Investing.com’s stocks of the week

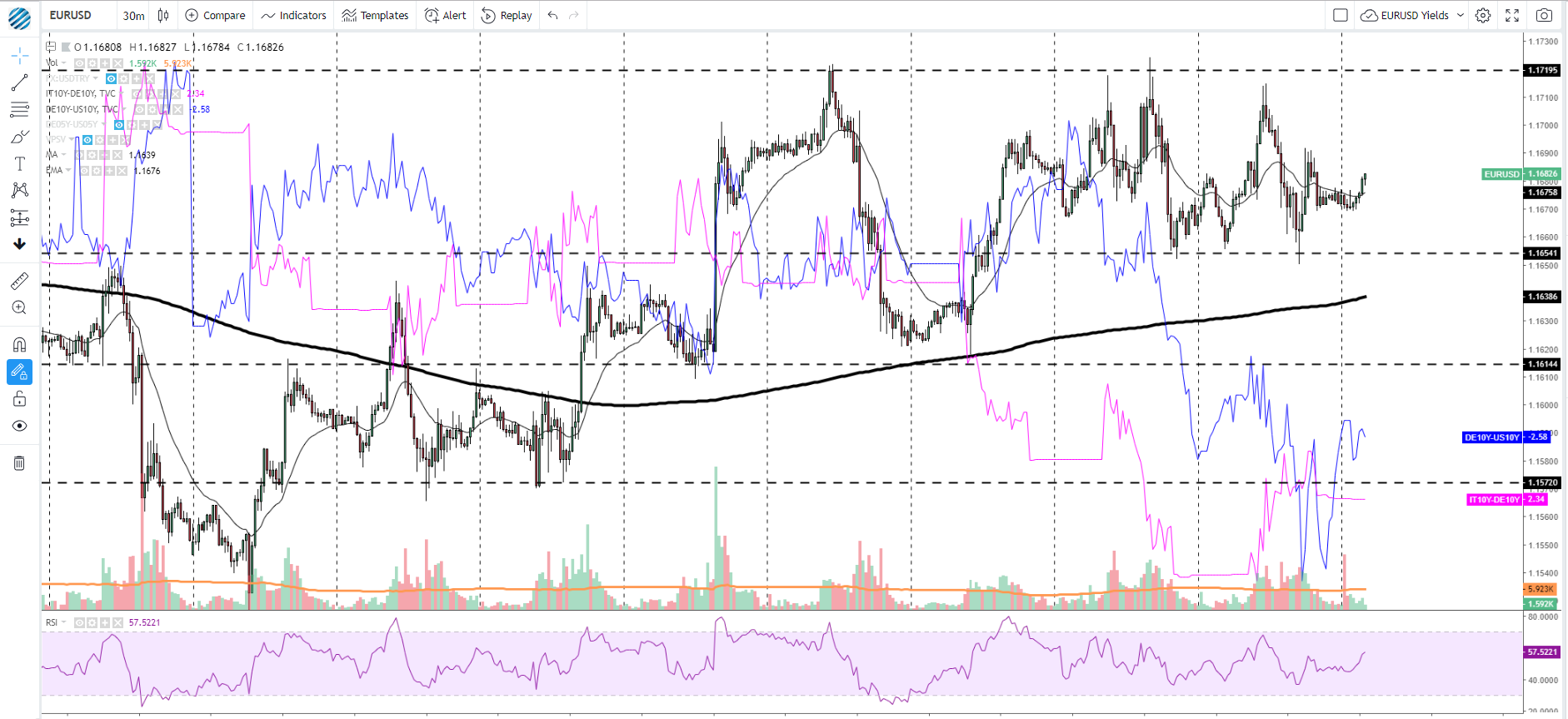

EUR/USD: In Consolidation, Bond Yields Negate 1.17+

As the picture stands, the pair has firmed up its current range-bound profile, with well-defined edges between 1.17/1720 and 1.1650. The latest price action is inconclusive, dominated by market makers at the extremes of the range.

The negative brexit headlines in the last 24h, together with rising Italian bond yield premiums vs the German (purple line) and a steepening of the US yield curve (also slightly lower German vs US bond yield as per blue) all argue for the upside to be capped.

At this stage, pressure may be building up for an eventual break lower, although no clues were provided via price action on Wednesday. The soggy pricing of the pair this week is also a reflection of indecision on the back of a steady ECB and rising US yields.

In these type of market conditions, it’s best to be patient and wait for the market to come to your levels rather than engaging in the middle of so much noise.

GBP/USD: Finds A Base Amid Rising UK-US Yield Spread

The Sterling went through a volatile ride on Wednesday, initially boosted on higher-than-expected UK CPI 0.12% numbers, only to lose all its advantage and some more evaporate as a reflection of renewed Brexit pessimism.

The pair ends with most of the volume transacted in an area of 50 pips, with over 30-40pips of upside/downside extensions not finding enough equilibrium to generate value outside the current range of 1.3130-1.3170.

For now, the downside appears to be well supported by a rising UK vs US 10-yr bond yield spread. If one utilizes the UK yield as a proxy of brexit concerns, it discerns an overall sanguine picture, with fixed income players not that concerned.

As long as the bond yield spreads underpin the price, the risk remains skewed towards fading downcycles. A resolution away from 1.3130-70 is necessary, which should materialize on the release of the UK retail sales data today.

Notice the common pattern in GBP/USD 0.03% price action: When the UK vs US yield spread recovers, buy on weakness strategies at key levels tends to pay off. In other words, as it stands, 1.3130 and 1.31 may provide opportunities.

USD/JPY: The Risk-Weighed Index Endorses Dip Buying Strategies

The limited range traded in USD/JPY -0.07% , while it may appear inconclusive on the surface, it reinforces a certain bullish narrative, especially when combined with a rising risk-weighed index. So, looking at Tues/Wed’s price action, the vast majority of the volume has been transacted near the highs of the week (above 112.00), which implies acceptance by market players as value is built.

Even more important, the risk-weighed index (thick black line), which accounts for the SP500 -0.04% , US 30y bond yield, and the DXY -0.04% , has broken into new highs in an environment of risk appetite as per the rise in equities and yields while the usd remains pressured. Interestingly, the pair has failed to move higher and is testing levels of support near 112.00 in Asia.

As the structure in the risk-weighted index stands, in the majority of cases, it should represent value to reinstate longs at key levels as the one currently tested. Only a sudden return of risk-off flows that leads to a breakout of the RWI structure will put a dent on what’s, for now, a constructive outlook to buy weakness on the pair.

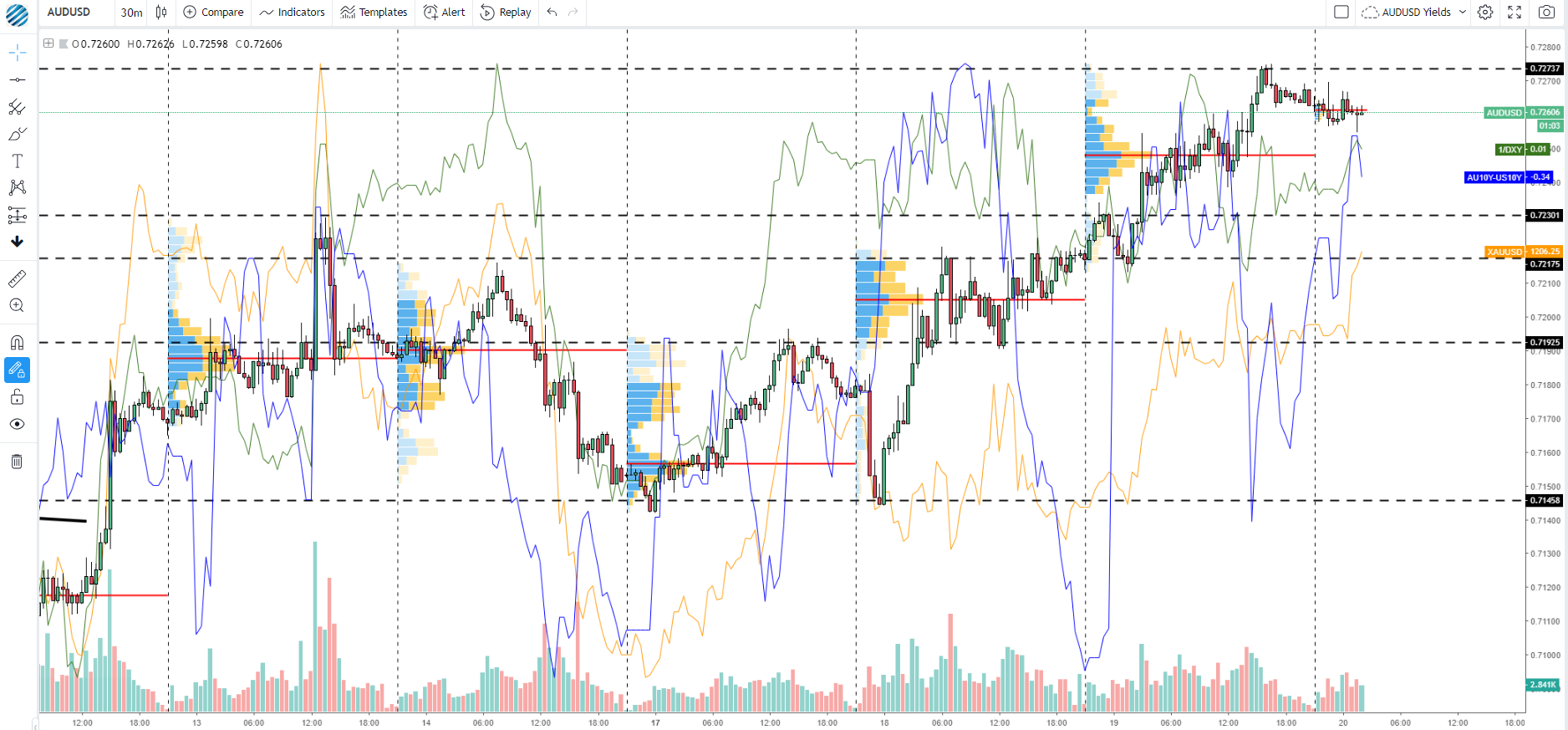

AUD/USD: Correlated Instruments Back Higher Rate

The progressive recovery in the Aussie continues to be a function of a neutral to weak USD, along with higher Gold 0.13% prices.

What’s more, the Australia 10 Year vs US 10 Year Spread trades near the highs of the week, in line with global DM 1.69% rising yields, also assisting the reshuffling of portfolios into a more appealing Aussie.

The latest push higher in the US session was quite impulsive in nature vs the current pullback in Asia, much more compressive; it bodes well for a trend continuation.

Looking at Thursday’s action so far renewed buying interest in gold 0.13% , which has broken into new highs, should be seen as a positive input for the Aussie, as the unwinding of shorts continues amid an ease in EM currencies.

Buying on dips is the preferred strategy as the price action and the structure of other correlated assets stand. However, this view collisions with the big picture, where the market is bearish and may soon come under macro pressure as 0.73 comes into focus.