The Priceline Group Inc. (NASDAQ:PCLN) justreleased its second-quarter 2017 financial results, posting earning of $15.14 per share and revenues of $3.02 billion. Currently, PCLN is a Zacks Rank #3 (Hold) and is down 6.25% to $1,921 per share in after-hours trading shortly after its earnings report was released.

PCLN:

Beat earnings estimates. The company posted earnings of $15.14 per share (which excludes $0.75 from non-recurring items), beating the Zacks Consensus Estimates of $14.25 per share.

Beat revenue estimates. The company saw revenue figures of $3.02 billion, just topping our estimate of $3 billion.

Priceline’s second-quarter gross travel bookings jumped 16% year-over-year to $20.8 billion, while revenues soared 21%. The company’s international sector rose 24% to $2.6 billion.

The travel company reported quarterly net income of $720 million, which is up 24% from the year-ago period. Net income per diluted share also rose 24%.

However, Priceline projects its third-quarter earnings to be in the $32.40 to $34.10 per share range, which is well below our projections of $34.42 a share.

"The Priceline Group achieved strong results for the second quarter," CEO Glenn Fogel said in a statement. "Globally, our accommodation business booked 170 million room nights in the quarter, up 21% over the same period last year."

"We are pleased with the performance of the business and will continue to build our franchise by adding properties to the platform and by investing in technology, customer experience and content expansion."

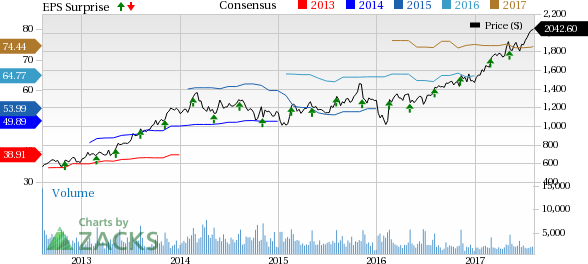

Here’s a graph that looks at Priceline’s Price, Consensus and EPS Surprise history:

Priceline.com Incorporated has pioneered a unique e-commerce pricing system known as a demand collection system that enables consumers to use the Internet to save money on a wide range of products and services while enabling sellers to generate incremental revenue. Using a simple and compelling consumer proposition - Name Your Own Price - priceline.com collects consumer demand, in the form of individual customer offers guaranteed by a credit card, for a particular product or service at a price set by the customer.

Check back later for our full analysis on Priceline’s earnings report!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

The Priceline Group Inc. (PCLN): Free Stock Analysis Report

Original post

Zacks Investment Research