Ranging is the word of the week. Every attempt to move up is stopped and price goes back to where it started... Bulls and bears are either fighting hard until one of them finally reign supreme or both have given up and status quo is accepted until one side decides to act and a new trend (up or down) will finally start.

January, especially for Bitcoin, has never been a good month. With only 2 days left before February, let see what our egoldfx algorithm is telling us...

The egoldfx algorithm is showing that ETH has been in a short term downtrend since 2017-1-11 when we last had a massive breach of the 70 level followed by a fast fall of the ETH strength line below 70.

Now, the egoldfx algorithm has just shown a new potential uptrend with a strong up move above the 70 level (1) If price breaks the nearest resistance (1) then a potential uptrend might start again.

But if in the next few days the egoldfx algorithm falls further then ETH will renew with its current downtrend (2). We will need to wait for the ETH strength line to bounce on the 30 level in order to look for a new potential uptrend.

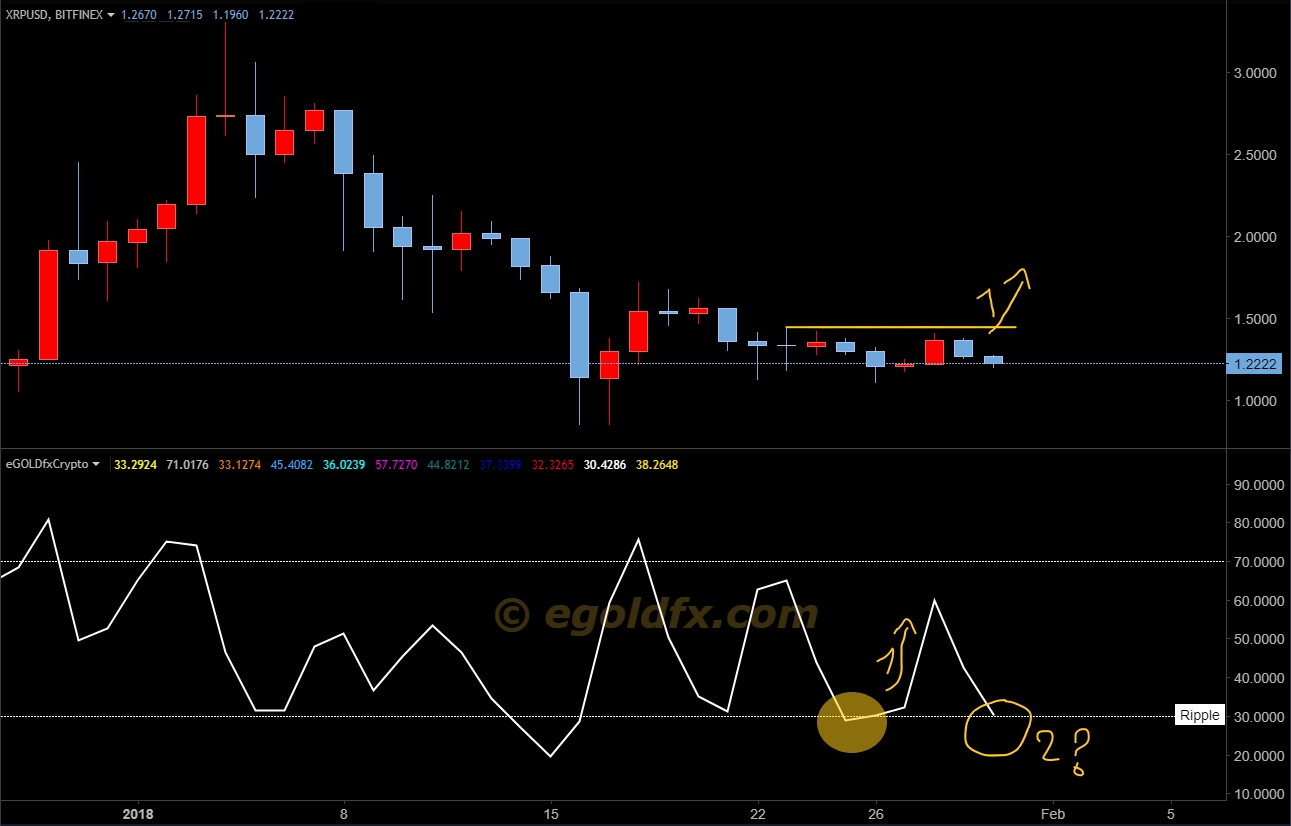

The egodlfx algorithm is showing that XRP has been in a downtrend since 2017-1-5 when we XRP strength line bounced on the 70 level and broke the nearest support.

Now, the egoldfx algorithm has shown that there is a potential new uptrend that could materialize after XRP strength line bounced back up above 30 and if price was to break the nearest resistance (1)

But Lately, XRP strength line is falling back toward the 30 level (2) indicating that the potential uptrend might be delayed until the XRP strength line bounces back again above 30.

LITECOIN

Litecoin has been is a downtrend since 2017-12-15 when the egoldfx algorithm bounced on the 70 level.

Now, the egoldfx algorithm has just bounced again on the 70 level indicating that the downtrend might continue if the nearest support is broken (1)

But the LTC strength line is approaching the level 30 (2) and a close below it followed by bounces above it will alert us on a new potential uptrend. We will need to wait few more days in order to have a better idea.