Foreign Exchange Price And Time At A Glance

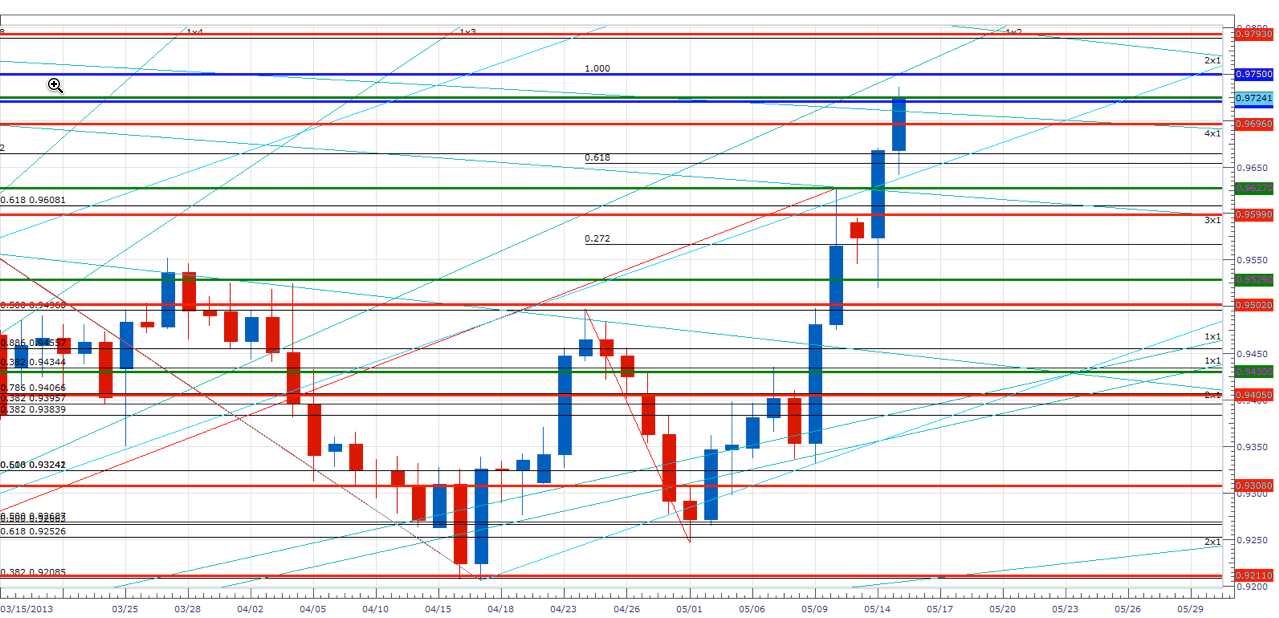

USD/CHF" width="1279" height="618">USD/CHF

USD/CHF" width="1279" height="618">USD/CHF

has moved sharply higher over the past few days to trade to its highest levels since last August

- Our bias remains higher in the exchange rate with immediate attention now on the 100% projection of the February to March advance in the .9750 area

- This level is strong resistance and a close above .9750 is needed to setup further strength towards a critical resistance zone near .9790

- Near-term focused cycles suggest that Friday is a minor turn window

- The 6th square root progression of the year-to-date low in the .9600 area is now support and only weakness below this level turns us negative on the rate

Over .9600 we still like holding USD/CHF longs positions. NZD/USD" width="1279" height="618">

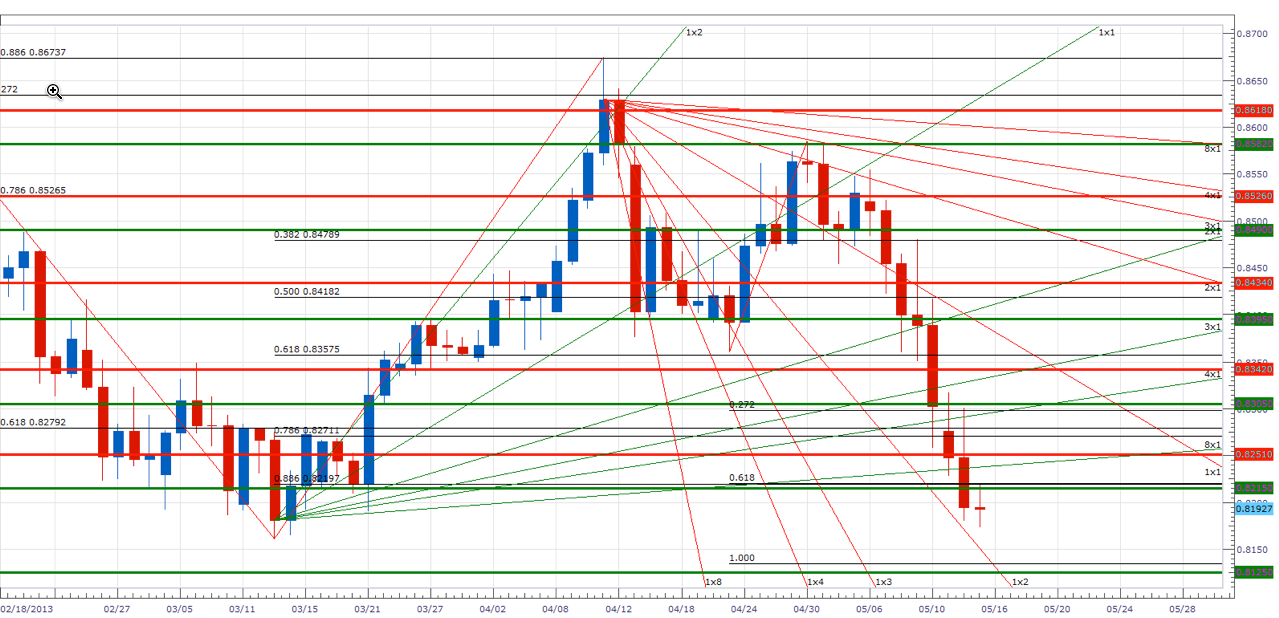

NZD/USD" width="1279" height="618">

NZD/USD broke below the 88.6% retracement of the March to April advance on Tuesday

- Our bias remains lower in the Kiwi and attention is now on a convergence of the year-to-date low and the 1x2 Gann angle line of the year’s closing high in the .8160 area

- This level could act as a strong support and a clear break below there is needed to expose .8125 and below -Near-term focused time cycles suggest scope for a minor turn at the end of the week

- The 5th square root progression of the year-to-date high in the .8215 area is immediate resistance, but only strength over .8270 turns us positive on the Bird

Continue to like short postions in the Kiwi while below .8270 USD/CAD" width="1279" height="618">

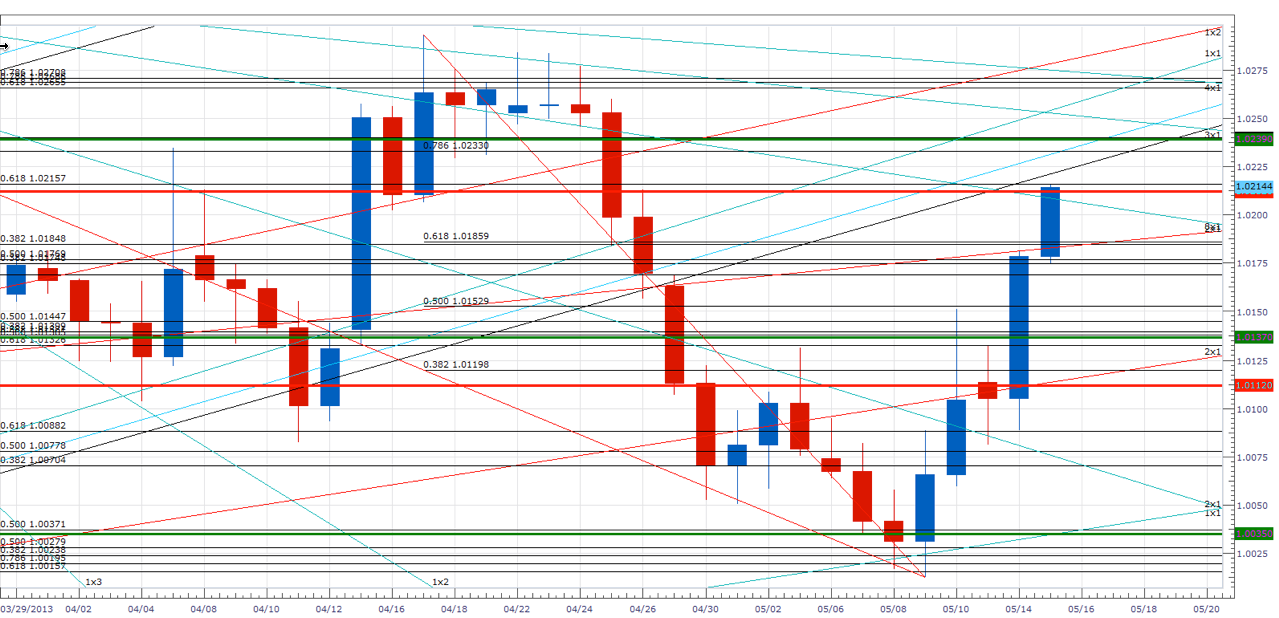

USD/CAD" width="1279" height="618">

USD/CAD has moved aggressively higher since finding support last week in the 1.0015/35 Gann/Fibonacci confluence zone

- Our bias is higher in Funds though the rate’s reaction to a convergence of the 2nd square root progression of last week’s low and the 61.8% retracement of the March to May decline at 1.0215 will be important

- A break over 1.0215 required to setup a further push towards 1.0240 and above

- There is some scope for a minor high to be seen today according to some short-term cycle studies

- The 50% retracement of the April to May decline in the 1.0155 area is support and only weakness below this level undermines the positive technical structure

We like holding long positions in Funds whilst above 1.0155.

Focus Chart of the Day: EUR/JPY EUR/JPY" width="680" height="328">

EUR/JPY" width="680" height="328">

As we have noted here before, the two peaks in April were significant for EUR/JPY from a time cycle perspective. They should have led to a more important decline. However, the fact that they didn’t is important and acts as a testament to the strength of the current uptrend in the cross and favors general strength in the weeks ahead. Given our view that the Euro recorded some sort of significant cyclical peak at the start of the month we can deduce the cross will probably be driven mostly by USD/JPY. There too the cycles are positive as the rate also recently took out some key ‘time resistance’. While the cycles are relatively clear we must admit we have some trepidation given how despairing sentiment has become towards the yen. Just yesterday, the Daily Sentiment Index (DSI) of futures traders recorded a historical extreme of just 3% yen bulls. Typically such extreme negative sentiment leads to a position washout of some sort. Caution is advised here.

Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com.

Charts Created using Marketscope – Prepared by Kristian Kerr.