AUD/USD - Watch out for bearish price action

The AUD/USD bought off last week following the pin bar buy signal from May 30th, which we discussed in the previous market analysis. It's now time to watch out for bearish price action and selling opportunity near the resistance area 0.746-0.752. If you decide to go short, we can expect price to go as low as previous support 0.72.

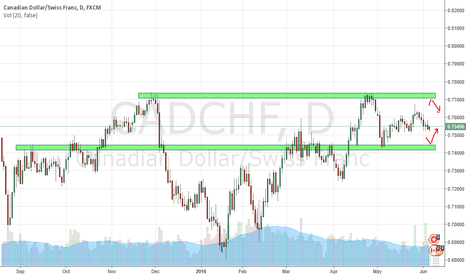

CAD/CHF - Waiting for price action at potential pullback zone

EUR/USD - Not ready to sell yet

The EUR/USD bought off last week following the engulfing reversal buy signal from June 1st. It's now time to watch out for bearish price action and selling opportunity near the resistance area 1.144-1.146. If you decide to go short, we can expect price to go as low as previous support 1.116.

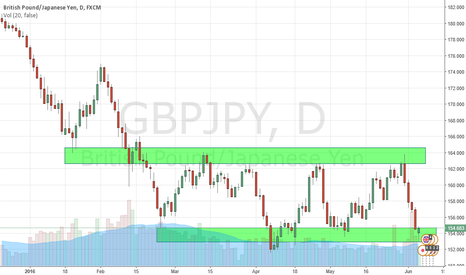

GBP/JPY - Price action at support

Yesterday's price action gave us a great opportunity to go long; we should expect price to go as high as 162.00.

GBP/USD - Second opportunity for traders who missed the last week's entry at 1.46

Price is testing the resistance area 1.463- 1.471 again. Traders going short should still aim for 1.416 or until they see price action near the support zone 1.412- 1.404.

NZD/CAD - Great price action at resistance

Yesterday's price action gave us a great opportunity to go short; we should expect price to go as low as 0.872.

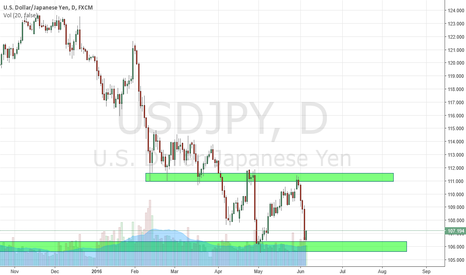

USD/JPY - Testing a support zone

Wait for a buying opportunity. Price could go back up to previous resistance zone 110.9-111.6. Beware - we are still in a downtrend.