H117 results for Primary Health Properties (LON:PHP) show strong growth in underlying (EPRA) earnings, driven by higher rental income and lower financing costs. Amid strong competition for assets, PHP is continuing to source acquisitions that meet its criteria and reports a strong pipeline of opportunities. Long-term demographic trends and broad political will for healthcare reform continue to support the outlook for primary care property in both the UK and Ireland, and PHP’s long and largely government-backed leases underpin an attractive and fully covered dividend, which we expect to continue its 20-year growth trend.

Growing rental income and lower finance costs in H1

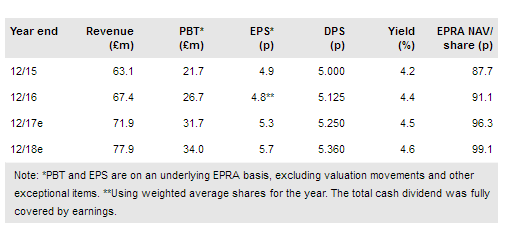

EPRA earnings grew 22% y-o-y in H117 and with more shares in issue from last April’s capital increase, EPRA EPS by 8%. Deployment of the new capital, through 2016 and continuing in H117 (when an additional £18.6m was committed), is the main driver of the 8.1% growth in rental income, although rent growth is also picking up (1.6% in H117 versus 0.9% through 2016). Finance costs were lower y-o-y, benefiting from lower average debt and a lower average cost of debt. Ongoing refinancing efforts should see the latter drop further in H217. With 2.62p of DPS paid ytd and a further 1.31p declared for payment on 25 August, PHP is on track to meet our full-year forecast, fully covered by earnings. In addition, EPRA NAV/share increased 5.5% to 96.1p, including £29.9m of net valuation gains, largely driven by yield contraction. Our updated estimates show no significant change.