AUDUSD

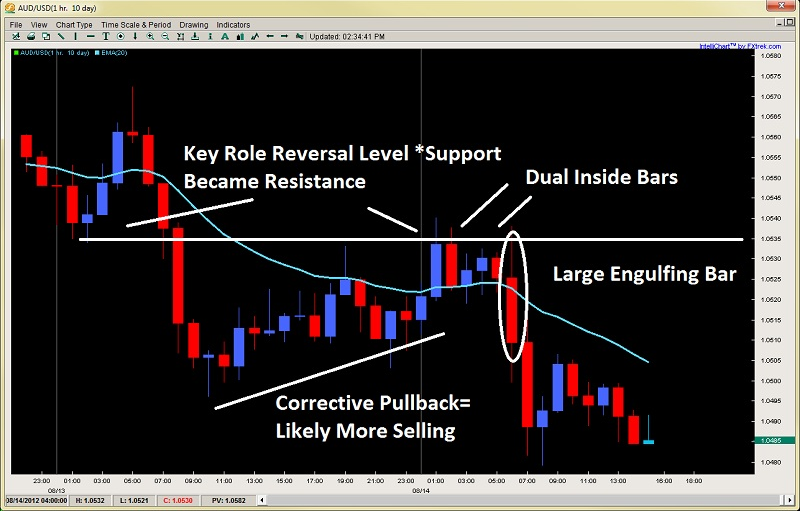

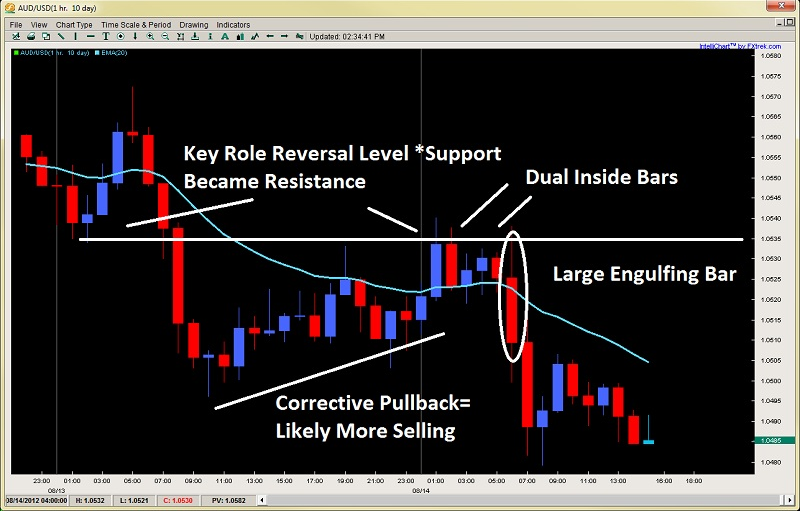

Sticking with the Aussie today, which I’ve been bearish on since Sunday – the pair sold off yesterday and formed a bottom off 1.0496 via an intraday pin bar setup. But notice how the reaction off said bottom was corrective while the selling price action was impulsive? This clued me into the fact the pullback was not heavily bought up by the institutions, and to look for a pullback setup at a good level.

Enter the 1.0533 area which I talked about on my price action commentary (last Thursday) as being a critical role reversal level. Sure enough, the pair started strong after the London open, only to struggle at this level for the next 6hrs forming two inside bars, but ending with a very strong engulfing bar to break the stalemate.

The strong engulfing bar was a clear communication who was still in control (sellers) and that the impulsive selling should continue. After a little fight at the 1.0496 support level, the pair finally broke it, but has since petered out. No surprise on the lack of follow through, as the markets have been putting most to sleep lately, even those who drink 10 cups of coffee before trading, or have ADHD.

Global Market Commentary:

A see saw of news today starting with Europe as the GDP numbers and ZEW came in much worse than expected, darkening the outlook as the EZ economy continues to shrink (quelle surprise) across the bloc with even the German economy slowing (no bueno) while the southern neighbors continue to borrow from the ECB at an alarming rate. This of course will continue to force politicians and European leaders to jawbone about how they will save Europe but offer no real solutions.

On the other side of the pond, July Retail Sales surprised to the upside, but was moreso a seasonal adjustment. Either way, nothing really moved much. But the July surprise sales numbers meant Good is Bad because this means a further delay of any CB printing money to save the bankers prop up the economy.

Gold was the main loser dropping about $12 on the day to close just below $1600, with all the US markets trotting in place on absolutely low volume and a low VIX print while European markets gained anywhere from .5-.9% on the day.

Sticking with the Aussie today, which I’ve been bearish on since Sunday – the pair sold off yesterday and formed a bottom off 1.0496 via an intraday pin bar setup. But notice how the reaction off said bottom was corrective while the selling price action was impulsive? This clued me into the fact the pullback was not heavily bought up by the institutions, and to look for a pullback setup at a good level.

Enter the 1.0533 area which I talked about on my price action commentary (last Thursday) as being a critical role reversal level. Sure enough, the pair started strong after the London open, only to struggle at this level for the next 6hrs forming two inside bars, but ending with a very strong engulfing bar to break the stalemate.

The strong engulfing bar was a clear communication who was still in control (sellers) and that the impulsive selling should continue. After a little fight at the 1.0496 support level, the pair finally broke it, but has since petered out. No surprise on the lack of follow through, as the markets have been putting most to sleep lately, even those who drink 10 cups of coffee before trading, or have ADHD.

Global Market Commentary:

A see saw of news today starting with Europe as the GDP numbers and ZEW came in much worse than expected, darkening the outlook as the EZ economy continues to shrink (quelle surprise) across the bloc with even the German economy slowing (no bueno) while the southern neighbors continue to borrow from the ECB at an alarming rate. This of course will continue to force politicians and European leaders to jawbone about how they will save Europe but offer no real solutions.

On the other side of the pond, July Retail Sales surprised to the upside, but was moreso a seasonal adjustment. Either way, nothing really moved much. But the July surprise sales numbers meant Good is Bad because this means a further delay of any CB printing money to save the bankers prop up the economy.

Gold was the main loser dropping about $12 on the day to close just below $1600, with all the US markets trotting in place on absolutely low volume and a low VIX print while European markets gained anywhere from .5-.9% on the day.