The Priceline Group Inc. (NASDAQ:PCLN) reported better-than-expected second-quarter 2017 earnings.

Non-GAAP net earnings of $15.14 per share beat the Zacks Consensus Estimate by 89 cents and were better than management’s guidance of $13.65 at the mid-point. Revenues of $3.03 billion beat the Zacks Consensus Estimate by 22 million.

On a year-over-year basis, both agency and merchant business showed strong momentum. Room nights and Rental cars performed impressively. The only point of weakness was airline tickets.

At the call, management stated that the company’s ongoing investments in people, technology, product and marketing are contributing significantly.

Overall, we remain positive about the secular growth trend in the online travel booking market, Priceline’s strong position in international markets, growth opportunities in the domestic market, good execution, prudent marketing strategy and strong financial position.

However, weaker ADRs, macro headwinds, increasing advertising spend and occupancy tax-related litigation remain overhangs. Year to date, the stock has surged 39.8%, underperforming the industry’s gain of 49.3%.

Let’s check out the numbers.

Revenues in Details

Priceline’s revenues were up 25% sequentially and 18.3% from the year-ago quarter.

Priceline generates the bulk of its revenues from international markets where the agency model is more popular. This is reflected in the merchant/agency split of revenues, which was 16/77% in the first quarter (previous quarter split was (18/74%).

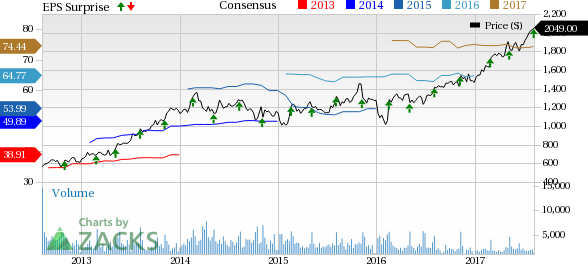

The Priceline Group Inc. Price, Consensus and EPS Surprise

Merchant revenues were up 12.7% sequentially and 3.8% year over year. Agency revenues increased 30.6% sequentially and 25.9% year over year.

Advertising & Other revenues were up 1% sequentially and 4.9% from last year. This is basically non inter-company revenues from Kayak and OpenTable.

On a sequential basis, room nights volumes decreased 2.2%, rental car days increased 11.3% and airline tickets stayed flat. On a year-over-year basis, room nights were up 21%, rental car days increased 11.7% while airline ticket volumes were down 8.7%.

Priceline’s room night growth is attributable to its geographically diverse inventory and brand recognition that tends to balance out macro uncertainties related to any one market, as well as growing competition from local and international players. The company saw average daily rates for accommodations or ADRs decline slightly year over year. Rentalcars.com also did quite well but there was some softness in ticket volumes.

Bookings

Priceline’s overall bookings were up slightly sequentially and 16% (19% in constant currency) year over year and were within the guided range.

Merchant bookings were up 11.9% sequentially and 14.3% year over year. Agency bookings decreased 1.1% sequentially but increased 16.8% from the year-ago levels.

Margins and Net Income

Priceline reported pro forma gross margin of 97.6%, up 112 basis points (bps) sequentially and 253 bps year over year.

Owing to the nature of its business and the mix of agency versus merchant revenues, management usually uses gross profit dollars rather than margin to gauge performance during any quarter. Priceline’s gross profit dollars were flat sequentially but up 21% (24% in constant currency) from last year and higher than the guidance. International gross profit grew 24% (26% on a constant currency basis). U.S. gross profit grew 7% from last year.

Priceline’s adjusted operating income was up 16.2% sequentially and 22.8% year over year to $935.4 million. Operating margin of 30.9% was up 615 bps sequentially and 9 bps from the year-ago quarter.

Priceline’s GAAP net income was $720.2 million or $14.39 a share, compared with $455.6 million, or $9.11 a share in the March quarter and $580.6 million, or $11.6 a share in the year-ago quarter.

Balance Sheet

Priceline ended the quarter with cash and short-term investments balance of 6.4 billion compared with $5.4 billion at the end of the first quarter. Priceline generated $1.6 billion of cash from operations. It spent around $147.3 million on capex and $555.3 million on share repurchases.

At quarter-end, Priceline had $7.6 billion in long-term debt with net debt being $5 billion compared with net debt of $4.9 billion in the previous quarter.

Guidance

For the third quarter of 2017, Priceline expects room nights booked to grow 11-16% and total gross bookings to increase 11-16% year over year (9-14% on a constant currency basis).

Notably, this guidance indicates a slowdown in growth rates of room nights booked and total gross bookings as it is the lowest compared to the last four quarters. Investors seem to be worried about this overly conservative guidance as reflected in the 6.7% depreciation in the stock price in afterhours trading.

Priceline expects gross profit dollars to increase 15.5-20.5% (12.5-17.5% on a constant currency basis), with adjusted EBITDA in the range of $2,030-2,130 million.

Pro forma earnings per share (EPS) are expected to come in the range of $32.4-$34.1. The Zacks Consensus Estimate is pegged at $34.4 per share. GAAP EPS is expected in the range of $31.7-$33.4.

Zacks Rank and Stocks to Consider

Priceline currently has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader sector include Alibaba (NYSE:BABA) , Lam Research Corporation (NASDAQ:LRCX) and Luxoft Holding (NYSE:LXFT) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings per share growth rate for Alibaba, Lam Research and Luxoft is projected to be 29%, 17.2% and 20%, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

The Priceline Group Inc. (PCLN): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research