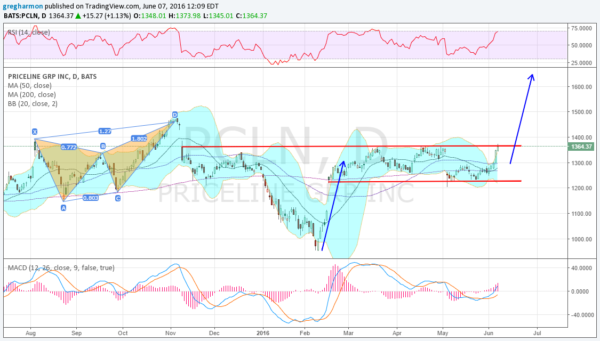

There has been a force field in place around Priceline.com (NASDAQ:PCLN). The 1365 price area will not stop it this time as it's time to make a move to the upside.

The chart below gives several reasons why. After completing a bearish Butterfly harmonic in early November, the PCLN reversed. A lot. It retraced over 150% of the Butterfly. But what is interesting in that downward move is where it started. The gap-down day opened at 1362.60. And that price area has been a brick wall ever since.

It took until the market bottom in February for the destruction to end. Then with a gap up over the 200-day SMA it cruised higher to 1361. Another pullback to the 200-day SMA, then it ran back up to 1369. A second pullback broke through the 200-day and oscillated around it for a month. As it did so, the Bollinger Bands® squeezed in and the momentum indicators found their bottom. As the RSI and MACD started higher, the Bollinger Bands opened to the upside and it has been a quick move back to 1373.

Slightly higher highs. Will the third time be the charm? Momentum supports continuation as do the opening Bollinger Bands. A break into the gap has until 1430 to fill it. And a Measured Move from the February low supports a lot more, up to 1650. A close over 1380 could be considered a buy trigger against a stop at that 1360 area or slightly below.