasts reflect the timing of acquisition and rent reviews and build in another £50m of portfolio additions in both FY13 and FY14, well within the investment pipeline and available funding. PHP expects to exceed this; we will revisit forecasts as acquisitions are secured. Rental growth was 2.4% on reviews completed last year (FY11: 3%). We assume a slightly lower rate, nearer 2% pa, for this year and next.

Valuation: 5.4% prospective yield, cover rebuilding

The 0.5p dividend increases demonstrate a commitment to progressive distributions, despite the lack of cash cover, and make restoration of the latter the key strategic target. PHP expects to close the gap over the next three years from (a) the positive cash flow impact of acquisitions at just below 6% yields financed by debt at c 3.5%; (b) the benefit of rent reviews at c 2.0% pa; (c) lower ‘cash drag’, due to use of funds held on deposit; and (d) expiry of interest rate swaps from 2016 (averaging c 4.75%) which enables it to reset relatively high-cost debt to current market interest rates.

To Read the Entire Report Please Click on the pdf File Below.