- After November's surge, investors are wondering if December will sustain the trend.

- In an era where the average equity holding period is merely 6 months, this is understandable.

- But in the grand scheme of things, a month's performance should not deter investors from their long-term goals.

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

After experiencing one of the best Novembers in the past 23 years, investors find themselves contemplating whether December will continue this trend or if things are about to change.

At this juncture, this is the key question they should ask themselves:

Does the performance of a single month truly hold significance in the grand scheme of things?

While the conventional perspective may perceive the significance of a single month, especially given the unfortunate reality that the average holding period for modern equity investors is merely 6 months, the initial approach is fundamentally flawed.

Prices Drive the Narrative

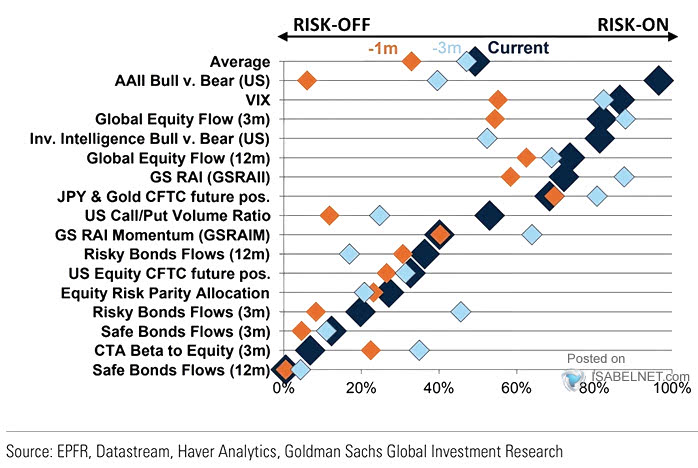

Right now, investors are gradually returning to a phase of risk-on, i.e., rising risk appetite and (therefore) more boldness, less caution, and more greed.

This is precisely because prices went up a lot in November. So once again look at the inconsistency (and wonderful opportunity for those who can understand it and use it to their advantage) of the markets:

Prices are going up ==> Higher valuations ==> Optimistic investor psychology ==> Potential downside risk rising ==> Perception of risk among investors falling

So just as risk is increasing, investors become more unscrupulous.

Conversely, with prices and morale at the bottom and with risk in freefall in October 2022, no one wanted to invest.

It is a wonderful world, and for those who begin to learn this simple but essential concept, immense opportunities can open up.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.